Home-Related Delinquencies Are Mostly Down

Delinquencies in closed-end loans increased in last year’s third quarter, according to results from the American Bankers Association’s (ABA) Consumer Credit Delinquency Bulletin, but three of the four housing-related loan categories saw declines.

The ABA found home equity loan delinquencies fell from 2.70 percent in the second quarter of 2016 to 2.59 percent in the third quarter, while mobile home delinquencies fell from 3.17 percent to 3.11 percent and home equity lines of credit delinquencies fell from 1.21 percent to 1.16 percent. However, property improvement loan delinquencies had a slight uptick from 0.91 percent to 0.94 percent.

“The three-year trend of declining home equity delinquencies reflects a healthier housing market and rising home values,” said James Chessen, ABA’s chief economist. “Borrowers are on much firmer financial footing than they were just a few years ago, and greater equity gives them additional motivation to stay current on their obligations.”

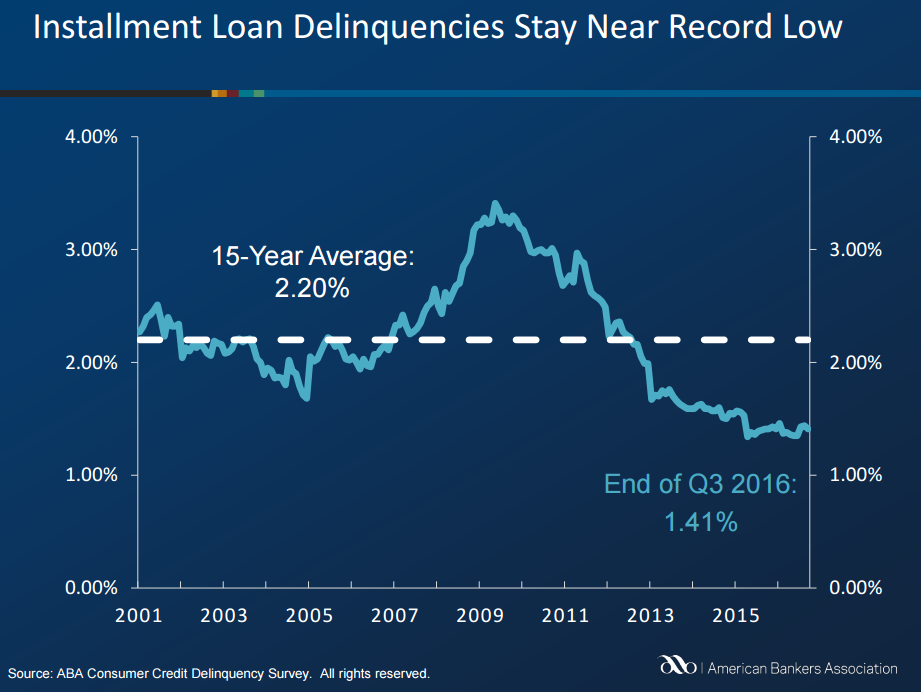

The composite ratio, which tracks delinquencies in eight closed-end installment loan categories, rose six basis points to 1.41 percent of all accounts. But despite this increase, the ABA was confident on the financial viability of American consumers.

“Delinquency rates have held near historical lows for an unusually long period due in large part to consumers’ skillful financial management, but it was inevitable that they would edge up eventually as part of the natural credit cycle,” said Chessen. “It’s important for consumers to remain cautious and maintain their discipline in keeping debt at levels they can comfortably manage.”