Inflation must hit its 2% goal for Fed to reduce rates.

Federal Reserve Chairman Jerome Powell announced the Federal Open Market Committee's (FOMC) decision to keep its funds rate between the 5.25% to 5.5% range Wednesday afternoon for the fifth consecutive time, remaining at a 23-year high.

Powell addressed the U.S. economy, labor market and inflation during a media briefing following the FOMC’s March 19-20 monthly meeting.

“Today the FOMC decided to leave our policy interest rate unchanged and continue to reduce our securities holding,” he said. “Our restrictive stance on monetary policy has been putting downward pressure on economic activity and inflation. As labor market tightness has eased and progress on inflation has continued, the risks to achieving our employment and inflation goals are coming into better balance.”

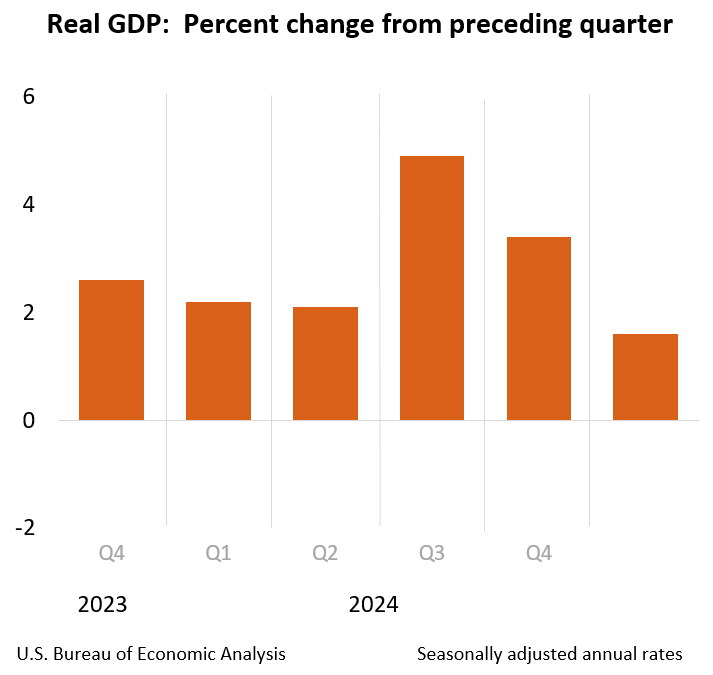

Progress towards the Fed’s dual mandate objectives has been considerable over the past year, with easing inflation and gains in the labor market. However, inflation rose to 3.2% in February and the agency is set on its 2% goal.

“Restoring price stability is essential to achieve a sustainably strong labor market that benefits all," Powell said. "We believe that our policy rate is likely at its peak for this tightening cycle and that if the economy evolves broadly as expected it will likely be appropriate to begin dialing back policy restraint at some point this year. The economic outlook is uncertain, however, and we remain highly attentive to inflation risks. We are prepared to maintain the current target range for the federal funds rate for longer if appropriate.”

The Fed has opted not to be brash in its rate-setting decisions, since reducing the rate too quickly can have the opposite effect on inflation than desired, while waiting too long to dial it back could have unintended impacts on the economy and jobs.

“In considering any adjustments to the target range for the federal funds rate, the committee will carefully assess incoming data, the evolving outlook and the balance of risks,” Powell said.

During their meeting committee participants were asked to write down an appropriate path for the federal funds rate if the economy evolves as projected.

The median response was that the rate could be 4.6% at the end of 2024, 3.9% at the end of 2025, and 3.1% at the end of 2026.

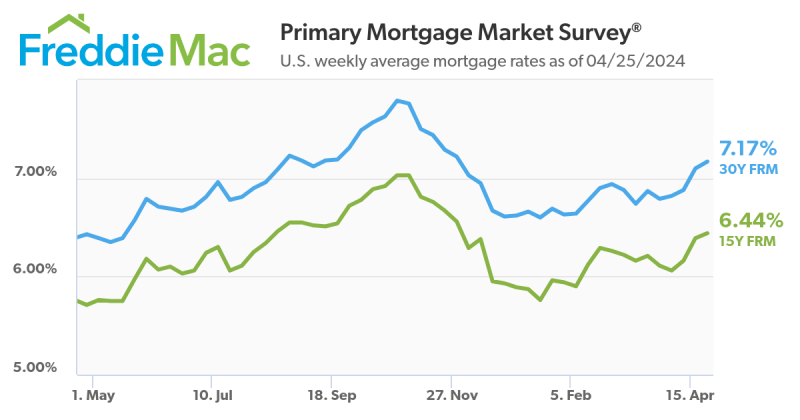

In response to the announcement Mortgage Bankers Association SVP and Chief Economist Mike Fratantoni questioned when exactly the Fed’s next rate cut would take place. The trade association continues to expect mortgage rates to decline gradually over the course of this year.

“Their new projections indicate three cuts for 2024, unchanged from their December projections for 2024, but with one less rate cut expected in 2025,” Fratantoni said. 'We are forecasting that the first rate cut will be in June, and a total of three rate cuts this year.”

The Fed’s next meeting is set for April 30-May 1.