Rates Uptick While Homeowners Express Confidence

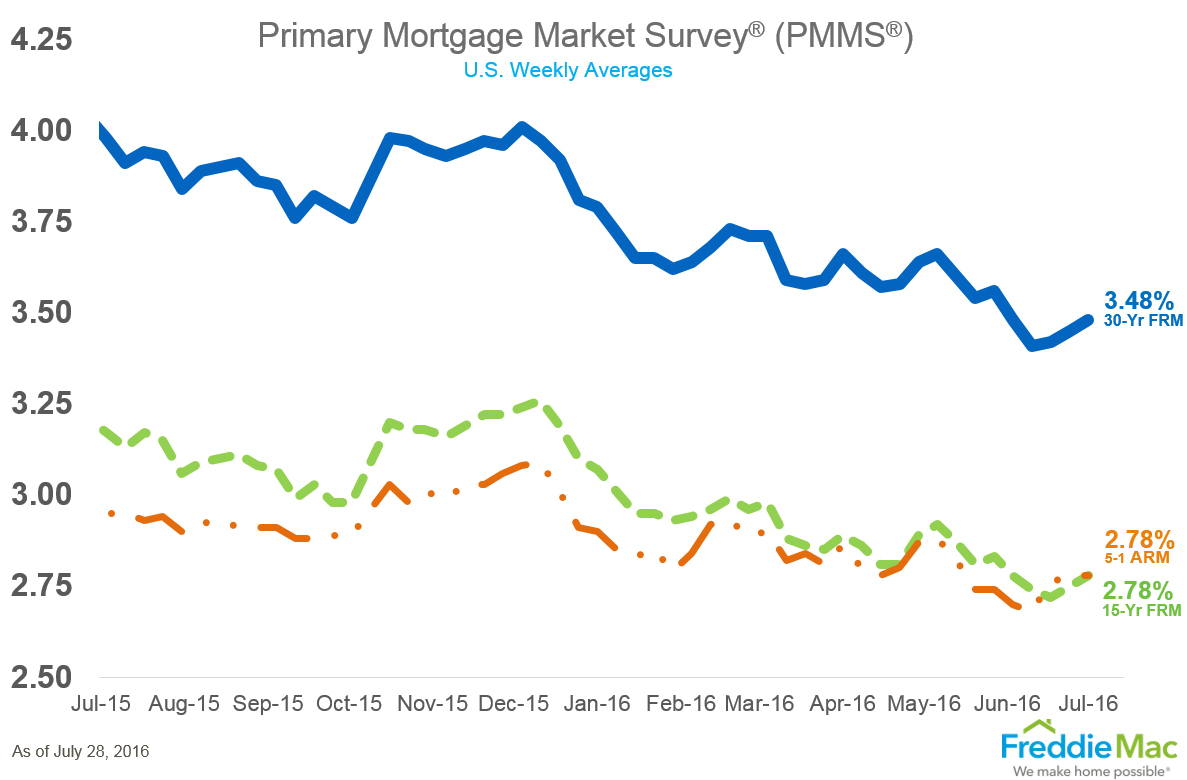

Average fixed mortgage rates experienced a mild increase in Freddie Mac’s latest Primary Mortgage Market Survey (PMMS). The 30-year fixed-rate mortgage (FRM) averaged 3.48 percent for the week ending July 28, up from last week’s 3.45 percent. The 15-year FRM this week averaged 2.78 percent, up from last week when it averaged 2.75 percent.

However, the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.78 percent this week, unchanged from last week.

A year ago, the five-year ARM averaged 2.95 percent. Sean Becketti, chief economist at Freddie Mac, once again blamed the Fed for much of the lethargy in the market, but insisted that the housing picture was not cloudy.

“The 10-year Treasury yield remained flat this week in anticipation of the Fed's July policy meeting,” he said. “Mortgage rates, on the other hand, rose another three basis points to 3.48 percent. Nonetheless, home sales continue to benefit from the persistently low mortgage rates with June's new home sales coming in at an annualized rate of 592,000 homes—its fastest pace since 2008."

More optimism in housing was found in a new poll of 2,800 adults commissioned by the National Association of Home Builders (NAHB). According to the poll, 82 percent of respondents rated “a home for you to live in” as being either a good or excellent investment—in comparison, 67 percent rated retirement accounts as their most important investment vehicle. Forty-six percent of respondents felt that now is a good time to buy a home, but 23 percent did not share that sentiment. And even the Millennials got into the act: 81 percent of 18-29-year-olds surveyed said that they want to buy a home.

“The survey shows that most Americans believe that owning a home remains an integral part of the American Dream and that policymakers need to take active steps to encourage and protect homeownership,” said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill.

And as for the presidential race, 38 percent of the respondents felt Hillary Clinton would be better for housing, 37 percent favored Donald Trump and 25 percent gave a “don’t know” or “no opinion” response.