Hotter-Than-Expected Inflation Keeps Rates Higher

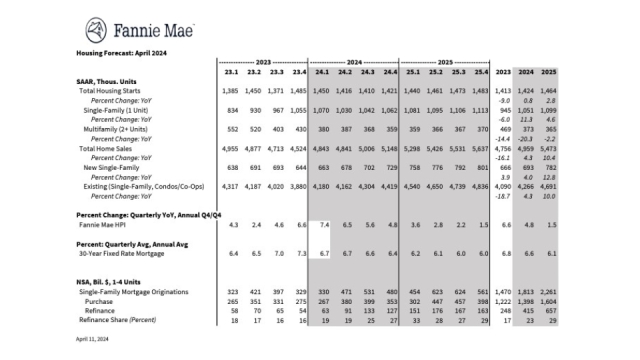

Fannie Mae forecasts fewer Federal Reserve rate cuts this year.

Economic and inflation data have remained stronger than expected, pushing interest rates higher and financial markets to price in fewer Federal Reserve rate cuts this year, according to the Fannie Mae Economic and Strategic Research (ESR) Group April 2024 commentary. Although higher mortgage rates present further headwinds to the expected recovery in home sales this year, as well as homebuyer affordability, the ESR Group notes that new listings of homes for sale have continued to rise.

The ESR Group projects existing home sales to rise modestly over the course of the year, expecting the flow of new listings to outpace home sales. That should help gradually thaw housing inventory and contribute to decelerating home price growth. However, the incoming home price data continues to come in strong, and the ESR Group expects home prices to rise 4.8% in 2024, up 1.6 percentage points from last quarter's projection, and then another 1.5% in 2025.

While interest rate cuts appear to be on hold due to a mixture of strong economic data and hot inflation reports, the ESR Group continues to forecast slowing employment and economic growth, as well as progress towards a 2% inflation rate. However, recent data have caused a reassessment of the pace of decelerating inflation, and the ESR Group now expects the Consumer Price Index to end 2024 at a 3.1% annual rate, compared to the 2.5% previously projected.

"Financial markets rapidly repriced their interest rate expectations following hotter-than-expected inflation reports and ongoing strong payroll employment gains," said Fannie Mae Vice President of Economic and Strategic Research Hamilton Fout. “While we still expect economic growth and inflation to moderate going forward — and, thus, for mortgage rates to drift downward — interest rates existing in a 'higher for longer' state seems to be an increasingly real possibility in the eyes of market participants, as well as some homebuyers and sellers.”

“While we've recently seen evidence that some potential home sellers are becoming more acclimated to the higher mortgage rate environment and putting their homes on the market, the recent move upward in rates is yet another headwind to the recovery of home sales, and it intensifies long standing affordability challenges for consumers," Fout added.