Home Prices Plateau

Stubborn sellers are staying put with their comfortable monthly mortgage payments.

- Rising mortgage rates coupled with stubbornly high home prices are driving drastic drops in affordability.

- U.S. home values hold steady, rising only 0.1% since September.

- Share of income spent on monthly mortgage payments has risen from 27.7% in February to 37.3% in October.

- The number of new for-sale listings dropped by more than 12% month-over-month.

Buyers and sellers are stepping away as mortgage rates continue to skyrocket, allowing the housing market to settle into a more balanced state.

The latest Zillow market report shows home values remained nearly flat in October, as new inventory waned and sales continued to fall from the pandemic frenzy.

"Home prices in October remained in suspended animation as more buyers, but especially sellers, took a wait-and-see approach to market conditions," said Skylar Olsen, chief economist at Zillow. "Fewer home sales is the hallmark of a housing market lull, but right now potential sellers sensitive to losing their historically low mortgage rates have as much, if not more, of a reason to wait for a robust spring season and hope for mortgage rate relief. With some renewed competition, buyers hoping for aggressive price declines may be disappointed in all but the frothiest pandemic-era markets."

The combination of rising mortgage rates coupled with stubbornly high home prices are driving drastic drops in affordability. The share of income spent on monthly mortgage payments has risen from 27.7% in February to 37.3% in October, well above the previous peak of 35% in 2006. Housing payments are considered to be a financial burden when they exceed 30% of a household’s income.

The average monthly mortgage payment when putting 20% down was $1,910 in October. That’s a 77% jump year-over-year and a 107% increase — nearly $1,000 — from 2019. Monthly payment figures are even higher when including taxes and insurance and when putting less than 20% down, as more than half of borrowers do.

These affordability challenges are heavily impacting sales. Sales counts show significant slowing in recent months, standing 16% to 17% below pre-pandemic October norms.

Although it’s tempting to focus on buyers, mortgage-rate-driven affordability challenges are highly impactful on seller behavior by keeping more existing homes off the market. While first-time homebuyers have experienced continued pressure on rent as well, homeowners who bought or refinanced when rates were near record lows in 2020 and 2021 are sitting on substantial home value gains and have little incentive to take out a new home loan, deciding instead to enjoy their current monthly payment.

As a result, the number of new for-sale listings dropped by more than 12% month-over-month, bringing the flow of listings to the market 24% lower than in 2021 and 21% below 2019.

The steepest drop in listings in September were in Seattle (-28.5%), Denver (-26%), and Washington, D.C., (-24.2%). New inventory increased month-over-month in two major metros, both in Florida — Jacksonville (3.1%) and Tampa (1.3%) — while the smallest declines took place in other Florida cities and relatively affordable metros in the Midwest.

The drastic pullback of new listings has stalled out the recovery in total inventory that began in March. There are slightly more (1.8%) for-sale listings on Zillow than a year ago, but still far fewer (-36.1%) than in October 2019.

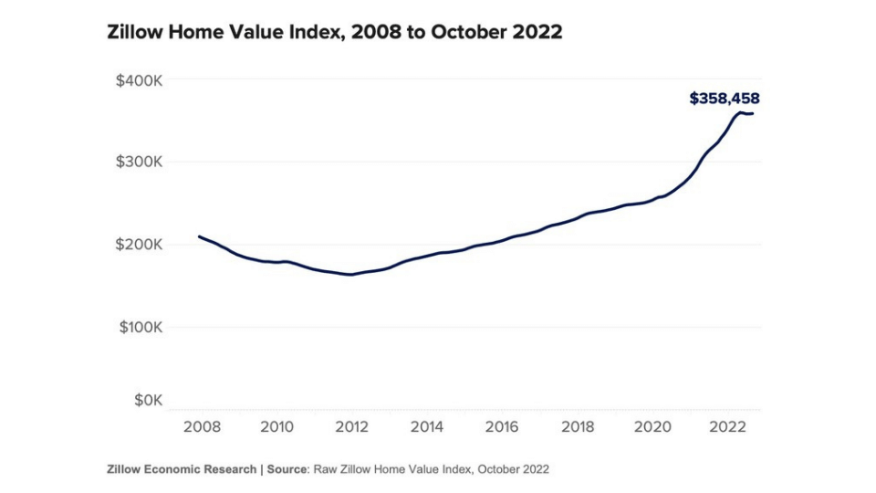

Both supply and demand are drying up while U.S. home values hold steady, rising only 0.1% since September, marking the fourth consecutive month of muted movement. Typical home values are $358,458, up nearly 12% over 2021 and 43% higher than before the pandemic. Major metros with the largest home value appreciation since 2019 are Tampa (72%), Austin (64%), Jacksonville (62%) and Phoenix (60%).

Expensive Western markets including Los Angeles (+0.8%) and Riverside, Calif., (+0.4%), abruptly snapped out of their value-losing streak. Only time will tell, Zillow said, if September marked the bottom for price declines in these cities. Las Vegas (-2.3%) and Austin, Texas, (-2.2%) saw the sharpest home value declines among major metro areas.