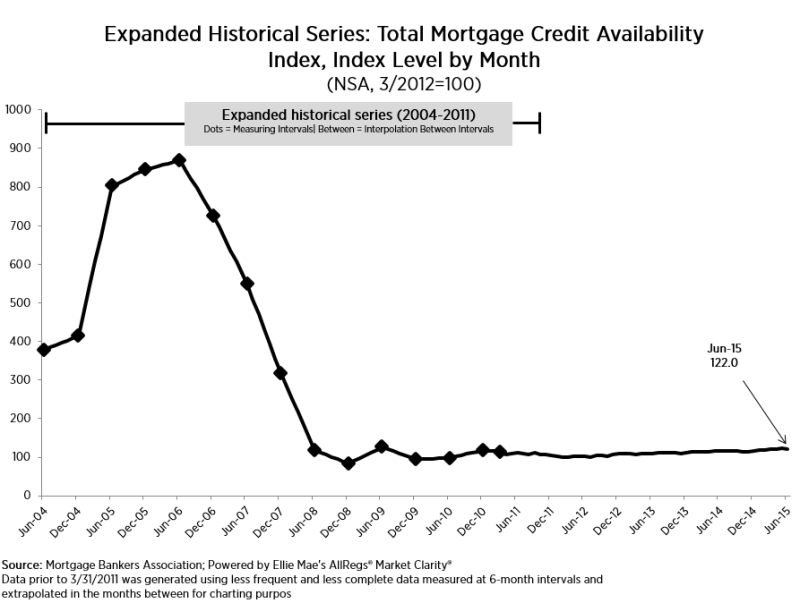

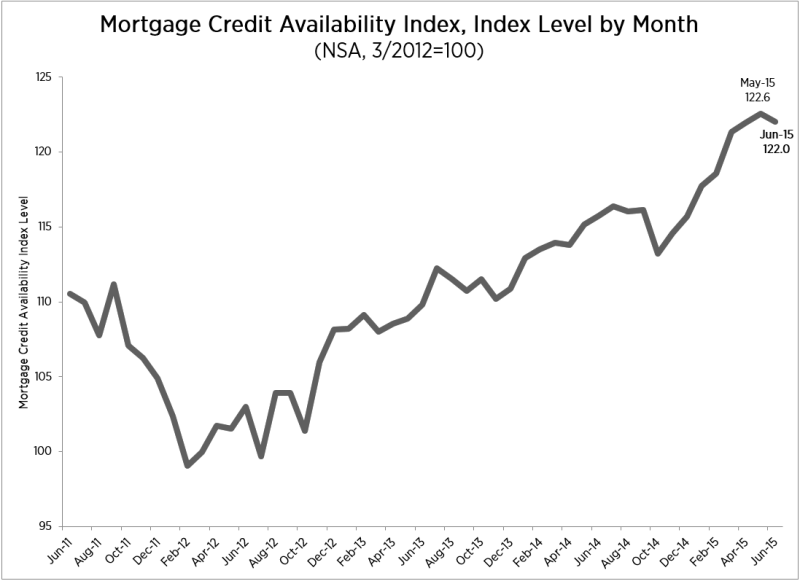

Mortgage Credit Availability Slips Slightly in June

Mortgage credit availability decreased in June according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) which analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool. The MCAI decreased 0.5 percent to 122.0 in June. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of a loosening of credit. The Index was benchmarked to 100 in March 2012. Of the four component indices, the Conventional MCAI saw the greatest tightening (down one percent over the month) followed by the Jumbo MCAI (down 0.6 percent), the Conforming MCAI (down 0.3 percent), and the Government MCAI (down 0.2 percent).

“This month mortgage credit availability reverted to its April level taking back the gains observed in May. Despite recent signs of improvement in housing markets, mortgage credit availability stalled in June,” said Lynn Fisher, MBA’s vice president of research and economics. “Increases driven by higher availability of cash out refinance loans were more than offset by reduced availability of other types of loans this month, resulting in a decline in the index from May.”

MBA now reports on five total measures of credit availability as part of the monthly MCAI release: The Total MCAI, the Conventional MCAI, the Government MCAI, the Conforming MCAI, and the Jumbo MCAI, with historical data back to 2011. Of the four component indices, the Conventional MCAI saw the greatest tightening (down one percent over the month) followed by the Jumbo MCAI (down 0.6 percent), the Conforming MCAI (down 0.3 percent), and the Government MCAI (down 0.2 percent).

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. Similarly, the Jumbo MCAI examines everything flagged as “Jumbo” while the Conforming MCAI examines loan programs that fall under conforming loan limits.