Home Sellers Consider Ditching Real Estate Agents

77% of sellers say new NAR rules affect their decision to hire a real estate agent, according to a survey by Clever Real Estate.

Home sellers are more likely to forego using a real estate agent with the advent of newly-proposed rules guiding the sale and purchase of homes, new research indicates.

In a survey by Clever Real Estate, more than three-quarters (77%) of home sellers say commission rates will factor into their decision to hire a real estate agent.

This comes after the National Association of Realtors (NAR) reached a settlement overhauling the traditional commission structure, in which buyers' and sellers' agents split a predetermined amount. Buyers would now need to negotiate their own agent’s compensation, putting more power in the hands of borrowers.

“This change could potentially deter first-time home buyers due to the added upfront costs — potentially 1.5% to 2% in fees based on the home's sale price,” real estate agent and Clever spokesperson Steve Nicastro pointed out.

That’s up to $8,000 on a $400,000 home purchase, an added burden that could deter some buyers from hiring an agent altogether.

Among those Clever surveyed, nearly all home sellers (94%) say they support the proposed commission changes, and 88% of homeowners selling in the next year plan to use a Realtor and see them as an important part of the process.

At the same time, sellers surveyed say they’re more comfortable tackling parts of their transaction without a Realtor, including the negotiations (61%), as well as paperwork in For Sale By Owner (FSBO) transactions.

More than two-thirds (67%) said they think artificial intelligence can already outperform a human agent.

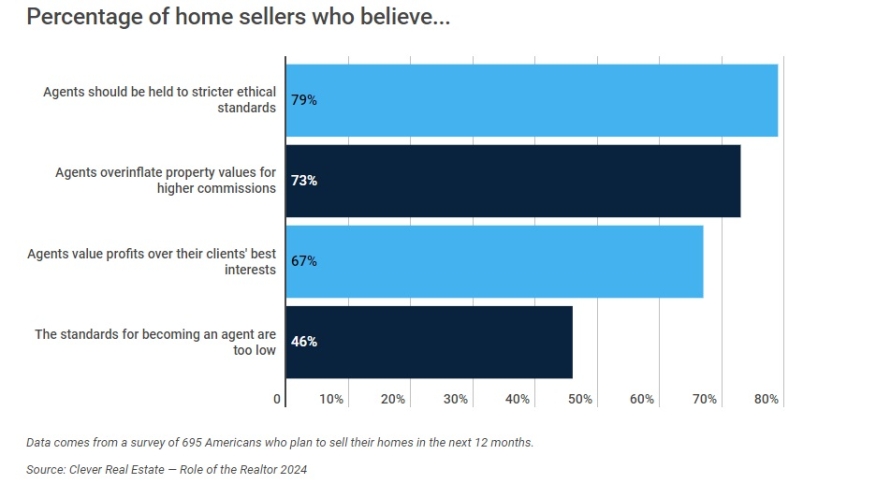

Among survey participants planning to sell their homes in the next year, more than half (52%) who say the current commission system is unfair say it’s because they have to compensate the buyer’s agent. Yet, the research found that the typical home seller overestimates the amount they'll pay in commission. Nearly half (49%) expect to pay 7% or more in commission, while only one in three (35%) expect to pay the typical amount of between 5% and 6%. Two-thirds of respondents (67%) believe real estate agents value profits over their clients’ best interests.

Of those who plan on selling a house without a Realtor, 60% say they’re doing so because real estate commissions are too expensive. But, other reasons include wanting more control over the home-selling process (44%); having past real estate experience and ability to handle the sale themselves (35%); having bad experiences with agents (33%); a desire to sell faster than with an agent (33%), a lack of trust in agents (21%); and, lastly, believing agents are inconvenient to use (20%).