Overview Of Clawback Provisions

The notion that lenders can recapture mortgage brokers’ compensation is generally understood. However, many mortgage brokers are unaware that clawback provisions can be triggered in many ways, sometimes relatively easily.

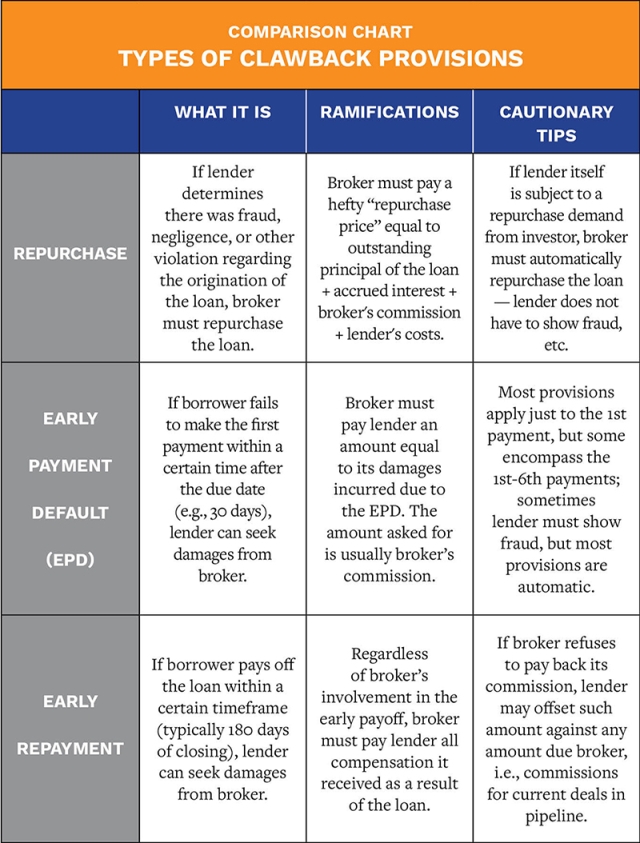

The chart below summarizes the different categories of clawback provisions that are typically found in agreements between mortgage brokers and lenders.

Understanding The Nuances

Next, we dive into the nuances to see the full ramifications of these clawback provisions.

Repurchase clauses

Many mortgage brokers assume that their repurchase obligations only arise in the case of fraud or gross negligence, which can be hard to prove.

However, the lender’s burden of proof to invoke the repurchase demand is usually much lower:

The repurchase obligation can be triggered by simply showing that the broker breached any of the representations or warranties in the mortgage broker agreement. The list of reps and warranties is often very long and broadly worded, making it difficult for even the most compliant broker to abide by them perfectly. For instance, the broker must represent that they comply with all federal, state, and local laws, thereby wrapping into the agreement all the requirements under federal statutes such as RESPA and state statutes such as Florida Statutes Chapter 494.

As mentioned in the chart, the repurchase obligation can automatically be triggered if the lender receives a repurchase demand from the investor. Importantly, all that is required is for the lender to have received the demand notice, not for the lender to have already repurchased the loan.

Moreover, it typically does not matter if there is a foreclosure. The mortgage broker’s responsibility shifts from repurchasing the loan, to purchasing the related property.

Here are the most common reasons why lenders ask brokers to buy back a loan:

- Income, employment and/or debt-to-income misrepresentations

- Appraisal misrepresentations

- Occupancy misrepresentations

- Assets misrepresentations

- Undisclosed debts

- Non-performing loans

In a perfect world, the lender and the mortgage broker should be equally responsible for soundly underwriting the deal. However, in the real world, these repurchase clauses essentially shift 100% of the underwriting burden to the mortgage broker.

Early payment default and early repayment clauses

While the risk of receiving a repurchase demand can last for several years (subject to any statute of limitations defenses), the early payment default and early repayment clauses have a much shorter shelf life.

Still, there are some important points to keep in mind:

- Regarding early payment defaults, the scope is usually limited to only the borrower’s first payment, but sometimes the scope extends to the first six payments. Typically, mortgage brokers are not in touch with borrowers when the first payment is due (two months after closing), let alone the next five payments.

- As for the early payoff clause, the lookback period is usually 180 days; again, the broker is usually out of contact by that point and has limited control over the borrower’s efforts to refinance or otherwise exit the loan early.

It is, therefore, good practice for mortgage brokers to maintain communication with their clients post-closing, including by helping them sign up for autopay for their mortgage payments. And, if the borrower really wants to pay off the loan early, within 180 days by refinancing, the broker can help limit the damages if the new loan is delivered back to the same lender.

Strategies To Reduce Risk And Liability

- Read the fine print. The language of clawback provisions can vary dramatically, so familiarize yourself with the mortgage broker agreements you currently have in place. Before contracting with new lenders, you can try negotiating more favorable language.

- Have strong internal controls in place. Hire a compliance specialist or attorney to set up internal policies to filter out fraudulent borrower applications as much as possible. And post-closing, have an automated system to remind borrowers to make their first payments on time.

- Get robust E&O insurance. If that “rainy day” comes, and a lender invokes a clawback provision against you, make sure your errors and omissions policy covers these situations and immediately file a claim. Note, however, that some E&O policies specifically exclude the insured’s refusal or failure to repurchase loans.

- Be ready to dispute the lender’s demand. Most lenders will work with a mortgage broker to resolve the matter through some sort of settlement. After all, the lender does not want to lose your business. However, if a settlement cannot be reached, you might have to hire an attorney to go to court or arbitration, depending on the dispute resolution provision. All the while, the lender has the right of offset, meaning you might not be entitled to your commissions for any other loans you have pending in that lender’s pipeline.