Advertisement

GSEs Respond to Hurricane Damages

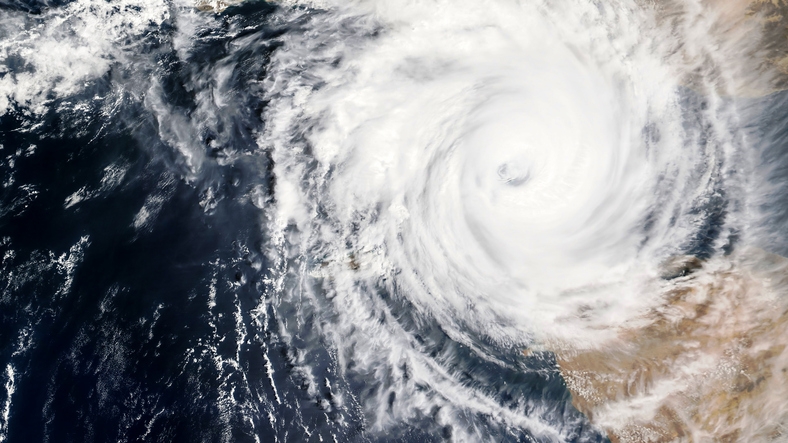

Freddie Mac and Fannie Mae have issued their respective responses on servicing-related matters in regions damaged by the recent Hurricanes Harvey and Irma.

Freddie Mac is suspending all foreclosure sales and eviction activities through Dec. 31 in hurricane-afflicted areas that the Federal Emergency Management Agency (FEMA) has declared eligible disaster areas. The government-sponsored enterprise (GSE) also stated it was working with servicers to ensure that property inspection costs resulting directly from either Harvey or Irma were not passed on to impacted borrowers.

“As we continue to work with servicers to assess the damage, we want to reassure borrowers that we will support them during this difficult time," said Yvette Gilmore, Freddie Mac's vice president of single-family servicer performance management. "They may be able to put their mortgage payments on hold for up to one year if their mortgage is owned or guaranteed by Freddie Mac.”

Fannie Mae announced last week that it was extending its Hurricane Harvey relief flexibilities to the areas impacted by Hurricane Irma. According to this GSE, evictions for properties affected by these storms will be suspended until Jan. 2, 2018, and foreclosure sales impacted by these storms will be suspended through Dec. 31. Fannie Mae also authorized servicers to suspend or reduce a homeowner's mortgage payments immediately for up to 90 days without any contact with the homeowner if the servicer believes the homeowner has been affected by a disaster, and additional payment forbearance of up to 12 months will be available in applicable circumstances.

About the author