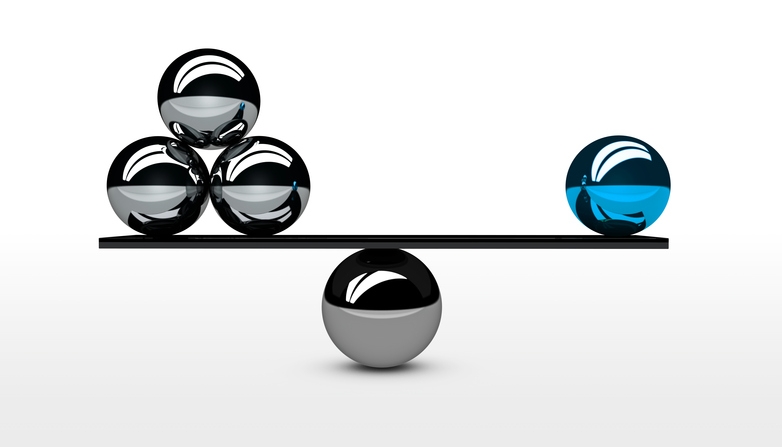

The Balancing Act

How creativity and compliance can live in mortgage lending social media harmony

In this modern age, mortgage lending companies must not only support social media channels for their branches, but they should also be forward-thinking, intentional and savvy with their social media strategies. Social media is a crucial part of the marketing and advertising aspects of mortgage lending, and it’s not something that can be taken lightly or treated as an afterthought in your marketing strategy.

Yet, in an industry that is heavily regulated by legal restrictions and compliance regulations, many mortgage lending companies may find it a challenge to create and manage social media content that is both engaging and compliant. Monitoring the social media accounts of loan originators is also another issue that many mortgage lenders may wish they could avoid. Still, with a well thought-out plan, effective strategies, and adequate guidance for your loan originators, social media management can be a smooth process.

The proof is in the numbers

Of American Internet users, 72 percent use Facebook, according to the Pew Research Center. Other popular social media channels that American adults utilize include: Pinterest (31 percent), Instagram (28 percent), LinkedIn (25 percent) and Twitter (23 percent). When compared to other mediums of advertising, these numbers are relatively high. With the changing demographics of homebuyers around the nation–especially with the Millennial generation beginning to venture into the homebuying process–the ability to effectively connect with and engage your social media followers is essential.

However, don’t make the mistake of thinking that only the younger generations are using social media. While it’s true that 90 percent of young adults (ages 18 to 29) use social media, the number of social media users in every age category has increased in recent years. In fact, the number of users in the 65-plus age category has tripled in the past six years, according to the Pew Research Center.

When considering these numbers, there is no denying that social media will continue to have a significant impact with the majority of American adults in the near future. Keeping this fact in mind, mortgage lending companies should do everything in their power to support the social media endeavors of their loan originators and branch managers.

If at first you don’t succeed, comply and comply again

While social media channels are often an efficient and economical way to get your marketing and advertising messages across to potential borrowers, real estate agent partners, and other business partners, it’s also important to remember that these are very public platforms. Of course, this means that ensuring all content is compliant should be a top priority. One of the best ways to go about this is to develop a strong marketing team, which can develop creative and compliant social media for your loan originators and branch managers to use.

The employees of a skilled and experienced marketing team will understand the details of mortgage industry-compliant materials, in regards to social media. Some of the basic rules to keep in mind, to avoid compliance violations and to portray your company in a professional way include:

►Ensuring that social media advertisements don’t target specific generational, racial, ethnic or geographical groups

►Using diversity with models or images

►Refraining from mentioning competitors by name

►Ensuring that all customer and business partner testimonials and/or photos have a corresponding signed consent form

►Keeping content general in nature

►Excluding information that guarantees or promises loan approval

►Utilizing the “one-click rule” for disclosures, which means that a social media user only needs to click once to have their browser re-directed to a page with the appropriate disclosures for the loan product/program being advertised

Of course, these suggestions are only a starting point. Every mortgage lending company needs its own specific set of regulations, style guidelines, and more–in order to create an effective and compliant social media strategy.

Now comes the fun part

While the compliance aspect of social media is crucial, it’s also important to remember that social media should also be fun, engaging, and even humorous–at times. When your marketing team is developing content for your loan originators to share, consider these suggestions for vamping up your social media efforts.

Be creative with your language!

This may seem like an obvious tactic. Social media is, innately, a creative way of communicating messages with others. Yet, with the many legal restrictions and compliance regulations that exist in the mortgage lending industry, many companies are hesitant to use their creative juices and tend to err on the side of caution by drafting tame, corporate speak language that may not intrigue or interest their followers. It takes time and skill to craft a voice that balances the fine line of compliant, yet engaging and fun. If your jargon comes across as stale, it won’t necessarily get your message across to social media-savvy homebuyers. When providing suggested social media text to your field, try using a creative approach with your words.

A picture is worth a thousand words

As often as possible, include professional images with every social media post that you provide the field. An image is often the most important part of any social media post, as it draws the eye of social media users who are mindlessly scrolling through newsfeeds full of content. Well-lit, professional stock photos of people (from sources such as Shutterstock or Getty Images) are often your best.

If your marketing team also has the ability to create well-designed infographics–this is another ideal option. Recent mortgage industry statistics or company statistics are the perfect subject matter for an engaging infographic. Make sure to send corresponding text to the field, along with photos and infographics, to ensure that they have direction as to how they should promote these items.

Use #hashtags and links when possible

Although hashtags are not commonplace on LinkedIn, they do have value on Facebook and especially on Twitter. In most cases, hashtags will improve your social media engagement. In fact, tweets with hashtags get twice as much engagement as those without hashtags–according to research by Buddy Media. As a mortgage lending company, it may be in your best interests to create a list of company-approved hashtags that the field can use, in order to help social media users find and follow certain conversations.

Hyperlinks are also an important part of a social media post; whenever possible, use a link to direct your followers back to your website, or another relevant website that may contain valuable information. Social media posts that are “clickable” tend to draw the eyes more so than the posts that are not.

Taking it to the next level

Aside from providing insightful and creative content to loan originators, it is also helpful to explore other ways of utilizing social media. For instance, programs like Hubspot and Buffer offer mortgage lending companies to ability to push out social media posts on behalf of the loan originators. This is an ideal option for branches that are short on administrative professionals who can manage social media, or who have loan originators who prefer to focus their efforts elsewhere.

Another effective way to use social media is to delve into the realm of advertising on social media channels, such as Facebook and LinkedIn. This venture requires its own level of expertise and skill, as advertisements, sponsored posts, and promoted posts often have strict rules and requirements. Taking the time to research effective ways to create advertisements and sponsored content for social media channels is often worth the effort, however. This can be an invaluable way for your loan originators and branch managers to reach more potential borrowers and business partners. Remember that it is essential to adhere to compliance guidelines when utilizing advertising functions in social media platforms.

Bringing it all together

While statistics on social media’s impact on the mortgage industry are few and far between, one thing is for sure: Social media can play a significant role in boosting sales. A 2015 study concluded that 74 percent of salespeople who surpassed their 2014 quota by at least 10 percent claimed to have an excellent understanding of how to use social media for finding new clients, connecting with past clients, and closing new deals (according to Kitedesk). These high-achieving sales professionals were six times as likely to exceed their quota than their colleagues who had limited or non-existent social media skills.

For mortgage lenders who place a significant emphasis on sales, social media is not simply a “nice to have” business component–it’s a “must have” option. In addition, it’s a business aspect that needs consistent attention. Because social media is continuously evolving–much like the mortgage industry itself–learning to adapt and embrace change is a crucial part of an effective social media strategy for mortgage lending companies. With careful planning, thorough research, and a splash of creativity, the benefits of providing engaging and compliant social media content to loan originators are virtually endless.

Ericka Smith is marketing manager for Waterstone Mortgage, based in Pewaukee, Wis. She may be reached by e-mail at [email protected].

This article originally appeared in the July 2016 print edition of National Mortgage Professional Magazine.