NMP's Visionary Organizations 2016

Every once in a while, an organization comes along, an organization that sets trends, remains ahead of the curve and sets a bar by which all others strive to attain. This month, we take a look at a sampling of these organizations, organizations that we have deemed “Visionary” for their inspiration to always strive to improve and go above and beyond to assist their clients, but ones that have successfully navigated an ever-changing mortgage industry marketplace. We present to you the following movers and shakers in the industry and the leaders behind them.

ACC Mortgage Inc.

ACC Mortgage Inc.

WeApproveLoans.com

►How the company started: For 17 years ACC Mortgage Inc. has been committed to bettering the financial positions of its customers, business partners and communities. Headquartered in Rockville, Md., this philosophy-driven lender has been owned and operated by its founding partners since day one. With a tried and true lending algorithm, ACC Mortgage, closes the loans that others may see as a financial risk. Experiencing significant yearly growth, ACC Mortgage, Inc. is now a leading portfolio lender.

Business partners Robert Senko and Stuart Wolpoff founded ACC Mortgage in 1999 to provide loans to an underserved market. Their vision established an organization that provides high-touch service, easy to understand programs and competitive pricing for residential and commercial customers.

In April, 2014 ACC Mortgage completed a two-year process, earning their Community Financial Development Institution (CDFI) certification from the U.S. Treasury. The CDFI Fund promotes access to capital in underserved communities across the nation.

►How the company has changed the mortgage industry: Our money, our rules! ACC is a portfolio lender specializing in underserved residential and commercial markets. The company has expanded into 14 states, coast to coast. ACC has developed a proprietary algorithm to offer uniquely tailored solutions for underserved clientele, offering a comprehensive suite of loan products and financial services. The company’s success and growth is directly attributable to their unique lending philosophy, commitment to the communities they serve and ability to close quickly.

►How the company has changed the mortgage industry: Our money, our rules! ACC is a portfolio lender specializing in underserved residential and commercial markets. The company has expanded into 14 states, coast to coast. ACC has developed a proprietary algorithm to offer uniquely tailored solutions for underserved clientele, offering a comprehensive suite of loan products and financial services. The company’s success and growth is directly attributable to their unique lending philosophy, commitment to the communities they serve and ability to close quickly.

All loans are process, underwritten, funded and serviced at their Rockville location. Loans are processed expeditiously, communication is clear and friendly. ACC closes loans that may be seen as higher risk by other financial institutions based on a simple and effective lending philosophy: Benefit to the customer and the community; capacity to repay; and fair market value.

The company offers the following loan products to residential and commercial customers: Foreign national clients; ITIN customers; low credit score debt consolidation; second chance purchase; commercial and investor loans.

ACC is committed to bettering the financial position of its borrowers and promoting economic development and offers the following services and benefits in support of this mission: Financial counseling; CDFI-certified; free credit reports; lending partner programs; and online financial calculators and resources.

ACC Mortgage holds a Community Financial Development Institution (CDFI) certification from the U.S. Treasury. The CDFI Fund helps promote access to capital across the nation. As a CDFI, ACC is able to further its commitment to putting community first and lending to and supporting those not eligible for traditional loans.

The company’s unique structure and lending philosophy, combined with its superior customer service, communication and responsiveness has led to year over year growth in a growing market. A leader in the private money-lending field, ACC will continue to expand services and offerings.

Alight Inc.

Alight Inc.

Alightinc.com

►How the company started: Alight Inc. was founded in 2006 by Rand Herr, the creator of Pillar Corporation (a tech start-up that was subsequently acquired by Hyperion and Oracle), with an eye toward reinventing how companies run enterprise financial management. A pioneer in the financial planning and analysis space, Rand believes that financial management should be done in real-time, all the time, with input from management and teams in all parts of the enterprise, from CEO and CFO, to operations, technology, marketing, sales and HR. And that those inputs could provide a real-time view on the financial and operational health of the enterprise. Alight spent the beginning of its history in intensive research and development, leading to its current technology platform and product lineup that spans a number of different verticals, including mortgage, mining and technology.

►How the company has changed the mortgage industry: Alight is changing the way businesses are run. Our applications let executives manage the future by comparing multiple scenarios and taking action in real-time. We’re doing this one industry at a time. Alight Mortgage Solutions provides real-time, industry-specific enterprise financial management applications to the mortgage banking industry.

►How the company has changed the mortgage industry: Alight is changing the way businesses are run. Our applications let executives manage the future by comparing multiple scenarios and taking action in real-time. We’re doing this one industry at a time. Alight Mortgage Solutions provides real-time, industry-specific enterprise financial management applications to the mortgage banking industry.

The roots of Alight Mortgage Solutions are firmly planted in the tech sector and in mortgage banking. We understand how to improve the way mortgage banking businesses are run and we have the technical expertise to make it work.

Alight Mortgage Lending, is the mortgage industry’s only application for real-time, multiple scenario analysis under any market conditions. It allows management teams to put their hands on critical financial and operational information from anywhere in the enterprise, and then evaluate multiple courses of action and the potential financial ripple effects on pro-forma operating and financial metrics including P&L, cash flow and balance sheet.

Alight provides real-time, any-time access to metrics that matter: Interest rate changes and the effects on warehouse loans, staffing, etc.; change in loan volumes or the mix between purchases and refinances; optimal staffing levels, including productivity and future workload; product profitability; and potential impact on P&L and cash positions based on shifts in the industry.

Alight Mortgage Lending connects all the critical, live event-driven information from across the enterprise–including data from your ERP, LOS and G/L–and lets management run limitless what-if scenarios to evaluate the potential ripple effects that changing market conditions and business decisions will have across the enterprise, before, during and after events take place. Delivering up-to-the-minute intelligence to key metrics-driven data from across the enterprise … that means running the business from anywhere, any time and any device. Critical, decision-making information is always available and at the fingertips of those who need it most. Anywhere, anytime, any device. That’s something only Alight can do.

Angel Oak Mortgage Solutions

Angel Oak Mortgage Solutions

AngelOakMS.com

►How the company started: Dedicated specifically to providing alternative lending solutions, Angel Oak Mortgage Solutions began in late 2013 as a small Wholesale Division of Angel Oak Home Loans. The firm’s founders identified a need for different types of loans–such as non-prime and Alt-A mortgage programs–in the market as they were not generally available at the time. Angel Oak Mortgage Solutions separated from Angel Oak Home Loans in October of 2014, and has continued to grow rapidly since. Originally licensed in only seven states, Angel Oak Mortgage Solutions has expanded to 25 states as of March 2016. The firm has tripled its non-agency production each year since inception and continues to establish itself as the market leader in the non-prime space by providing specialized mortgage solutions for brokers and consumers with unique flexibility when applying for home loans.

►How the company has changed the mortgage industry: Angel Oak Mortgage Solutions has played a part in the evolution of the mortgage industry since late 2013, when the firm first began offering its non-agency, specialized mortgage products. Since then, Angel Oak has focused primarily on educating the entire industry on “the new sub-prime” and other alternative mortgage solutions for consumers.

►How the company has changed the mortgage industry: Angel Oak Mortgage Solutions has played a part in the evolution of the mortgage industry since late 2013, when the firm first began offering its non-agency, specialized mortgage products. Since then, Angel Oak has focused primarily on educating the entire industry on “the new sub-prime” and other alternative mortgage solutions for consumers.

The new sub-prime—or as we refer to them, non-prime/non-qualified mortgage/non-agency/alt-A—products are sensible and safe options for borrowers who would not generally qualify for agency programs. The safety of these programs is inspired by three main concepts: Ability-to-Repay (ATR), Appraiser Independence Requirements (AIR), and “skin in the game.” Despite popular belief, ATR applies not only to agency products, but to all products provided by Angel Oak Mortgage Solutions. AIR ensures that the loan-to-value (LTV) that we lend on is fair and accurate. And, finally, with “skin in the game,” borrowers are required to make at least a 10-20 percent downpayment for all loans, as borrowers are significantly less likely to walk away after putting so much equity into their home.

Since 2013, the market has taken off. Lenders and borrowers are catching wind of non-prime product availability, fueling supply and demand for non-prime products. In 2015 alone, Angel Oak Mortgage Solutions closed loan volume more than tripled 2014 volume, and its network of broker companies has more than doubled. Angel Oak Mortgage Solutions has proven to be the unrivaled expert and market leader in the non-prime market, and will continue to bring much-needed liquidity back to the U.S. mortgage market.

Caliber Home Loans Inc.

Caliber Home Loans Inc.

CaliberHomeLoans.com

►How the company started: Caliber Home Loans Inc. has experienced tremendous growth since 2008. And we’re not stopping now. The company that exists today was created in 2013, when Caliber Funding LLC and Vericrest Financial Inc. merged to create Caliber Home Loans Inc., a full-service mortgage banking company.

One of Caliber Home Loans’ predecessors, Caliber Funding, came into existence when Caliber’s parent company acquired legacy Bear Stearns origination assets together with its production platform. The business was rebranded to Caliber Funding LLC. Our parent company also acquired the CIT Group’s home lending and servicing operation unit in 2008, along with $9 billion of mortgage and consumer assets. This entity was rebranded Vericrest Financial. In August 2013, Caliber Funding became Caliber Home Loans.

►How the company has changed the mortgage industry: Two major factors in Caliber Wholesale’s vision are a sales-centric corporate culture, combined with seeking new ideas from our wholesale account executives and clients to improve our products and services. Combined with Caliber’s role as a dedicated national mortgage lender, Caliber Wholesale rose to number three in broker originations in 2015–a ranking it has retained ever since. Broker originations have increased by over 78 percent over the past 12 months*.

►How the company has changed the mortgage industry: Two major factors in Caliber Wholesale’s vision are a sales-centric corporate culture, combined with seeking new ideas from our wholesale account executives and clients to improve our products and services. Combined with Caliber’s role as a dedicated national mortgage lender, Caliber Wholesale rose to number three in broker originations in 2015–a ranking it has retained ever since. Broker originations have increased by over 78 percent over the past 12 months*.

Another industry-changing strategy is the development of Caliber’s Portfolio Lending Suite. These non-traditional loan products are designed to serve qualified borrowers who have the documented ability to repay a mortgage, but who may not meet the requirements for Agency products due to past credit issues or traditional investor/Jumbo guidelines.

Caliber’s wholesale account executives are highly-experienced, knowledgeable lending professionals. They are supported by a team of dedicated operational support staff within Caliber’s Regional Operations centers.

Broker Associates enjoy perks known within the industry as The Caliber Advantage. They include: Access to H2O, Caliber’s proprietary, state-of-the-art originations system; a wider array of loan options, including non-traditional loans developed by Caliber’s own Product Support executives; support from account executives and dedicated customer relationship managers; the freedom to issue TRID disclosures from their own systems, or Caliber’s; the advantage of choosing their own title agents and companies; and the option to deliver status updates by text or e-mail automatically via H2O.

To apply to become a broker associate or for more information, e-mail [email protected] or visit CaliberWholesale.com.

CIVIC

CIVIC

CIVICFS.com

►How the company started: CIVIC has a short history, but a well-capitalized pedigree. CIVIC was established in 2014 by its parent companies, Wedgewood and HMC Assets LLC, to meet the needs of real estate investors that did not fit within traditional lending criteria. From its humble start in mid-2014, CIVIC has grown quickly, closing 441 loans in 2015 with a total loan volume of $138 million.

How can we do that? CIVIC is a direct lender with local control. We underwrite our own files and provide our own appraisals which makes our loan process transparent and fast, closing deals in as little as four to 10 days.

►How the company has changed the mortgage industry: CIVIC delivers common-sense lending and focuses on building strong relationships with its clients, but its real point of difference is in its ability to have local control of the lending process. CIVIC originates one- to four-year non-owner-occupied investor loans that are competitively priced and funded on tight timelines by leveraging Wedgewood's proprietary asset valuation underwriting platform. We have teams, both in-house and in the field, who are experts in property appraisals, rehab cost assessments, and estimating market values.

►How the company has changed the mortgage industry: CIVIC delivers common-sense lending and focuses on building strong relationships with its clients, but its real point of difference is in its ability to have local control of the lending process. CIVIC originates one- to four-year non-owner-occupied investor loans that are competitively priced and funded on tight timelines by leveraging Wedgewood's proprietary asset valuation underwriting platform. We have teams, both in-house and in the field, who are experts in property appraisals, rehab cost assessments, and estimating market values.

Furthermore, CIVIC, with affiliated companies Wedgewood & HMC Assets, offers an exclusive online marketplace with hundreds of REOs and short sales, solving one the biggest problems for real estate investors—finding inventory to buy. Through the Preferred Investor Program, investors can find cooperative short sale listings and pre-list REO that cannot be found anywhere else. Additionally, investors get direct access to the lender to negotiate and streamline the short sale transaction, taking minutes rather than months to negotiate and close deals.

From navigating rigid lending guidelines to dealing with lengthy closing times, traditional banks can be a pain to work with. At CIVIC, we provide you access to the private money you need to fund your real estate ventures quickly and efficiently. With a specialized set of market competitive products, CIVIC makes possible the ability to acquire multiple properties and gives investors leverage over their cash position.

Class Appraisal

Class Appraisal

ClassAppraisal.com

►How the company started: Class Appraisal started in 2009 in response to government legislation that created a need for AMCs to help manage the appraisal process for lenders and banks.

Class started with a plan to provide appraisal services nationwide and started with a few small clients. We were fortunate that several of the clients we started working with grew quickly, enabling us to grow along with them.

Since 2009, Class Appraisal has grown into one of the top appraisal management companies in the country. We are currently working with five of the top seven wholesale lenders in the country.

►How the company has changed the mortgage industry: Class Appraisal has changed the way that appraisal management companies are viewed in the mortgage industry. We've built a culture internally that focuses on creating a friendly, upbeat environment for our team members to work in. Our internal culture helps foster a special relationship between our team members and our clients and our appraiser partners.

►How the company has changed the mortgage industry: Class Appraisal has changed the way that appraisal management companies are viewed in the mortgage industry. We've built a culture internally that focuses on creating a friendly, upbeat environment for our team members to work in. Our internal culture helps foster a special relationship between our team members and our clients and our appraiser partners.

Our clients often express to us that they feel more like business partners as opposed to clients. Each client has a dedicated team built out that handles their orders from start to finish to ensure consistency and continuity. Because we are a nationwide company, providing access and assistance to clients in all time zones is essential. We staff accordingly to make sure that our team is always available to assist during normal business hours for clients on the East Coast and the West Coast.

The biggest difference between Class and other AMCs is the relationships that we have with our panel of appraisers across the country. The appraiser population has been gradually shrinking the past few years, and it's more important than ever to build and maintain strong relationships with the professionals that are completing appraisals for our clients. We have implemented creative benefits for our appraisers like 24 hour quick-pay, an Appraiser Help Desk, and a Preferred Plus Panel that have helped us to make Class a desirable business partner for appraisers. This helps translate into faster turn times, more accurate reports, and essentially more closed loans for our clients.

Class has also become a leader in the technology sector in the industry. We have created a proprietary TRID Calculator that has changed the way that our lenders disclose appraisal fees. We also have built an interactive dashboard that allows our clients to access our performance metrics in real-time by state or region.

DocMagic Inc.

DocMagic Inc.

DocMagic.com

►How the company started: DocMagic’s president and CEO Dominic Iannitti founded DocMagic Inc., in 1988 as a local doc prep firm. Beginning immediately with an unheard-of 24-hour delivery system and followed up with custom form design, the company continued to innovate with the introduction of DocMagic software, the first auditing system, a full compliance department, eServices and on to mobile technology.

Today, DocMagic is called upon by lenders to provide cutting-edge services that assure compliance and increase efficiency while reducing loan production costs.

DocMagic has enjoyed steady growth over the years by regularly expanding its offerings to accommodate industry demand. Everything DocMagic does is geared toward meeting the needs of clients in a way that simply could not be done without a vision towards the future and the constant evolution of our technologies.

►How the company has changed the mortgage industry: DocMagic Inc. has become the leading provider of fully-compliant loan document preparation, compliance, eSign eDelivery, eClosing and eService solutions for the mortgage industry. The company’s extensive team of compliance experts and in-house legal staff consistently monitor legal and regulatory changes at both the federal and state levels to ensure accuracy.

►How the company has changed the mortgage industry: DocMagic Inc. has become the leading provider of fully-compliant loan document preparation, compliance, eSign eDelivery, eClosing and eService solutions for the mortgage industry. The company’s extensive team of compliance experts and in-house legal staff consistently monitor legal and regulatory changes at both the federal and state levels to ensure accuracy.

DocMagic has grown its solution set into facilitating a true end-to-end eMortgage process, among its other robust list of widely used software products. Most recently, the company launched its new total eClosing solution, which digitally transforms the entire mortgage process from initial eDisclosure to final eClosing and investor eDelivery from start to finish.

In order to effectively address TRID, DocMagic developed SmartCLOSE, which is a collaborative closing portal that offers a secure, centralized online environment for lenders, settlement providers, and other associates to share, validate, audit, track and collaborate on documents, data and fees. DocMagic’s Audit Engine runs continuously behind the scenes to ensure compliance and everything is accessible within SmartCLOSE, including the eSigning and eDelivery of documents. To date, SmartCLOSE has been well-received by users with rapidly increasing adoption.

Also significant is that in 2016 DocMagic introduced a new rep and warrant offering that guarantees TRID compliance of up to $5 million. The insurance-backed guarantee is the most far-reaching compliance guarantee of its kind in the mortgage industry. It is designed to provide peace of mind to lenders when it comes to compliance with the TRID rule.

DocMagic is constantly innovating, enhancing existing products, launching new solutions, and forging significant strategic partnerships that have collectively made it the leader in document preparation, eClosings, eMortgages, and other eServices that bring newfound efficiencies to the mortgage industry.

Ellie Mae Inc.

Ellie Mae Inc.

EllieMae.com

►How the company started: Founded in 1997, Ellie Mae is a high-tech mortgage software company with old-fashioned values. Now processing almost a quarter of all U.S. mortgage applications, Ellie Mae ensures compliance and high quality. Ellie Mae founders Sig Anderman and Limin Hu started the company with one goal: to use technology to reduce friction, paper, time and cost. They never imagined this simple idea would grow Ellie Mae to what it is today, supporting thousands of clients and millions of mortgage transactions.

►How the company has changed the mortgage industry: While the industry has changed since the company’s founding almost 20 years ago, Ellie Mae’s mission to automate mortgages so lenders can achieve compliance, quality and efficiency hasn’t. Ellie Mae is committed to innovating how mortgage professionals work together to originate, process and close loans. Ellie Mae’s Encompass software gives the mortgage industry an all-in-one, end-to-end enterprise solution that handles all functions involved in running the business of originating mortgages. Ellie Mae’s Encompass clients save on average $231 per loan, receive 57 percent ROI in less than three months, and avoid up to $75,000 in potential compliance costs. Ellie Mae now processes almost a quarter of U.S. mortgage applications, and is continually recognized as an innovator in the field. The company has been recognized by Forbes as one of America’s best small companies, and has received various industry awards for its Encompass platform.

Geneva Financial LLC

Geneva Financial LLC

GenevaFI.com

►How the company started: In 2006, the company Aaron VanTrojen began his mortgage career with was sold to a large mortgage banking platform. He refused to work for a large bureaucratic, corporate, mortgage bank.

In 2007, VanTrojen formed Geneva Financial LLC as a multi-state licensed mortgage banker. In 2008, Geneva began closing loans. Due to the Great Recession, and no "seed" money, Geneva Financial LLC primarily brokered loans during its infancy.

After a couple of challenging years, Geneva Financial LLC obtained warehouse lines, and began banking loans through correspondent channels.

Geneva Financial is now licensed in 26 states and growing, and employs approximately 250 people. Geneva now sells to a dozen-plus correspondents through mandatory delivery. Geneva Financial is hiring professional loan originators and branch managers nationwide who are looking for an entrepreneurial opportunity.

►How the company has changed the mortgage industry: Geneva Financial was created to be a mortgage company for the employees first with a vision to treat the loan originator as the client.

When the financial crisis was in full swing in 2008, mortgage brokers who traditionally paid the most with the greatest loan product selection, closed their doors in record numbers, and many of those left standing fled to mortgage banking platforms. The mortgage bankers that had survived the near collapse of the entire industry capitalized on this shift from brokering to banking. Some driven by necessity, and others by greed, many mortgage banking platforms increased margins and lowered compensation to those that generated the originations.

Geneva Financial formed during this time of industry makeover. With no legacy issues, and very little overhead, Geneva Financial leveraged the only commodity it had: Originators. Pay the originator the maximum legal compensation, while delivering a competitive price to the homeowner.

Geneva Financial focuses on originating and closing "good" loans. We are exceptional at the originating, processing, underwriting and the funding of "good" loans. Quality loans for quality borrowers: Agency, government, jumbo, and even non-QM. Geneva’s focus is not on loan type, but the quality of loan originated; and also the person originating the loan.

Geneva Financial stills pays nearly twice the industry average to its loan originators, while delivering a more competitive price than the competition. It does this by efficiently closing quality loans that don't go bad.

And there is the all-important intangible … there are a thousand mortgage companies to work for. While Geneva pays more, is competitive and fast, those that choose to work with us are treated as our most valuable asset … as they are. The industry could use more heart. That is something Geneva offers as well.

MLinc Solutions

MLinc Solutions

MLincSolutions.com

►How the company started: Established in 1999, MLinc Solutions brings expertise and innovative solutions to the settlement industry in the structuring of strategic relationships between service providers. Mark L Meyer (pictured here), founder and CEO, has always believed that complementary relationships make us stronger, both personally and professionally. Having previously spent several years operating a national mortgage originator with affiliations and service arrangements involving dozens of key industry players across the country, Mark developed a commitment to engineering business associations that are consumer friendly, business-smart and compliant (aka “Strategic Relationeering”).

►How the company has changed the mortgage industry: MLinc’s Affiliated Business Arrangement (ABA) and Services Agreements solutions and related transformative offerings have brought hundreds of companies the independent expertise and diligence needed to confidently forge thousands of mutually-beneficial business relationships that are compliant with the Real Estate Settlement Procedures Act (RESPA). Specifically, the company’s ABA and Services Agreements Solutions provide tools, templates and videos for helping clients evaluate, sell and set up strategic relationships. And, MLinc’s industry-leading ComplyMSA, ComplyWSA, ComplyEvents and ComplyOffice offerings help companies value and verify services provided by business associates, including marketing activities, Web advertising, sponsored events, and office leases, to enhance RESPA compliance.

►How the company has changed the mortgage industry: MLinc’s Affiliated Business Arrangement (ABA) and Services Agreements solutions and related transformative offerings have brought hundreds of companies the independent expertise and diligence needed to confidently forge thousands of mutually-beneficial business relationships that are compliant with the Real Estate Settlement Procedures Act (RESPA). Specifically, the company’s ABA and Services Agreements Solutions provide tools, templates and videos for helping clients evaluate, sell and set up strategic relationships. And, MLinc’s industry-leading ComplyMSA, ComplyWSA, ComplyEvents and ComplyOffice offerings help companies value and verify services provided by business associates, including marketing activities, Web advertising, sponsored events, and office leases, to enhance RESPA compliance.

Collaboration between settlement providers is an important catalyst to creating a better homebuying process. In fact, properly structured relationships between complementary providers to a home purchase are one of the most important contributors to a buyer’s positive experience. Opportunities for compliant collaboration continue to evolve as technology, buying behavior and regulatory interpretations change over time. MLinc helps clients stay on top of RESPA interpretations, and continues to innovate to help clients implement strategic arrangements that result in a more predictable, convenient, efficient and cost-effective purchase transaction for all.

MLinc Solutions may be contacted by e-mail at [email protected] or call (866)241-6802.

Primary Residential Mortgage Inc.

Primary Residential Mortgage Inc.

PrimaryResidentialMortgage.com

►How the company started: Headquartered in Salt Lake City, Utah, Primary Residential Mortgage Inc. (PRMI) was founded in 1998 by Dave Zitting, Jeff Zitting and Steve Chapman. PRMI has grown to include Tom George, COO and Burton Embry, CCO in its executive team and evolved into a nationwide, multi-billion dollar operation with over 2,000 employees and nearly 300 branches. The company is licensed in 49 states and serves all segments of the market. PRMI is a privately-held company that focuses primarily on traditional residential loan products. For information on PRMI, please visit PrimaryResidentialMortgage.com.

►How the company has changed the mortgage industry: PRMI is a large national mortgage bank founded by loan originators for loan originators. PRMI redefined the corporate/loan originator relationship by creating partnerships that respect local domain knowledge and the power of choice so vital to the success of PRMI’s originators. This innovative business model of empowered operators results in a best-in-class experience for the borrower. We are actively engaged as a respected thought leader positively influencing industry change, and rebuilding consumer trust in real estate finance. We are also a leader in launching breakthrough technologies, utilizing mobile strategy and Big Data analytics to revolutionize the real estate finance transaction. Combining a framework of regulatory compliance and an originator-friendly business model with strong marketing support and industry-leading technology have placed PRMI at the forefront of mortgage lenders.

PrimeLending

PrimeLending

PrimeLending.com

►How the company started: Thirty years ago, PrimeLending opened its doors with a staff of 20 people in Dallas, Texas. Today, the company has more than 2,500 employees working in branches across 41 states, serving the needs of homeowners throughout the country. Since 1986, PrimeLending has helped more than 500,000 families with their homeownerships goals, consistently earning a 96 percent customer satisfaction rating (based on its customers’ rating of loan officers) and ranked nationally as a top 10 purchase lender by MarketTrac (January-December 2015).

PrimeLending is proud of its numbers, but is even more inspired by its track record of award-winning employee satisfaction. In 2015, PrimeLending ranked fourth nationally among top 10 large companies on the Great Rated! People’s Picks: 20 Great Workplaces in Finances Services. We were named one of the “100 Best Workplaces for Women” and ranked 11th among the “50 Best Workplaces for Camaraderie,” both by Great Place to Work and Fortune.

►How the company has changed the mortgage industry: Over the years, we’ve experienced countless innovations and changes—the emergence of smartphones and mobile apps, more stringent federal regulations and changing perceptions about traditional banks, to name just a few. But more things have remained the same—integrity is priceless, personal service makes a difference and Americans still dream of owning a home. We are proud to have been a stable, reliable lender since 1986.

►How the company has changed the mortgage industry: Over the years, we’ve experienced countless innovations and changes—the emergence of smartphones and mobile apps, more stringent federal regulations and changing perceptions about traditional banks, to name just a few. But more things have remained the same—integrity is priceless, personal service makes a difference and Americans still dream of owning a home. We are proud to have been a stable, reliable lender since 1986.

Part of our approach to serving the changing needs of home buyers is to provide technology with a warm touch. We continually invest in developing the most secure, innovative and efficient systems and processes. From its Web-based application process, to mobile apps for consumers and business partners, to customized home loan scenario proposals, we leverage innovation to help our customers make smart decisions. However, with every new automated step or enhancement, we never lose sight of the value of personal service provided by our experienced, knowledgeable loan officers.

Without a doubt, our talented, dedicated employees set us apart in the industry. We know having a passionate, motivated team that cares about our customers, business partners and each other is our greatest asset. We work together to have a profound and positive impact on the lives of all we serve. We are known for a spirit of service, heart, respect and purpose throughout the organization. Collectively, we are focused on caring more, dreaming bigger, setting our goals higher and achieving them. It’s the secret to PrimeLending’s longevity and success, and the reason so many homebuyers trust us to guide them through the mortgage process.

REMN Wholesale

REMN Wholesale

REMNWholesale.com

►How the company started: The leaders of REMN Wholesale have worked in many facets of the industry before starting REMN. Some were, at one point, brokers and witnessed the frustrations as a broker partner first hand. From these experiences, they created a company built on what made sense. To REMN Wholesale and its partners, the key is the value of time, illustrated by our same day turn times.

►How the company has changed the mortgage industry: The REMN Wholesale mission is, and always has been, to improve the broker experience. By doing so, we have really set the bar for expectations and what brokers have come to rely on in their lender partners. No other lender can duplicate our customer service, closing department, or same day turn times. Pair that distinction with our education platform and product portfolio, and we have developed a broker experience unmatched and well sought after.

Secure Insight

Secure Insight

SecureInsight.com

►How the company started: Secure Insight was originally founded as Secure Settlements and launched in January 2012 as the first mortgage industry vendor management firm focused on settlement agent risk. The company's risk evaluation and monitoring technology was developed after more than five years of research and development in conjunction with warehouse banks, lenders, former regulators and risk analysts at Lloyds. The focus on data evaluation, risk rating and ongoing monitoring in a shared database was a unique approach to a serious problem and the first of its kind. The privately-owned company's founders include professionals in the law, banking, title, and insurance fields.

►How the company has changed the mortgage industry: Secure Insight made the term "vetting" a term of art in the mortgage industry. Before SSI was launched in 2012, the evaluation and monitoring of counter-party risk was disjointed, incomplete and very rarely regulated. Despite recommendations from FNMA, OCC, NCUA and others, banks, mortgage lenders and credit unions generally incorporated little or no vendor management process in their operations platform. When they did it almost always was entity-based, and done once and forgotten. With the issuance of new rules by the CFPB in April 2012, the industry gradually began to acknowledge the importance of managing vendor risk. SSI was paramount in promoting this need for both lender risk management and consumer protection. In its early years 2012-2013, the company survived significant push-back from associations and vetting subjects who were startled to discover that a private company was asking personal questions about their business and staff in an effort to assure lenders and consumers that they were safe from the risk of fraud harm. Gradually through a process of excellent service, perseverance and education, SSI became recognized as an industry standard and its database viewed as valuable utility for measuring and monitoring risk. Today, SSI has successfully vetted more than 35,000 agents nationwide and serves nearly 100 lenders around the country, helping them manage their regulatory obligations while protecting them and their customers from fraud losses. The SSI database has been accessed in more than 1.5 million transactions to date as a pre-closing quality control tool. Today, nearly five years after the company's launch, the SSI motto, "Trust, but Verify!" is accepted as an operational risk goal for lenders throughout the mortgage industry.

United Wholesale Mortgage (UWM)

United Wholesale Mortgage (UWM)

UWM.com

►How the company started: Founded in 1986, United Wholesale Mortgage (UWM) is a family -wned and operated company based in Troy, Mich. and operating nationwide. As one of the nation’s largest and fastest-growing wholesale lenders, UWM has an impressive history of growth, innovation and unwavering commitment to its clients. In its early stages, UWM started out as a bricks and mortar retail loan shop and then made the strategic decision to focus on the wholesale side of the business. Since the company started out as a broker, everything we do is through the lens of our clients’ best interests. UWM has a rich heritage in championing its clients and serves its mission of making dreams come true for brokers, borrowers and its team members.

►How the company has changed the mortgage industry: UWM has revolutionized wholesale lending, transforming a historically commodity-driven industry into a client service model that is focused on championing the success of its independent broker clients. From creating an inside sales model to developing game-changing technology, UWM prides itself on helping its clients grow their business. Team members are trained across the life of a loan in order to make their processes as fast as possible.

Led by President and CEO Mat Ishbia, UWM is run like no other mortgage lender in the market today. As a former Michigan State basketball player under legendary coach Tom Izzo, Mat learned invaluable lessons on the court that he has brought to the team at UWM. He has instilled an attitude focused on championing our clients, a desire to make every loan a success, and the ambition to work harder and be better than the day before.

UWM’s technology offerings are second to none in the industry. With TRID affecting the ability of so many lenders to close loans in a timely manner, UWM’s UClose tool is a major difference-maker–empowering brokers to go from clear-to-close to closing in just minutes, and put money on the table in less than an hour.

UWM’s game-changing UConnect program ensures that brokers stay linked to their borrowers to enhance repeat business. UWM monitors its brokers’ past clients and notifies the broker when their past clients are in the market to purchase or refinance.

On top of all that, UWM is leading a movement to create more mainstream awareness of mortgage brokers and the wholesale lending channel. By championing brokers via national television, radio, digital and print media, UWM is constantly pressing to raise awareness of mortgage brokers in the marketplace and educate consumers on the benefits of working with a broker.

Vantage Production LLC

Vantage Production LLC

VantageProduction.com

►How the company started: Vantage Production LLC is the nation's leading innovator of the mortgage-specific technology platform—VIP. VIP empowers lenders to deliver exceptional experiences with pioneering customer relationship management (CRM), powerful, automated marketing—complete with content, efficient and effective sales enablement and the most accurate MBS market advisory services. Vantage Production’s solutions help more than 400 lenders and tens of thousands of individual mortgage loan originators throughout the nation succeed every day in our challenging, dynamic market.

Established in 2001 as Mortgage Success Source, Vantage Production has more than 70 employees headquartered in Red Bank, N.J. The company’s driving force has always been—and remains—to aggressively respond to the dramatic structural and regulatory changes in the industry, including exceeding the rigorous SOC 2, Type II security requirements. Vantage Production strives to provide lenders with solutions to accelerate production, operate efficiently, recruit and retain top talent and manage risk.

►How the company has changed the mortgage industry: Just as the mortgage industry has changed over the past 15 years, so has Vantage Production. What has not changed is the company’s commitment to providing the highest quality, most effective and innovative solutions that lead our clients to success.

►How the company has changed the mortgage industry: Just as the mortgage industry has changed over the past 15 years, so has Vantage Production. What has not changed is the company’s commitment to providing the highest quality, most effective and innovative solutions that lead our clients to success.

From the beginning, Vantage Production has been focused on helping the mortgage industry adapt to and optimize the opportunities available in a way that builds value for the lender, loan originator (LO), referral partner and borrower.

Originally founded to serve individual LOs, Vantage Production offered business-building solutions that allowed LOs to achieve top producer status, including the often-imitated, never duplicated MBS market advisory service, Mortgage Market Guide; the go-to professional development solution, LoanToolbox and the “set-it and forget-it” automated marketing solution, Platinum Marketing.

With the effects of the Dodd-Frank Wall Street Reform and the Consumer Protection Act of 2010, the mortgage industry quickly shifted to operate in an extremely tight regulatory environment. Just as the mortgage industry transformed to be filled with new regulatory guidelines and compliance requirements, it also had new business models and technology capabilities to leverage.

Vantage Production developed a single, corporately-controlled solution that allows lenders to adhere to the compliance guidelines through admin controls and audit support—with complete archiving of marketing and presentations—as well as compete with greater productivity and secure more market share and volume in this fast-paced, highly competitive market.

From mobile solutions to dynamic websites to centralized databases to real-time integrations, Vantage Production provides mortgage industry leadership and lenders with an environment that drives revenue profitably … while managing risk.

Mortgage lenders will continue to adjust their organizations and workflows to more effectively and efficiently go to market. Staying ahead of changes, both at a macro and lender-specific level is how Vantage Production meets the needs of the mortgage industry.

Waterstone Mortgage

Waterstone Mortgage

WaterstoneMortgage.com

►How the company started: Waterstone Mortgage President & CEO Eric Egenhoefer entered into the mortgage lending business in 1997 as a processor, and quickly moved through the ranks as a closer, loan originator and operations manager. This experience gave him a thorough knowledge of the loan origination process.

In 2000, he created Waterstone Mortgage as a company focused on supporting loan originators–a philosophy the organization still upholds today. He put industry best practices to work, building the company to sustain rapid growth in a short period of time. As the company grew, it committed to supporting its loan originators in producing high quality loans, with a strong focus on purchase loans. This approach has allowed Waterstone Mortgage to not just survive economic and industry challenges, but to thrive in spite of them. Today, the company has more than 600 employees in 19 states, and originates more than $2 billion in mortgage loans annually.

►How the company has changed the mortgage industry: With a primary focus on supporting loan originators, Waterstone Mortgage is a company built around what these professionals need to be successful. Aside from offering our loan professionals superior support–such as in-house marketing, legal/compliance, and loan processing support–Waterstone Mortgage also equips them with a variety of innovative loan products. This makes it easy for loan originators to find a program that caters to the specific circumstances and needs of most borrowers.

As a bank-owned organization, Waterstone Mortgage also has the rare ability to develop new products, such as the Wealth Building Loan, physician loans, and one-time close construction loans. For every unique question that arises with loan programs, Waterstone Mortgage is able to provide an answer. As an innovative and forward-thinking company, giving its loan originators viable and effective solutions is a top priority.

Another part of the forward-thinking mentality is Waterstone Mortgage’s ability to provide effective technology to its loan originators. Waterstone has several proprietary systems that were developed with the objective of making the mortgage process efficient, streamlined, accessible, and uncomplicated.

By providing full support for its loan originators, Waterstone Mortgage also ensures that it provides the best experience possible to its borrowers. Its variety of loan programs has changed the way borrowers “shop” for a mortgage. No longer are they presented with only one option; many of Waterstone Mortgage’s borrowers are eligible for a variety of programs, so they can choose the loan that best fits their situation. Waterstone Mortgage is dedicated to continuously improving the loan process for our borrowers. They can expect timely updates, transparency, and effective communication as they go through the loan process. After all, they are making what may be the largest financial transaction of their life; Waterstone Mortgage makes it a priority to ensure that they are pleased with the homeownership journey.

Homeside Financial

Homeside Financial

GoHomeside.com

►How the company started: Why Homeside? Homeside Financial saw a major need for a company to come in and disrupt the current state of mortgage banking. Hence, it undertook the extensive mission to change the industry from what it is, to what it should be: An industry that cares more about people than profit, an industry that cares about giving Millennials the opportunity for career growth, and an industry that is on the leading edge of technology and process efficiency.

►How the company has changed the mortgage industry: Homeside has redefined what it means to be modern in the mortgage industry; not modern in the sense of time, but modern as a state of mind. With modern thought, Homeside has innovated purchase lead technology to increase its average loan officer’s production by 50 percent, all while building a customer experience that is localized and scalable in every market we serve. The results? Decision-making closer to the customer, and more transactions closed on-time.

The Money Source

The Money Source

TheMoneySource.com

►How the company started: The Money Source was founded in New York in 1997 by Stavros Papastavrou and experienced continual growth in correspondent and retail lending. In 2013, The Money Source expanded operations through partnership with Darius and Mike Mirshahzadeh, and Ali Vafai to found Endeavor America Loan Services as a division of The Money Source.

Based in Walnut Creek, Calif., Endeavor quickly grew to be a leading wholesale lender. In January of 2015, Stavros, Ali, Darius and Mike merged entities to create one of the largest correspondent and wholesale lenders in the country. The Money Source has since established its own servicing division in Meriden, Conn., as well as a location in Tempe, Ariz. for expanded loan servicing and origination. The Money Source is licensed in all 50 states and enjoys continual growth and expansion based on its brand promise of “Relationships Matter.”

►How the company has changed the mortgage industry: A key pillar of success at The Money Source is the one thing often overlooked in the mortgage industry—company culture. Whether it’s the company’s mascot (a giant pink Unicorn), the internal newsletter (Pink Unicorn Gazette), the peer-to-peer employee recognition system or the annual TED-like “Growing Happiness” conference which the company puts on each year—the company culture is like nothing this industry has seen before.

All of these initiatives are part of the stated core purpose of “Growing Happiness.” We have created a client-focused culture that rewards employee engagement, embraces innovation and harnesses industry-leading technology.

As one of the top lenders in the U.S., The Money Source also has a goal of helping one million U.S. households achieve and maintain the dream of homeownership in the next decade. Working with homebuyers across the nation, the company has established a core values-driven culture, along with a streamlined mortgage process, while welcoming a Millennial workforce that understands the habits of the next generation of homeowners.

This innovative approach to business has been recognized with national awards. The company’s CEO Darius Mirshahzadeh was recognized as one of Glassdoor’s top CEOs in the nation for 2015. Mirshahzadeh has contributed to nationwide business magazines, including Forbes and Entrepreneur magazines and been recognized by National Mortgage Professional Magazine as one of the Next 40 Mortgage Professionals to Watch. Managing Partner Mike Mirshahzadeh and President Ali Vafai have also penned columns on mortgage best practices for national business magazines and leading mortgage publications.

The Money Source is a company driven by its core purpose of growing happiness and its core values of people matter, inspiring leadership, strength of character and rock-solid service.

Total Expert

Total Expert

TotalExpertInc.com

►How the company started: Total Expert was founded by industry veterans on the premise mortgage companies needed a software platform that was intensely focused on innovation and solving common pain points of the end users. Legacy software platforms were growing more inefficient as they failed to address industry changes, such as the need for a solution that will align compliance, sales, and marketing. This massive unmet need fueled the launch of Total Expert.

►How the company has changed the mortgage industry: For the first time in history, the playing field was leveled as lenders were forced to exist their MSAs. This created a vacuum as lenders sought out compliant marketing partnerships in order to continue growing their exposure to consumers through co-marketing efforts with their valued Realtor partners. Total Expert has provided one of the first end-to-end solutions for co-marketing and customer relationship management with a keen eye to compliance tracking. Total Expert’s patent pending technology helps provide lenders with a simple and secure platform to co-market and share marketing costs based on pro-rata basis. The Total Expert platform automates the calculation of pro-rata costs of co-marketing across multiple channels which allows companies to manage and enforce their compliance policies across the enterprise based on RESPA Section 8. With Total Expert as the system of record, all co-marketing efforts can be measured, tracked and deployed from a single integrated dashboard.

Wallick & Volk

Wallick & Volk

Vision.WVMB.com

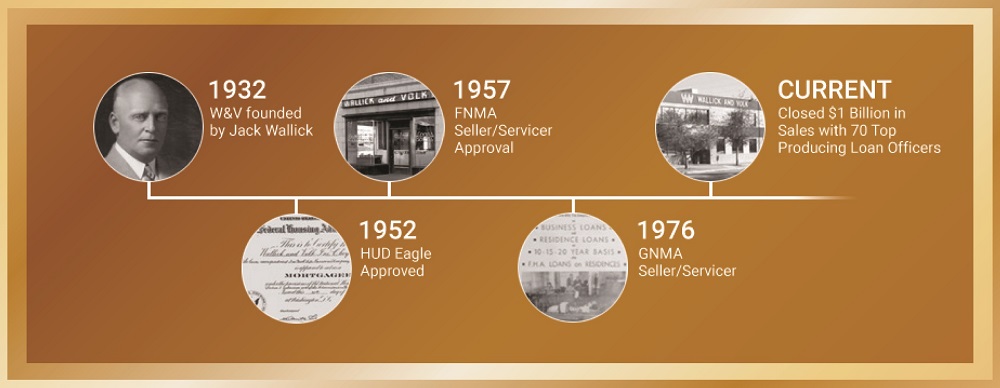

►How the company started: Founded in 1932, Wallick & Volk is the oldest privately-held mortgage company in the United States. We are a family owned and operated mortgage lender. The firm’s four basic values: honesty, integrity, hard work and passion. Wallick & Volk has one mission … to assist members of the community in their efforts to realize the great American dream of homeownership. The company’s business is built upon its knowledge in the mortgage industry and an unwavering commitment to its customers.

►How the company has changed the mortgage industry: In the digital lending world of today, Wallick & Volk continues to adhere to the core principles founded more than 80 years ago. The company does not use a one-size-fits-all approach. It strives to produce a “WOW” experience for its clients, generate referrals without having to ask. Wallick & Volk has two clients: The prospective mortgage holder and the internal client—the staff that completes the dream for its primary client. Staff is vital, one of Wallick & Volk’s most important assets. Perhaps that’s why the company was recently voted number two on Mortgage Executive Magazine’s 50 Best companies to work for in America. Wallick & Volk is big enough to be ranked in the top 100 mortgage lenders in the nation, yet everyone in the company is known by their first name. Wallick & Volk believes bigger is not better. It would rather be something exceptional to the few, than mediocre to the masses.