Advertisement

Kellum's Korner ... Mediocrity: The Bleeding of American Progress

Forward on Reverse ... A Bountiful Harvest: Workers Needed in Cherry-domAtare E. Agbamu, CRMSreverse mortgages, Standard and Poors, home equity, Sarah Hulbert, Seattle Mortgage Company, NRMLA

Imagine for a moment that we are traveling to a land called

Plum-doma sprawling, rich-green field as vast as the eyes can see.

This field is home to countless, growing plum trees, holding some

of the juiciest and sweetest plums this side of the fabled Garden

of Eden. On the opposite side of Plum-dom are cherry plum trees. We

will call this side Cherry-dom.

In Plum-dom, there are a great number of farmerssome would say

too many for the prosperity of legions of smaller plum farmers.

Plum farmers come and go, and the seasons are carefully monitored

and managed by a wise overseeing committee. Whenever there is too

much moisture in the soil, the committee issues a decree, water is

sucked from the soil, and the price of plums increases. The

opposite is true when there is too little soil moisture. Right now,

in A.D. 2003, during the reign of Emperor HUBS II, there is an

abundance of water in Plum-doms soil, and the moisture-control

committee has yet to determine that the vast soil of Plum-dom is

too wet for the botanical health of plum trees, so, the vast plum

harvest continues, and most farmers are happy.

By contrast, there are only three major farmers and a handful of

assistant farmers in neighboring Cherry-dom, mostly comprised of

migrant farmers from Plum-dom. In fact, two of the major Cherry-dom

farmers are already neck-deep in farming in Plum-dom, but are

farsighted and courageous enough to stake a leadership position in

Cherry-dom as well. Although it takes twice as much effort to grow

and harvest cherry plums, the farmers of Cherry-dom are pleased and

excited about their work, with the unique strains of plums

sprouting everywhere, growing each year. They believe that

Cherry-dom holds considerable promise for the future of Plum-dom in

general, and they are puzzled by the general lack of interest in

the opportunities offered by their emerging crop.

Now, let us look at the plum story in the context of our

industry. Obviously, Plum-dom is the forward mortgage credit

industry, and Cherry-dom is the reverse mortgage credit segment. If

the reverse mortgage opportunities are so compelling, why is there

a relative lack of interest in them by Mortgage Brokers?

Census Bureau data tells us that households headed by those age

65 and over have increased by more than 5.6 million since 1980. In

fact, the total number is estimated to jump to more than 25 million

households by 2010.

A study conducted by Standard & Poors, the credit-rating

powerhouse, says elderly households have gathered $1.8 trillion in

home equity, and that number will only grow as baby-boomers begin

to hit 65. Here is what the S&P study has to say about the

coming opportunity in reverse mortgages: "The strong demographic

force, coupled with huge home equity just waiting to be tapped,

forms a powerful base to generate a strong demand for reverse

mortgages in the upcoming decade." In separate studies, Fannie Mae

and Moody's Investors Services have reached similar conclusions

about the coming reverse mortgage boom. So, with so many reverse

mortgage cherry plums waiting to be harvested, the question

remains: Why aren't Mortgage Brokers excited about reverse

mortgages?

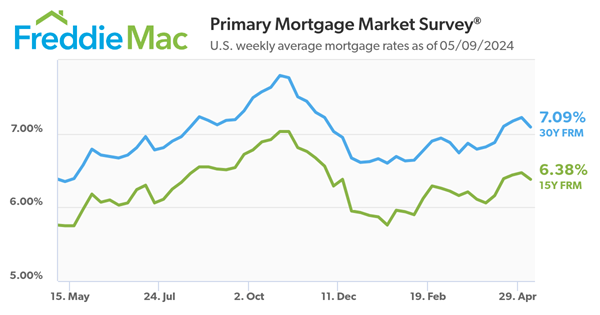

There are several reasons, according to Sarah Hulbert, national

director of Seattle Mortgage Company's reverse mortgage division

and co-chair of the National Reverse

Mortgage Lenders Association. The first reason Hulbert

identifies is the low interest rate environment and the refinance

boom that it subsequently created. She also mentioned lack of

Mortgage Broker awareness of the reverse mortgage opportunity, the

ease of forward mortgage origination relative to reverse mortgages,

and the current low income potential in contrast to forward

mortgages.

Hulbert predicts that, with the coming silver-age-wave,

increased awareness, knowledge and acceptance of reverse mortgages,

Mortgage Brokers will be compelled by consumer demand to take

reverse mortgages seriously. She also concludes that baby-boomers

are more savvy about debt and have no inhibitions about using

leverage; consequently, they will use reverse mortgages more

aggressively than their Great Depression-era parents.

Are you ready for the imminent reverse mortgage boom? Have you

taken the time to understand this innovative mortgage product? Can

you afford not to be ready when the boom hits?

I will tell you this muchthe harvest is bountiful, and workers

are needed in Cherry-dom. Get ready!

Atare E. Agbamu, CRMS, is a reverse

mortgage specialist and director of training at Inver Grove

Heights, Minn.-based Credo Mortgage. Atare's reverse mortgage

interviews have been webcast on Mortgage Mag Live!, and he

currently serves on the boards of Little BrothersFriends of the

Elderly in the Twin Cities and nationally. He can be reached by

phone at (651) 389-1105 or e-mail [email protected].

About the author