Advertisement

Mortgage Rates Remain Stagnant, Credit Availability Inches Up

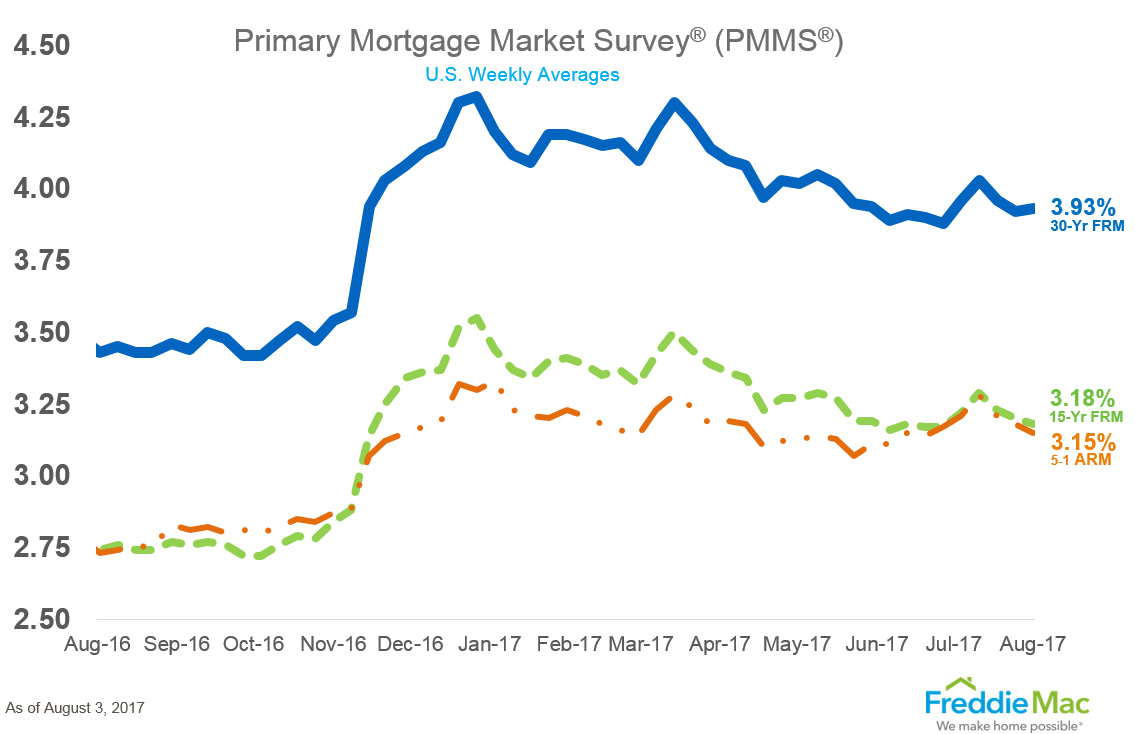

Average mortgage rates showed relatively little movement over the past week, according to new data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 3.93 percent for the week ending Aug. 3, up from last week when it averaged 3.92 percent. The 15-year FRM this week averaged 3.18 percent, down from last week when it averaged 3.20 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.15 percent this week, down from last week when it averaged 3.18 percent.

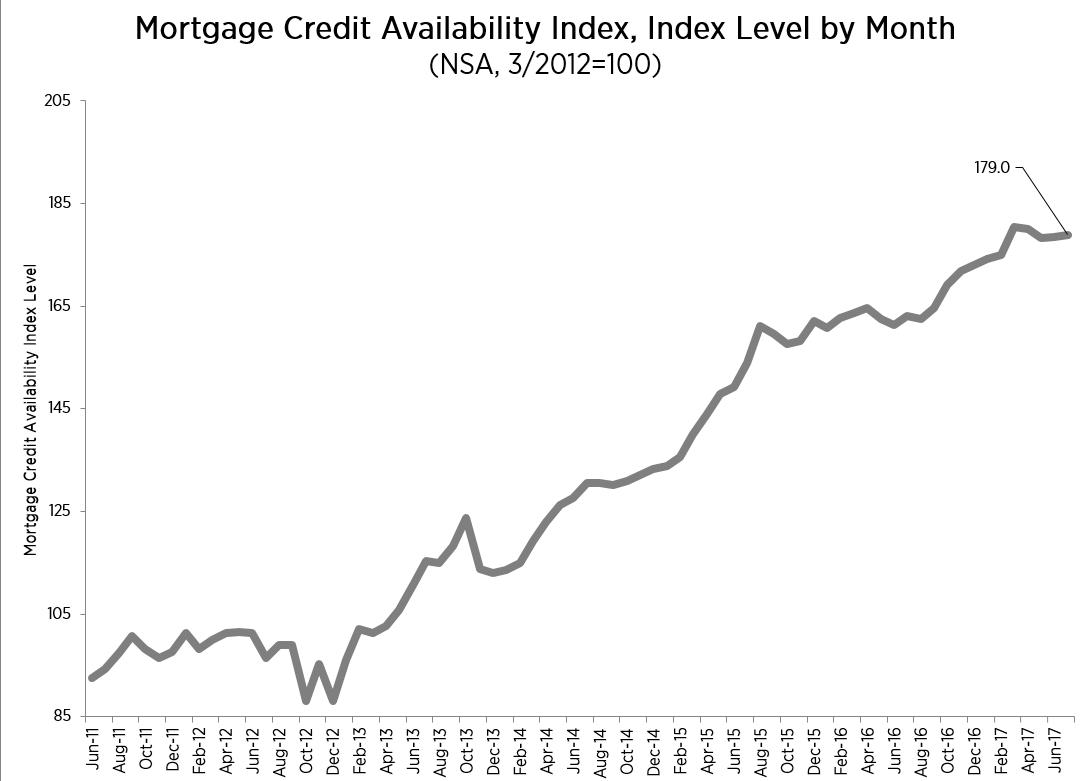

Separately, the Mortgage Bankers Association (MBA) reported that its Mortgage Credit Availability Index (MCAI) rose by 0.3 percent to 179.0 in July. Three of the four component indices took an upswing last month: The Jumbo MCAI (up 2.7 percent), the Conventional MCAI (up 1.5 percent) and the Conforming MCAI (up 0.3 percent). The Government MCAI, however, dropped by 0.6 percent last month.

"Many agency eligible loan programs have been updated so that underwriting parameters for adjustable-rate mortgages more closely align with their existing fixed rate counterparts," MBA Vice President of Research and Economics Lynn Fisher. "In many cases this means higher loan to value ratios on existing ARMs loan programs, which exerted an upward pressure on the MCAI. This change affected conforming loan programs as well as agency jumbo programs, which focus on loans in high cost areas that exceed the baseline conforming loan limit of $424,000 but which are still eligible for purchase by the GSEs."

About the author