Nearly 45 Percent of U.S. Homes in High Risk Natural Disaster Zones

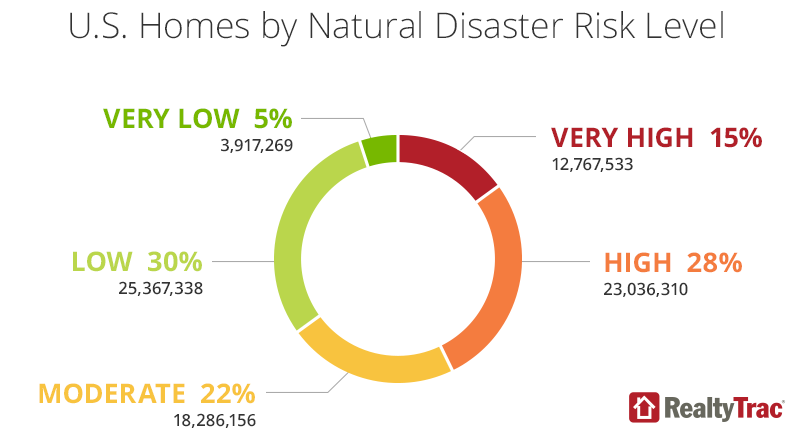

RealtyTrac has released its 2015 U.S. Natural Disaster Housing Risk Report, which found that 35.8 million U.S. single family homes and condos with a combined estimated market value of $6.6 trillion are in counties with high or very high natural hazard risk. Those 35.8 million homes represent 43 percent of the 83.4 million single family homes and condos in all counties analyzed for the report. For the report, RealtyTrac assigned a natural disaster risk score to 2,318 counties nationwide with sufficient home value data available. Based on its score, each county was assigned to one of five risk categories for overall risk of natural disaster: Very High, High, Moderate, Low and Very Low. Similar scoring and ranking was also used to rate risk for each of the five natural disasters individually.

“In the interest of personal safety and protecting the value of what is likely their biggest financial asset, prospective buyers and investors should be aware of any natural disaster risk impacting a potential home purchase,” said Daren Blomquist, vice president at RealtyTrac. “There is no reason homebuyers need to be surprised with natural disaster risk information when wading through a stack of disclosures at the closing table given the widespread availability of this data online and even through mobile apps. In most cases learning about natural disaster risk will not stop a home sale, but it will help buyers make a better-informed decision about where to buy and also be prepared in terms of appropriate insurance coverage and family contingency plans depending on the type of natural disaster risks most affecting the home they end up purchasing."

States with the most homes in High Risk or Very High Risk counties for overall natural disaster risk are California (8.4 million), Florida (6.7 million), New York (2.4 million), New Jersey (2.3 million) and North Carolina (2.3 million).

Metro areas with the most homes in High risk or Very High risk counties for overall natural disaster risk are New York (3.5 million), Los Angeles (2.5 million), Miami (1.9 million), Houston (1.2 million), and Riverside-San Bernardino in Southern California (1.1 million).

“The weather is beautiful in SoCal, but we are statistically more susceptible to the risk of fire, floods and earthquakes than most areas. Our agents must be articulate in explaining the higher risks to buyers. People have to be able trust their agent to fully disclose the risks of natural disasters and homeownership to allow buyers to make the most informed decisions,” said Mark Hughes, chief operating officer with First Team Real Estate, covering theSouthern California market. “A well-informed knowledgeable buyer is best prepared to take on the potential risks associated with SoCal homeownership.”

The report found that 24.5 million single family homes and condos (29 percent of the 83.4 million total) with a combined estimated market value of $4.7 trillion are in counties with a High risk or Very High risk for hurricanes.

States with the most homes in High risk or Very High risk counties for hurricanes are Florida (6.7 million), North Carolina (2.4 million), Virginia (2.0 million), New York (1.9 million) and New Jersey (1.8 million).

Metro areas with the most homes in High risk or Very high risk counties for hurricanes are New York (3.0 million), Miami (1.9 million), Washington, D.C. (1.8 million), Boston (1.1 million) and Tampa (953,000).

“The allure of South Florida’s sun and surf, for most, outweigh any concern of a hurricane threat,” said Mike Pappas, CEO and president of the Keyes Companycovering the South Florida market. “The improved communication, continual education and enhanced predictability all give comfort to our coastal residents. History has shown that we are not only able to survive but in fact thrive with insurance and property improvements after a storm hits.”

The report found that 10.6 million single family homes and condos (13 percent of the 83.4 million total) with a combined estimated market value of $1.8 trillion are in counties with a High Risk or Very High risk for wildfires.

States with the most homes in High risk or Very High risk counties for wildfires are California (1.9 million), New York (1.6 million), Florida (1.6 million), North Carolina (1.1 million), and New Jersey (1.1 million).

Metro areas with the most homes in High risk or Very High risk counties for wildfires are New York (2.1 million), Riverside-San Bernardino in Southern California (1.1 million), Charlotte, North Carolina (471,905), Columbia, South Carolina (252,155), and Charleston, South Carolina (214,666).

Homes in Very High risk counties for overall natural disaster risk had an average estimated market value of $170,237, and homes in High risk counties had an average estimated market value of $191,244. Meanwhile the average home value in Very Low risk counties was $151,793, and the average home value in Low risk counties was $154,464.

Although average home values were higher in higher-risk counties, home price appreciation over the past 10 years was stronger in lower-risk counties. Among 551 counties with sufficient historical home price data, home sales prices in counties with a Low risk for natural disasters increased 6.6 percent on average between 2005 and 2015, and home sales prices in counties with a Very Low risk for natural disasters rose 9.5 percent on average during the same time period.

Conversely, home sales prices in counties with a High risk for natural disasters decreased 2.5 percent on average over the past 10 years while home sales prices in counties with a Very High risk for natural disasters decreased 6.4 percent on average.

“Each year we experience damaging storms and it is with anticipation we recommend buyers make sure they have adequate insurance to protect them from carrying the burden of replacing a roof when the storms hit,” said Heidi Greer, owner/broker at RE/MAX Alliance, covering the Denver market in Colorado, which was one of six states with no counties rated High or Very High for overall natural disaster risk despite having some counties rated as High risk for wildfires and floods. “Our mountain areas have a much higher risk of fire and there are regulations buyers must be made aware of when they purchase wooded properties or have the intent of adding structures in wooded locations. Buyers who prefer the mountain areas are normally aware of the added risk before they consider moving there.”

Home price appreciation over the past three years has been stronger in higher risk counties for natural disaster. In counties with a High risk for overall natural disaster, home prices increased 16.6 percent between 2012 and 2015 on average, while home prices in counties with a Very High risk for natural disasters increased 20.4 percent during the same time period. Home prices in Low risk counties increased an average of 10.1 percent over the past three years, and home prices in Very Low risk counties increased an average of 12.8 percent during the same time period.