Home Sellers' Q1 Profit Margins Declined Quarterly, Annually

ATTOM reported decrease of 55.3% in the first quarter – the smallest level in more than two years.

ATTOM released its Q1 2024 U.S. Home Sales Report, revealing that profit margins for U.S. home sellers on median-priced single-family home and condo sales in the United States decreased to 55.3% in the first quarter – the smallest level in more than two years.

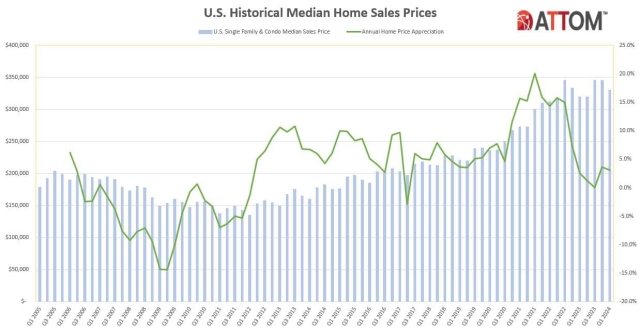

The decline in typical profit margins, from 57.1% in Q4 2023 and from 56.5% a year ago, came as the median nationwide home price decreased quarterly by 4.3% to $330,000. Typical profit margins are defined as the percent difference between median purchase and resale prices.

Investment returns for sellers decreased for the second straight quarter after several increases last year, hitting the lowest point since mid-2021. Even as seller returns slipped, they remained higher than during most of the housing market boom that has continued throughout the nation over the past decade.

The same was true in the early months of 2024 for the typical $120,500 gross profit on typical home sales across the country.

ATTOM says that although prices often fall back during the slower winter home-selling season each year, the latest decrease marked one of the largest quarterly declines over the past 10 years. At the same time, investment returns for sellers decreased for the second straight quarter after several increases last year, hitting the low point since mid-2021.

“The latest price and profit numbers show notably downward trends, which raises new questions about whether the housing-market boom is indeed ebbing, or even ending, after so many years of improvement,” said Rob Barber, CEO of ATTOM. “We saw a similar downward pattern from late 2022 into early 2023, and then the market surged. Plus, profits and profit margins still are very high by historical measures. Amid all that, the Spring buying season will be a huge barometer for whether the market still has steam in its engine.”

Typical profit margins decreased from the fourth quarter of 2023 to the first quarter of 2024 in 89 (66%) of the 134 metropolitan statistical areas around the U.S. with sufficient data to analyze. They also were down annually in 71, or 53%, of those metros.

The biggest year-over-year decreases in typical profit margins came in the metro areas of Lake Havasu City, Ariz. (margin down from 102.4% in the first quarter of 2023 to 76.3% in the first quarter of 2024); Naples, Fla. (down from 88.4% to 62.9%); Hilo, Hawaii (down from 82.3% to 57.8%); Crestview-Fort Walton Beach, Fla. (down from 68% to 47.3%) and Port St. Lucie, Fla. (down from 92.8% to 72.3%).

Typical profit margins increased annually in 63 of the 134 metro areas analyzed (47%). The biggest annual improvements were in Peoria, Ill. (margin up from 32.6% in the first quarter of 2023 to 52.8% in the first quarter of 2024); Scranton, P.a. (up from 88.1% to 106.5%); Oxnard, Calif. (up from 55.1% to 71.2%); Rochester, N.Y. (up from 50.4% to 65.2%) and San Jose, Calif. (up from 85.8% to 100%).

Nationwide, the median price of single-family homes and condos declined quarterly to $330,000, down from $345,000 in the fourth quarter of 2023 – a record hit several times over the past two years. The typical home sale decreased quarterly in 112 (84%) of the 134 metro areas around the country with enough data to analyze,

Latest median prices remained 3.1% higher than the $320,000 level in the first quarter of 2023, rising annually in 103 of the metros reviewed (77%).

Metro areas with the biggest decreases in median home prices from the fourth quarter of 2023 to the first quarter of 2024 were Pittsburgh, P.a. (down 11.5%); Flint, Mich. (down 10.7%); Memphis, Tenn. (down 10.7%); Birmingham, Ala. (down 10.2%) and Montgomery, Ala. (down 9.7%).