Advertisement

Home Flipping Soars to 10-Year High

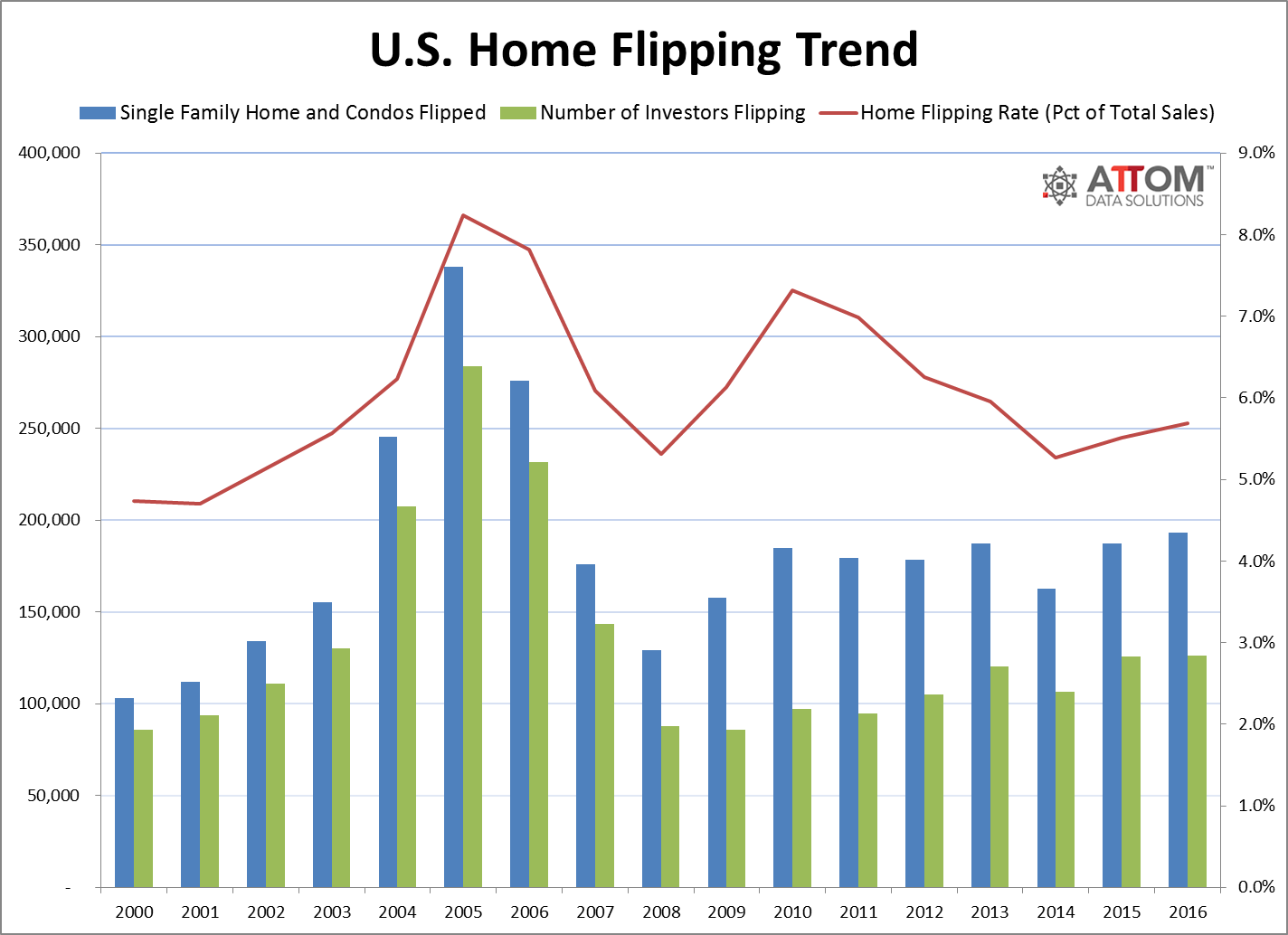

Home flipping is back with a vengeance, according to ATTOM Data Solutions’ 2016 Year-End U.S. Home Flipping Report, which found 193,009 single-family homes and condos were flipped last year, up 3.1 percent from 2015 to the highest level since 2006.

Home flipping, which ATTOM Data Solutions defines as property “sold in an arms-length transfer for the second time within a 12-month period,” represented 5.7 percent of all single-family home and condos sales during 2016, up from 5.5 percent in 2015 to a three-year high. And 126,256 entities—including both individuals and institutions—were flipping residential properties last year, up by less than one percent from the previous year but still high enough to reach the greatest peak level since 2007.

Homes flipped in 2016 sold for a median price of $189,900, a gross flipping profit of $62,624 above the median purchase price of $127,276 and representing a gross flipping return on investment (ROI) of 49.2 percent. Both the gross flipping dollar amount and ROI were the highest going back to 2000, the earliest home flipping data is available for this report.

Furthermore, the share of flipped homes that were initially purchased by the flipper with financing hit an eight-year high of 31.5 percent in 2016, while the median age of homes flipped increased to 37 years—a 16-year high. But the median square footage of homes flipped decreased to 1,422—a new record low going back to 2000.

“Home flipping was hot in 2016, fueled by low inventory of homes in sellable or rentable condition along with a flood of capital—both foreign and domestic—searching for the returns and stability available with U.S. real estate,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “The combination of more home flips and a greater share of financing for flip purchases resulted in a 19 percent jump in the estimated dollar volume of financing for home flip purchases, up to $12.2 billion for the flips completed in 2016—a nine-year high. Investors in search of flipping returns are increasingly willing to move to secondary and tertiary housing markets and neighborhoods with older, smaller properties that are available at a deeper discount. Given that many of these markets are more affordable, we are also seeing a higher share of the flipped homes sold to FHA buyers, with that share reaching a four-year high of 19.6 percent in 2016.”

About the author