Mortgage Applications Down, Appraisal Perceptions Tighten

Mortgage applications took a tumble for the week ending Dec. 9, according to the Mortgage Bankers Association’s latest Weekly Mortgage Applications Survey.

The Market Composite Index dropped by four percent on a seasonally adjusted basis and by five percent on an unadjusted basis from the previous week. The seasonally adjusted Purchase Index took a three percent spill while the unadjusted Purchase Index was down by seven percent compared to the previous week—however, it was two percent higher than the same week in 2015. The Refinance Index was down by four percent from the previous week, but the refinance share of mortgage activity increased to 57.2 percent of total applications from 56.2 percent the previous week.

Among the federal loan programs, the FHA share of total applications increased to 11.6 percent from 11.3 percent the week prior, while the VA share of total applications decreased to 11.9 percent from 12.6 percent and the USDA share of total applications remained unchanged at 0.9 percent.

"At this point, the market has already priced in the short-term rate increase which is expected from the Federal Open Market Committee today," said MBA Vice President of Research and Economics Lynn Fisher. "Refinance application activity nonetheless continued to fall last week and average refinance loan sizes declined as more rate sensitive borrowers stayed away. Despite recent rate increases, applications for purchase mortgages remained at levels on par with this past summer on a seasonally adjusted basis."

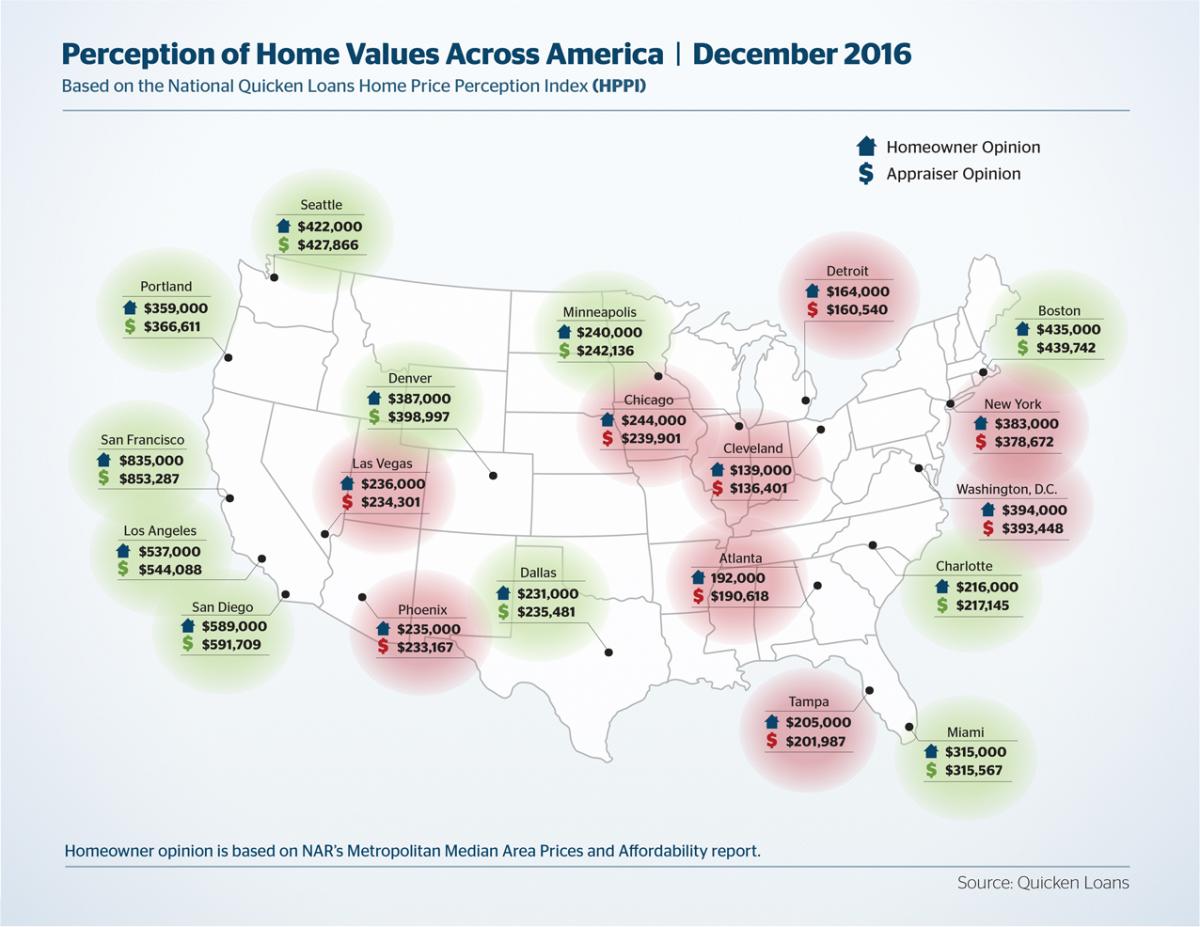

Separately, the latest data from to Quicken Loans’ National Home Price Perception Index (HPPI) found homeowner perceptions were a relatively scant one percent higher than appraiser opinions in November. Last month, appraised values took a 0.42 percent uptick, according to Quicken Loans’ Home Value Index.

“The HPPI compares the perceived gap between the homeowner and the appraiser’s opinion of a home’s value and has provided an intriguing look into the psychographics of our housing market,” said Quicken Loans Chief Economist Bob Walters. “The most recent HPPI indicates homeowners and appraisers are closer to agreeing at the end of 2016 than they were at the start of the new year. It’s our hope that with this information the only surprises this holiday season are the ones wrapped under the tree.”