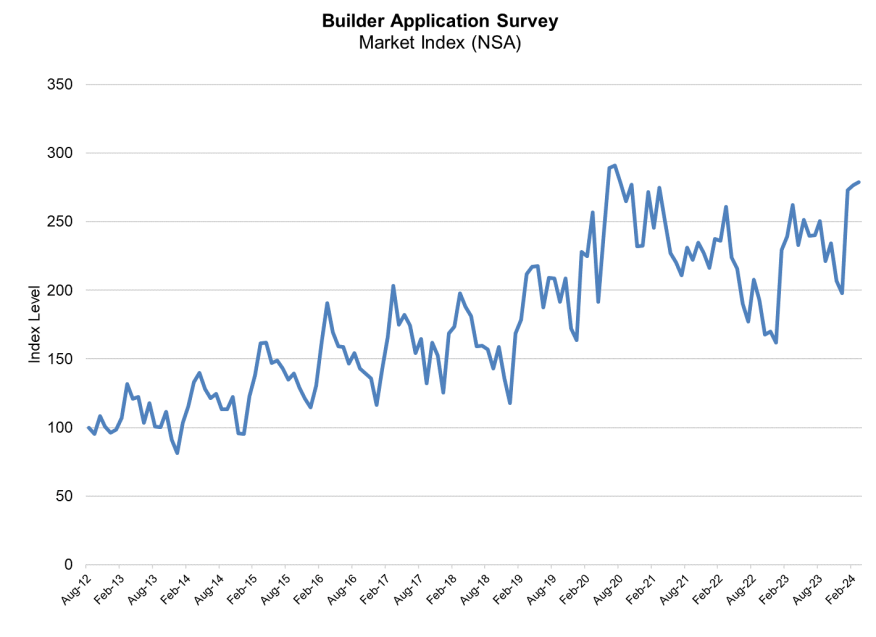

New Home Purchase Mortgage Applications Post Slow Growth in March

Mortgage applications for new home purchases increased 6.2% year-over-year, but only 1% month-over-month.

- Applications were still ahead of last year’s pace, but the annual growth rate was the slowest since September 2023.

Mortgage applications for new home purchases during March increased 6.2% year-over-year. That's according to the Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data. Compared to February 2024, applications increased by 1%.

This change does not include any adjustment for typical seasonal patterns.

“March is typically a month when new home purchases see a seasonal boost, but this year March applications for new home purchases saw less than a 1% increase over the prior month on an unadjusted basis,” said MBA’s Vice President and Deputy Chief Economist, Joel Kan. “Applications were still ahead of last year’s pace, but at 6%, the annual growth rate was the slowest since September 2023. Homebuyers remain adversely impacted by strong home-price growth and mortgage rates hovering around 7%."

Kan noted that the FHA share of applications increased in March, exceeding 26%, compared to a 24% average for the prior 12 months. Per Kan, "a higher FHA share can be a sign of more first-time buyer activity, but that segment of buyers is also more sensitive to affordability challenges.”

Added Kan, “MBA’s estimate of new home sales fell more than 10% over the month to a seasonally adjusted pace of 615,000 units, the slowest annual pace in four months.”

The seasonally adjusted estimate for March is a decrease of 10.7% from the February pace of 689,000 units. On an unadjusted basis, MBA estimates that there were 60,000 new home sales in March 2024, a decrease of 3.2% from 62,000 new home sales in February.

By product type, conventional loans comprised 63% of loan applications, FHA loans comprised 26.4%, RHS/USDA loans comprised 0.3%, and VA loans comprised 10.4%. The average loan size for new homes decreased from $405,719 in February to $405,400 in March.