Home Price Appreciation Decelerates in February

RealtyTrac has released a February 2015 Home Price Appreciation Analysis, which found that annual home price appreciation in February slowed compared to annual home price appreciation a year ago in 60 of the 92 metros analyzed with a population of 500,000 or more and sufficient home price data.

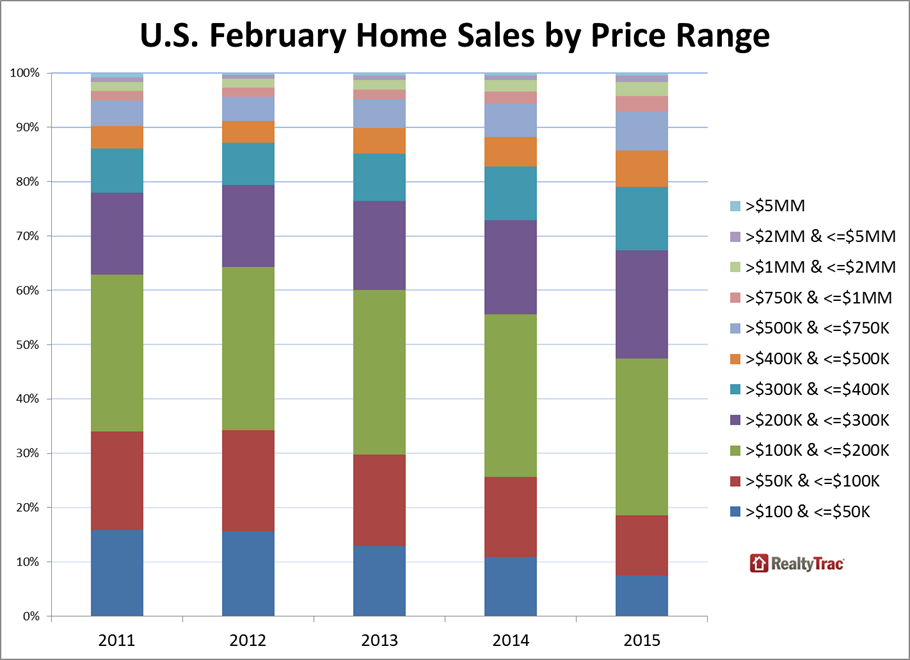

The report also found that the U.S. median home price in February increased 14 percent from a year ago but was flat from the previous month to $183,000. The median sales price of distressed homes—those in the foreclosure process or bank-owned—increased 13 percent from a year ago to $127,000, 33 percent below the median sales price of non-distressed properties, $190,000.

“While still significant at 33 percent, the average discount buyers are realizing on distressed homes has been shrinking over the past 18 months after hitting a high of 40 percent in September 2013,” said Daren Blomquist, vice president at RealtyTrac. “Inventory of distressed properties is drying up in many markets even while demand for those properties—which typically fall into the target market for both investors and first-time homebuyers—is ramping up. That is in turn resulting in nationwide home prices skewing higher as a smaller share of homes sell at the lower end of the market.”

“2014 was a historical year for the luxury market in the Lake Tahoe area,” said Sue Lowe, senior vice president/corporate broker for Chase International, covering the Lake Tahoeand Reno, Nev. Markets. “We expect to see big things happen as the summer buying season begins in 2015.”

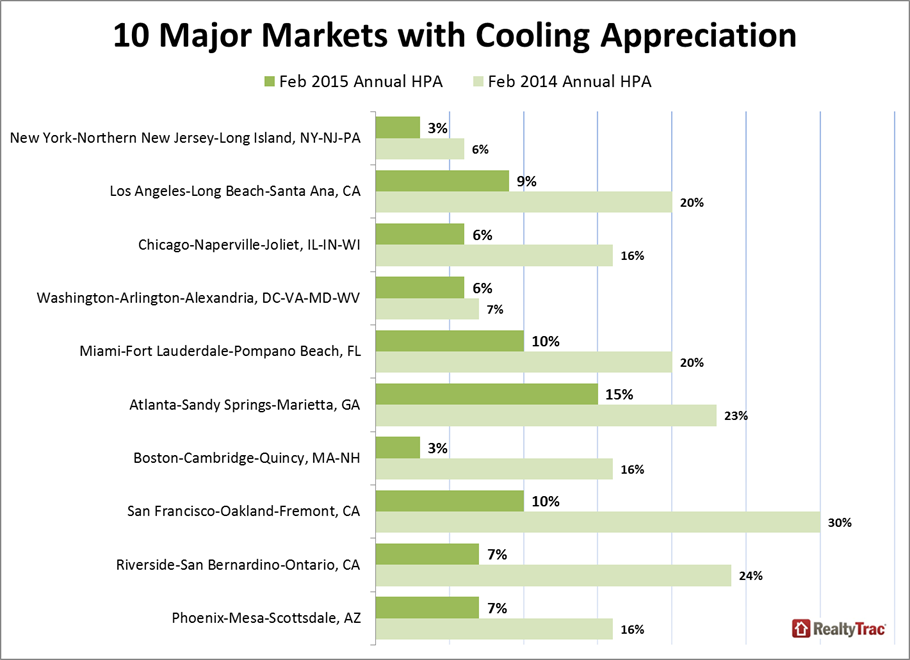

Among the nation’s largest metro areas, those with slowing home price appreciation included New York, New York (annual appreciation of three percent compared to six percent last year), Los Angeles, California (annual appreciation of nine percent compared to 20 percent last year), Chicago, Illinois (annual appreciation of six percent compared to 16 percent last year), Washington, D.C. (annual appreciation of six percent compared to seven percent last year), and Miami, Fla. (annual appreciation of 10 percent compared to 20 percent last year).

“Last year, Seattle home prices saw double digit increases, but as we predicted earlier this year, that pace has started to slow,” said OB Jacobi, president of Windermere Real Estate, covering the Seattle market where annual price appreciation was six percent compared to 13 percent a year ago. “We actually see this as a good thing because if home prices were to continue appreciating in the double digits for too long, we could run into the same boom/bust market of years past.”

“After the last flurry of distressed buying in the first half of 2013 we have seen a gradual move to a more normal real estate market – with real buyers and real sellers,” said Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market, where annual home price appreciation was 10 percent compared to 20 percent last year. “This translates to a healthy move toward historic single digit appreciation levels.”

The recovery has helped 17 metro areas (18 percent of total 92) reach new peaks in median home prices in 2014 including Denver, Colo. ($265,000), San Jose, Calif. ($714,750), Chattanooga, Tenn. ($130,000), Madison, Wis. ($215,900) and Nashville, Tenn. ($175,000).