RealtyTrac Reports: Homebuying Still More Affordable Than Renting

RealtyTrac has released an analysis of fair market rents and median home prices in more than 500 U.S. counties, which shows that buying is still more affordable than renting in the majority of U.S. housing markets, while the opposite is true in markets with the biggest increase in the millennial share of the population over the last six years. RealtyTrac analyzed 2015 fair market rental data recently released by the U.S. Department for Housing & Urban Development (HUD) for three-bedroom properties in 543 counties nationwide with a population of at least 100,000. In the 473 counties with sufficient rental and home price data, the fair market rent for a three-bedroom property in 2015 will require an average of 27 percent of median household income, while buying a median-priced home requires an average of 25 percent of median household income based on the median sales price in November.

Buying a median-priced home was more affordable than renting a three-bedroom property in 68 percent of the counties analyzed, representing 57 percent of the total population in those counties. But in the 25 counties with the biggest increase in millennials between 2007 and 2013, fair market rents for a three-bedroom property in 2015 will require 30 percent of the median household income on average while buying a median-priced home requires 36 percent of median household income on average. For the analysis millennials were defined as anyone born between 1977 and 1992.

“First-time homebuyers and potential boomerang homebuyers are stuck between a rock and a hard place in today’s housing market: many of the markets with the jobs and amenities they want have hard-to-afford rents and even harder-to-afford home prices; while the more affordable markets have fewer well-paying jobs and tend to be off the beaten path,” said Daren Blomquist, vice president at RealtyTrac. “Those emerging markets with the combination of good jobs, good affordability and a growing population of new renters and potential first-time homebuyers represent the best opportunities for buy-and-hold real estate investors to buy low and benefit from rising rents in the years to come.”

The top markets with the biggest increase in the percentage of millennials over the past seven years were counties in Washington D.C., San Francisco and Denver, all of which saw an increase of more than 50 percent in the share of the population that is millennials. Other markets in the top 25 for biggest increase in millennials included counties in New York; Nashville, Tenn.; Portland, Ore.; St. Louis, Mo.; Seattle; Charlotte, N.C.; Minneapolis; Indianapolis; Atlanta; Orlando, Fla.; Austin, Texas; Des Moines, Iowa; and Midland, Texas.

The average 2015 fair market rent in these top 25 counties is $1,459, 19 percent above the national average for all counties analyzed. On average, 2015 fair rents increased three percent from a year ago in these counties, with the standouts being Denver County and Midland County, Texas, both of which saw fair market rents increase more than 20 percent.

Median home prices increased nine percent from a year ago in these counties on average compared to an average six percent increase among all counties analyzed nationwide. The average unemployment rate among these counties was 5.2 percent in October compared to an average of 5.5 percent for all counties analyzed.

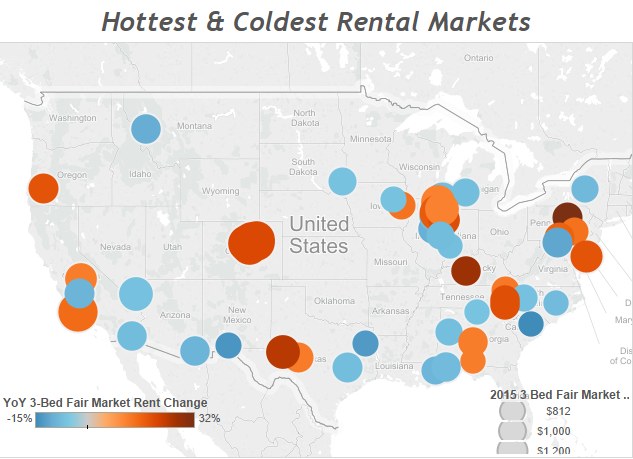

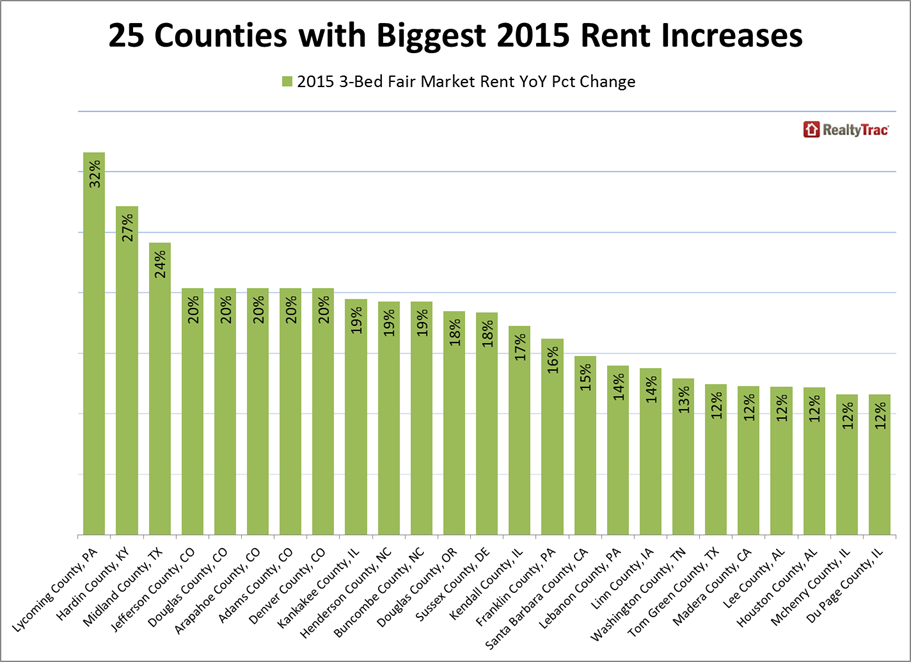

The top counties in terms of increasing fair market rents on three-bedroom properties were in Williamsport, Pa.; Elizabethtown, Ky.; and Midland, Texas, all of which saw an increase of 24 percent or more in fair market rents compared to 2014. Williamsport and Midland are both experiencing oil and gas booms facilitated by fracking, and Elizabethtown is home to the Fort Knox U.S. Army post. Other markets among the top 25 for increasing rents included counties in Denver, Colo.; Asheville, N.C.; Chicago and Santa Barbara, Calif. The average 2015 fair market rent in these top 25 counties is $1,327, 8 percent above the national average for all counties analyzed. Among these counties, 2015 fair market rent on a three-bedroom property will require 25 percent of median household income on average while buying a median-priced home requires 27 percent of median household income on average. The average unemployment rate among these counties was 4.9 percent compared to an average of 5.5 percent unemployment rate among all counties analyzed. Median home prices increased six percent from a year ago in these counties on average, the same as the average for all counties analyzed.

The top markets with the biggest decreases in fair market rents on three-bedroom properties were in Sumter, S.C.; Las Cruces, N.M.; and Longview, Texas. All three saw fair market rents decrease at least 13 percent from 2014 to 2015. Other markets in the top 25 for decreasing rents included counties in several college towns: Bloomington, Ill.; Champaign-Urbana, Ill.; College Station, Texas; Terre Haute, Ind.; along with Las Vegas. The average 2015 fair market rent in these top 25 counties is $1,023, 16 percent below the national average for all counties analyzed. Among these counties, 2015 fair market rent on a three-bedroom property will require 29 percent of median household income on average while buying a median-priced home requires 23 percent of median household income on average. The average unemployment rate among these counties was 6.7 percent compared to an average of 5.5 percent unemployment rate among all counties analyzed. Median home prices decreased one-half percent from a year ago in these counties on average, compared to an average increase of 6 percent for all counties analyzed.

The top counties where fair market rents were least affordable as a percentage of median household income were in New York; Baltimore, Md.; Philadelphia; Miami, Fla.; Virginia Beach, Va.; San Francisco; Eureka, Calif.; and Los Angeles. Fair market rents required at least 40 percent of median household income in all of the 10 least affordable counties.

“With interest rates still at record lows, the buy analysis is compelling for many renters,” said Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market. “We are beginning to see those who lost their homes in the great recession re-enter the purchase market. Coupled with the re-emergence of the low down payment loans and the aging of the millennials—2015 bodes well for an improving purchase market.”

Other markets among the top 25 for least affordable fair market rents were in Tampa, St. Louis, New Orleans, Richmond, Va., Atlanta, San Diego, Sacramento and Orlando. The average 2015 fair market rent in these top 25 counties is $1,686, 38 percent above the national average for all counties analyzed. Among these counties, 2015 fair market rent on a three-bedroom property will require 42 percent of median household income on average while buying a median-priced home requires 44 percent of household income on average. The average unemployment rate among these counties was 6.5 percent compared to an average of 5.5 percent among all counties analyzed. Median home prices decreased 3 from a year ago in these counties on average, the same as the average for all counties analyzed.

The top counties where fair market rents were most affordable as a percentage of median household income were in Columbus, Ohio; Indianapolis; and Nashville, Tenn. Fair market rents required less than 15 percent of median household income in parts of these markets.

"Across Ohio we have experienced an increased demand with rentals due to a growing job market and affordable rental rates throughout the state,” said Michael Mahon, executive vice president at HER Realtors, covering the Cincinnati, Columbus and Dayton markets. “As many consumers remain optimistic over job and income stability, many are still repairing credit issues and paying down debt incurred over recent past years economic concerns. Particular focus is on the millennial demographic whom appear to be taking advantage of renting available homes while seeking greater personal financial security by redirecting down payment funds to paying off targeted debt such as student loans."

Other markets among the top 25 for most affordable fair market rents included counties in Atlanta, Cincinnati, Milwaukee, and Houston. The average 2015 fair market rent in these top 25 counties is $1,019, 17 percent above the national average for all counties analyzed. Among these counties, 2015 fair market rent on a three-bedroom property will require 26 percent of median household income on average while buying a median-priced home requires 12 percent of household income on average. The average unemployment rate among these counties was 5.8 percent compared to an average of 5.5 percent among all counties analyzed. Median home prices were flat from a year ago in these counties on average, compared to an average increase of six percent for all counties analyzed.