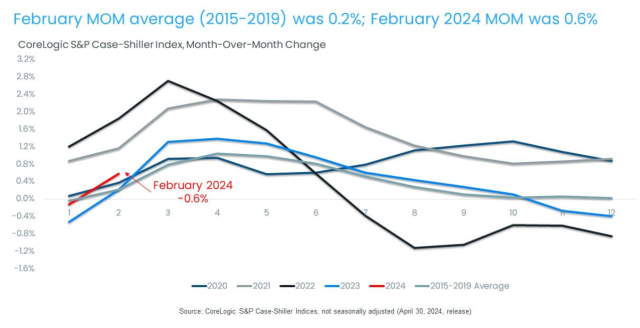

Home Price Appreciation Accelerates In February

The latest CoreLogic S&P Case-Schiller Index shows home prices remain resilient amid higher borrowing costs.

Home price growth in February accelerated beyond historical norms amid surging borrowing costs, the latest CoreLogic S&P Case-Shiller Index (CSI) shows.

Released Tuesday, the index recorded a 6.4% year-over-year gain, marking the eighth straight month of annual increases. Home prices are now up by 1.3% compared with their June 2022 peak, according to the report.

On a monthly basis, the CSI jumped 0.6%, considerably higher than the 0.2% average increase recorded between January and February from 2015 and 2019. Even last spring, when home price growth heated up beyond the seasonal trend, February’s monthly increase was only 0.2%.

Over the course of the year, low-tier homes appreciated at the fastest pace, up by 7.2%, while high-tier homes prices grew by 6.5%. While San Diego prices rose the most across all price tiers, low-tier homes in Chicago and New York led the pace in appreciation of low-tier homes, up by 12% and 11%, respectively.

The 10-city and 20-city composite indexes also each posted their eighth straight month of annual increases in February, up by 8% and 7.3%, respectively. According to the report, many of these metros are catching up on home prices gains that pandemic-era boomtowns experienced during COVID-19. In the 20-city index, Portland, Ore. remains the slowest appreciating market, up by only 2% compared with last year.

Seattle, San Diego, and San Francisco posted the nation’s largest monthly gains, a respective 2.3% and 1.7% for the latter two. Meanwhile, Tampa’s prices were down by 0.3% in February – making it the only market with a monthly loss. Tampa saw a considerable increase in new listings this spring.