Survey Finds Millennials in the Dark on Closing Costs

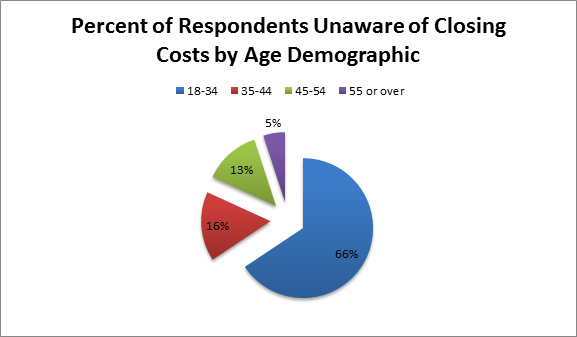

ClosingCorp has released the results of a nationwide survey which reveals that approximately two-thirds of Millennials, adults between the ages of 18-34, who plan to buy a home are unaware of closing costs. The survey also found that across all adult age brackets, more than one-third of potential homeowners are “Not Very” or “Not At All” aware of closing costs.

“Much has been written about Millennials because they are the largest generation so far in U.S. history, and their longstanding impact on the real estate market and economy is going to be huge,” said Brian Benson, CEO of ClosingCorp. “Their buying behaviors are much different than previous generations, and of particular concern to the industry is that they are waiting longer to buy their first homes. This study emphasizes the need to better educate Millennials, and really all consumers in general, on the real estate closing process. While interest rates are often the driving force in initiating a real estate transaction, the realtor, lender, title and other settlement fees also have a significant impact on the down payment and cash outflow from the borrower perspective. Not understanding how everything is related can be a real impediment for first-time homebuyers who want to get into the market.”

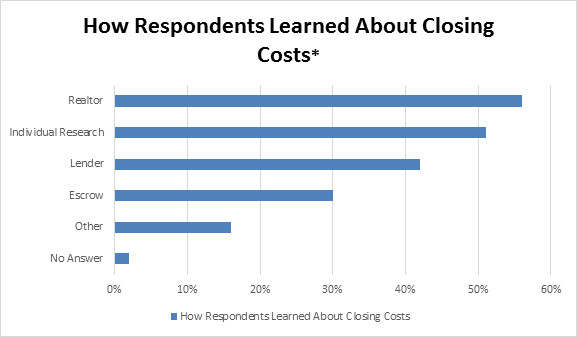

The “ClosingCorp National Closing Costs Survey” of more than 1,000 adults, also showed that most people learn about closing costs from realtors, or by doing their own research. In fact, Millennial homeowners are more likely to learn about closing costs from a realtor as opposed to a lender by a ratio of nearly two-to-one.

“This study is very interesting in that it shows Millennials are more dependent on realtors than previously presumed,” said Benson. “We know they are more tech-savvy than their predecessors, so we believe this really highlights the complexity of a residential real estate transaction. Whether they are researching a home on their own or getting help from an interested third-party, the bottom line is that people need access to the correct information, and it needs to be simple for them to understand. With the upcoming changes to the disclosure process being made by the Consumer Financial Protection Bureau this August, we as an industry should be stepping up our proactive education efforts to ensure homebuyers are fully prepared to make the most significant financial transaction of their lives.”