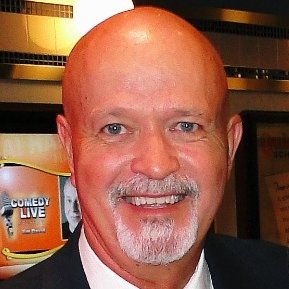

Featured Industry Leader: Mike Mitchem, President, Central Chapter of the Florida Association of Mortgage Professionals

Mike Mitchem is the Florida regional manager for Paramount Residential Mortgage Group (PRMG) and president of the Central Chapter of the Florida Association of Mortgage Professionals (FAMP). National Mortgage Professional Magazine spoke with him about his work with his state’s mortgage trade group.

Mike Mitchem is the Florida regional manager for Paramount Residential Mortgage Group (PRMG) and president of the Central Chapter of the Florida Association of Mortgage Professionals (FAMP). National Mortgage Professional Magazine spoke with him about his work with his state’s mortgage trade group.

How and why did you get involved in the FAMP Central Chapter? Can you share the track within your association that led to the leadership role?

I was asked to become involved in the Central Chapter of the FAMP by a colleague of mine who had been a past president. My initial role was as board secretary, then a year later, I became vice president, followed by a two-year term as president.

Why do you feel members of the mortgage profession in your region should join your association?

It is of great importance that our constituents, licensed mortgage professionals, become active in this association. When I attained my first management role in this business, the owner sat across the desk from me on the first day. He neatly placed membership applications for the Florida Association of Mortgage Brokers, the predecessor of FAMP, and NAMB in front of me, asked me to sign them and give him a check. When I asked why, his simple response was, "Without their support, we are completely on our own." That has always resonated with me.

What role does the FAMP Central Chapter play in the state legislative and regulatory environment, and are there any items on the current agenda you would like to highlight?

Our chapter, in conjunction with the state association, has always played a supportive role in how the legislative process affects our membership. We attempt to regularly engage our legislators, inviting them to speak at our monthly membership meetings, and early each year in Tallahassee as the legislature convenes.

What do you see as your most significant accomplishments with FAMP?

What do you see as your most significant accomplishments with FAMP?

My personal goals when reaching the office of president were openly defined. I wanted to see the ideals of which our association stand for carried on, bring a little fun back into our region, improve the financial position of the chapter, and put together a team with character and integrity to carry on for future years.

What is the synergy between the FAMP and NAMB, the national mortgage trade association?

FAMP and NAMB work together well. We rely on the NAMB to be the greater voice for national issues and for legislation at the federal level. FAMP carries on a similar role at the state level. Many of our members are also members of the NAMB, and several serve as officers on their board.

In your opinion, what can be done to bring more young people into careers in the mortgage profession?

One of the most puzzling situations we face in our business is the average age of our membership. I believe the last statistic that I heard was our average loan originator is 56. This has to change in order for our place in the economy to survive. The "puzzling" part is that the positions of loan originator, loan assistant, processor and underwriters are great careers! We need to get the word out to our colleges through their administrators to educate the new people entering the workplace. A career in the mortgage business is a great place to be—one in which you can exercise upward mobility and make a really good living. It can fit a multitude of personality types and skill sets. I was very proud when my son Phil made that career choice.

How would you define your state's housing market?

The Florida market is in a good place. We have not had the rapid run up of pricing that dominated 2004-2007, and while prices have gone up, our available inventory is within low to normal ranges. Florida will always be a popular destination for retirees and second homes. Our state government is also doing a great job of attracting new businesses to Florida. Being a native Floridian, I am happy to call it home.

Phil Hall is managing editor of National Mortgage Professional Magazine. He may be reached by e-mail at [email protected].