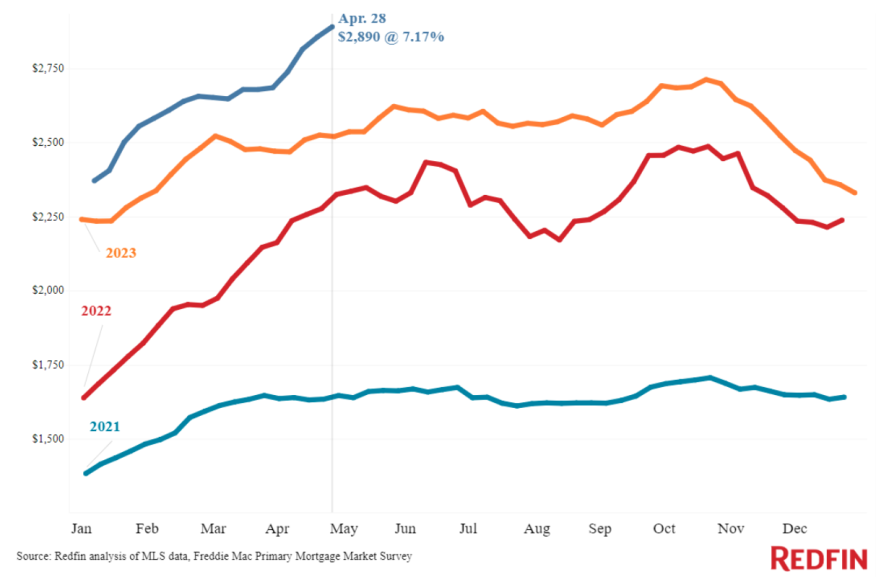

Redfin: Median Monthly Payments Reach $2,890 In April

Rising home prices and mortgage rates pushed monthly payments up 15% last month, year over year.

Reaching a record $2,890, median monthly payments rose 15% year-over-year in April, according to a new report from Redfin. In the week ending April 25, 30-year fixed-rate mortgages averaged 7.17%, up from 6.43% during the same period last year, per Freddie Mac.

For the first time since July 2022, the median home-sale price rose from a year earlier or stayed the same in all 50 of the most populous U.S. metros during the four weeks ending April 28. Nationwide, the median sale price rose to a near-record $383,188, up 4.8% year over year. In the four weeks ending April 28, median asking prices hit an all-time high of $420,450, a 7.7% increase year over year.

The metros with the largest annual increases in median home-sale price were Anaheim, Calif. (+22.8%), Detroit, Mich. (+14.9%), San Jose, Calif. (+13.6%), West Palm Beach, Fla. (+13.4%), and New Brunswick, N.J. (+12.8%).

With the Federal Reserve holding interest rates at elevated levels, likely through the summer, mortgage application volume has slowed, and some borrowers have turned to adjustable-rate mortgages (ARMs) in pursuit of affordability.

Demand exists, but Redfin's data show that declining affordability is taking a toll on sales movement. Though new listings rose annually by 15.2% in April, or 101,065 units – the largest increase in three years – pending sales fell 3.4% year over year to 88,408 units.

The metros with the largest annual increases in new listings in April were San Jose, Calif. (+53.2%), Oakland, Calif. (+34.3%), Phoenix, Ariz. (+28.6%), Seattle, Wash. (+28.4%), and Miami, Fla. (+28%).

Nationally, the share of homes with a price drop during the four weeks ending April 28 rose by 6.2% to reach the highest level since November 2022. Sellers in Florida and Texas in particular have been slashing prices to entice buyers.