Pre-Thanksgiving Housing Data Offers Positive News

Now, here is something that the housing industry can be thankful for: The Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending Nov. 18 is reporting that the Market Composite Index increased 5.5 percent on a seasonally adjusted basis and three percent on an unadjusted basis from one week earlier. Even better, the seasonally adjusted Purchase Index increased 19 percent from one week earlier while the unadjusted Purchase Index increased 13 percent compared with the previous week and was 11 percent higher than the same week one year ago.

However, the Refinance Index dipped three percent from the previous week to its lowest level since January, while the refinance share of mortgage activity decreased to 58.2 percent of total applications from 61.9 percent the previous week. Among the federal home loan programs, the FHA and VA shares of total applications were down while the USDA share was slightly up.

“Mortgage rates have continued to move higher in the post-election period, as investors worldwide are looking for increases in growth and inflation, with the 30-year mortgage rate reaching its highest weekly average since the beginning of 2016,” said Michael Fratantoni, chief economist and senior vice president of research and technology at the MBA. “Refinance volume dropped further over the week, particularly for refinances of FHA and VA loans. Purchase volume increased sharply for the week compared to both last week, which included the Veteran’s Day holiday, and last year, with purchase volume up more than 11 percent on a year over year basis. The increase in purchase activity was driven by borrowers seeking larger loans and that drove up the average loan amount on home purchase applications to $310 thousand, the highest in the survey, which dates back to 1990.”

Separately, the Federal Housing Finance Agency (FHFA) House Price Index reported home prices rose 1.5 percent in the third quarter from the previous quarter and were up 6.1 percent from the third quarter of 2015. FHFA's seasonally adjusted monthly index for September was up 0.6 percent from August.

The top five states in annual home price appreciation were Florida (10.7 percent), Oregon (10.4 percent), Washington (10.4 percent), Colorado (10 percent) and Utah (9.5 percent). Delaware and the District of Columbia were the only areas not to see price increases. Among major metro areas, Washington’s Tacoma-Lakewood corridor saw the greatest price appreciation (12.0 percent), while prices were weakest in Connecticut’s New Haven-Milford metro (a 1.7 percent decline).

"Our data indicate that the deceleration in home price growth that we observed in late spring proved to be short-lived," said FHFA Supervisory Economist Andrew Leventis. "While price growth in select markets has cooled somewhat, for the U.S. as a whole, the third quarter showed no evidence of a widespread slowdown."

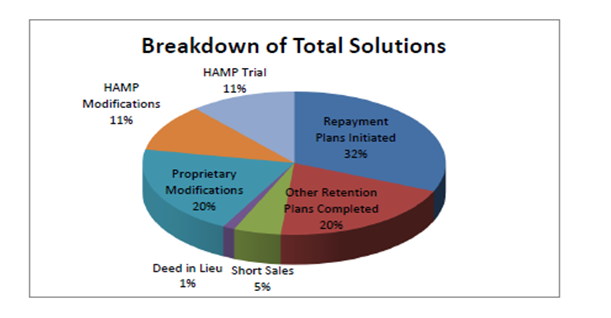

As for existing homeowners facing financial peril, HOPE NOW announced that the mortgage industry completed approximately 344,000 non-foreclosure solutions during the third quarter. These actions included approximately 102,000 permanent loan modifications and 17,000 short sales, with the remaining 225,000 solutions included repayment plans, deeds in lieu, other retention plans and liquidation plans. In comparison, there were roughly 75,000 completed foreclosure sales from July to September, continuing a trend of non-foreclosure solutions outpacing foreclosure sales.

Of the 102,000 loan modifications completed for the third quarter of 2016, about 69,000 homeowners received proprietary loan modifications and 32,586 homeowners received loan modifications completed under the Home Affordable Modification Program (HAMP).

“HOPE NOW’s third quarter loan solution data continues to show evidence of an improving housing market on a national level,” said Erik Selk, executive director at HOPE NOW. “Our servicermembers continue to work with nonprofit, government and community partners to offer the most sustainable solutions for homeowners who are still struggling to afford their mortgage.”