Black Homebuyers Use 401Ks To Afford Down Payments

17% of Black homebuyers used their 401k and pensions, higher than any other group.

First-time buyers have it tough, and Black first-time buyers have it even tougher.

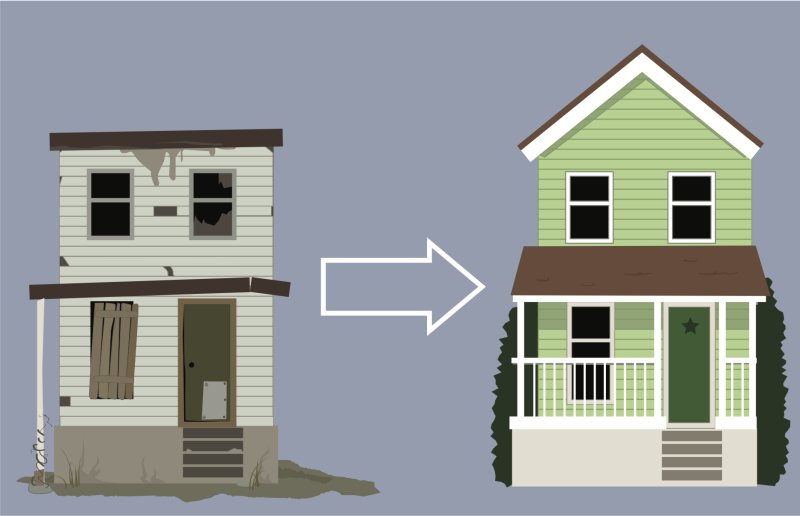

Last year, the National Association of Realtors (NAR) reported that nearly half of Black/African American buyers reported the discrimination they faced in a real estate transaction to a government agency. But history shows Black homebuyers are able to overcome market conditions like they did in 2022 when rates quickly shot up, increasing their homeownership rate slightly while white homeownership fell. This year many Black homebuyers are delving into their retirement funds to afford down payments on houses.

The 2024 NAR study, A Snapshot of Race and Home Buying in America, shows about 17% of Black homebuyers used their 401k and pensions to generate a down payment for a home. That’s one percentage point higher from the year before, and higher than any other group.

"We see that they're needing to look at some of the other ways that they can put money towards their down payment that might not be from that equity that they might have had if they were a repeat home buyer," said Brandi Snowden, NAR's director of member and consumer survey research.

Some analysts suggest that for first-time home buyers, using retirement savings such as a 401k to fund the buying of a house is a good move.

"It's a good choice because the purpose of your retirement account is to fund your retirement. The long-term home ownership will also create its own retirement asset and the reason is because you're paying rent essentially to yourself," David Dworkin, president and CEO of the National Housing Conference, told Newsweek. "So, over time, while you're paying interest payments, the longer you hold the home, the bigger percentage of your monthly payment goes to your own equity. And so it's a smart trade because you're also continuing to put money into your 401k."

The NAR study shows that Black homeownership increased by 1.6% over the last decade, even though the pace of growth was slower compared to other demographic groups.

"The fact is that when you look at the collapse in homeownership rates, in 2009 through 2013, you see that you were really digging out of a much, much bigger hole," Dworkin said. "What we're seeing now is an increase, which is great, but you have to go further back to see how devastating the loss was.”