Do Single Women See Less Financial Gains as Homeowners?

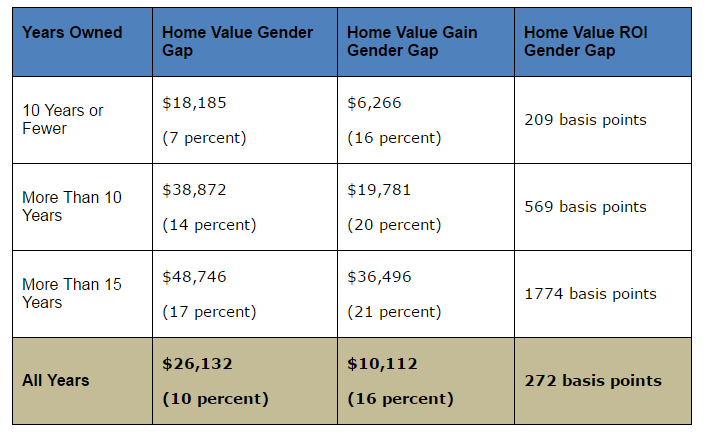

Gender inequality appears to have permeated housing valuations, according to new data from RealtyTrac that determined that homes owned by single men were, on average, valued 10 percent more and appreciated 16 percent more since purchase than properties owned by single women.

RealtyTrac analyzed more than 2.1 million single-family homes nationwide for its study. The company concluded that the average estimated current market value of homes owned by single men was $255,226, which was 10 percent above the $229,094 average current market value of homes owned by single women. Furthermore, tomes owned by single men gained an average of $63,921 since their purchase, resulting in a 33 percent return on purchase price—which was $10,112 (or 16 percent) higher than the average $53,809 gain since purchase for homes owned by single women, who earned a 31 percent return on their purchase prices.

Adding insult to financial injury: RealtyTrac also determined that neighborhoods where more single women are homeowners tend to have higher criminal activity and more severe environmental issues.

“Women earn less than men on average—19 percent less in 2015 according to the Bureau of Labor Statistics—giving them less purchasing power when it comes to buying a home,” said Daren Blomquist, senior vice president at RealtyTrac. “So it’s not surprising to see the 10 percent gender gap in average home values between single men and single women homeowners; however, the slower home price appreciation for homes owned by single women demonstrates that less purchasing power is also having on a domino effect on their ability to build wealth through homeownership as quickly as single men.”