Home Price Growth Expected To Remain Stagnant

Redfin Home Price Index shows 0.6% growth month-over-month

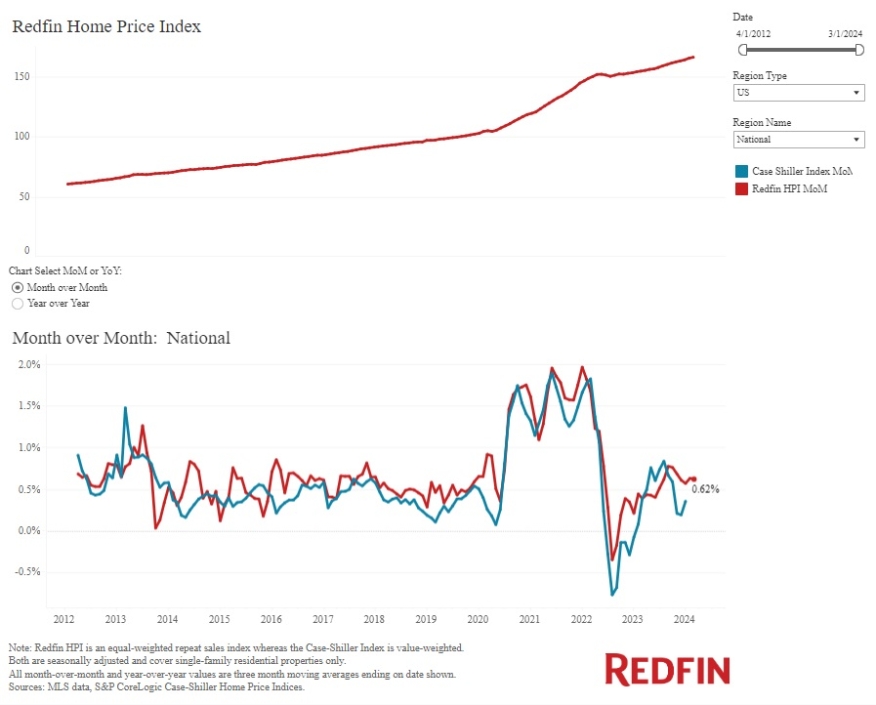

Redfin’s latest Home Price Index (HPI) echoed the findings of other HPIs reflecting quarter-one data, with prices remaining on a slight incline across the U.S.

Home prices climbed 0.6% nationally in March on a seasonally-adjusted basis, matching February’s 0.6% month-over-month gain, Redfin reported.

Home prices rose 7.3% year-over-year (YOY), also little changed from February’s 7% annual increase.

“Elevated mortgage rates are putting a cap on home price growth,” Redfin Senior Economist Sheharyar Bokhari commented. “Sellers can’t jack up prices like they did during the pandemic because buyer budgets are already constrained by 7% interest rates. But while price growth is leveling off, prices remain at historic highs. That’s because a shortage of homes for sale — largely driven by the mortgage-rate lock-in effect — is buoying prices.’’

Redfin’s HPI is similar to the S&P CoreLogic Case-Shiller Home Price Indices, which was published over a month earlier.

Fannie Mae’s HPI, released last week, showed home prices rising by a seasonally adjusted 1.7% in Q1 2024, essentially the same as the growth in Q4 2023. Single-family home prices increased 7.4% YOY for the same period.

Analysts expect price growth to remain stagnant in the next few months as mortgage rates remain higher than average.

Home prices did drop in nine of the 50 most populous U.S. locales, including San Jose, Calif. (-1%), San Antonio (-0.8%), Fort Worth, Texas (-0.6%), San Francisco (-0.5%), Fort Lauderdale, Fla. (-0.5%), Charlotte, N.C. (-0.5%), Orlando, Fla. (-0.3%), Indianapolis (-0.3%) and Minneapolis (-0.1%).

The metropolitan areas that saw the highest price increases in March were Providence, R.I. (3.2%), Montgomery County, Pa. (2.5%), Nassau County, N.Y. (2.4%), Milwaukee (1.7%) and Anaheim, Calif. (1.7%).