Advertisement

HUD’s Dr. Carson: ‘Innocent Errors’ Do Not Deserve Harsh Enforcement

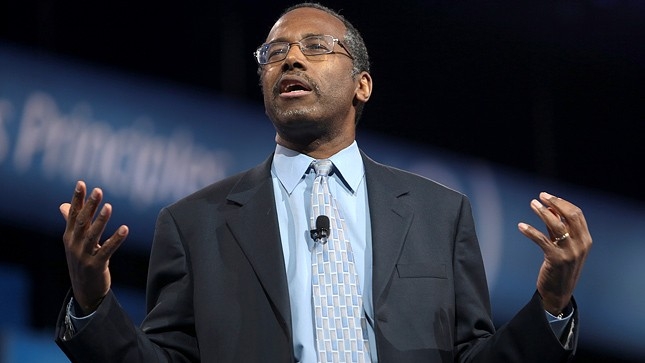

U.S. Department of Housing & Urban Development (HUD) Secretary Dr. Ben Carson has a message for the mortgage industry: The Department does not want to be seen as a trigger-happy enforcer.

Speaking today before the Mortgage Bankers Association’s Annual Conference in Denver, Dr. Carson stated that lenders who make honest errors should not fear the level of regulatory retaliation that has been enacted against lenders for intentional fraud. He added that HUD’s Federal Housing Administration (FHA) and the Department of Justice (DOJ) are working together to clarify rules that have created agitation by lenders and may have resulted in less lending to lower-income borrowers.

“Innocent errors should not create chaos and fear and make people less likely to get involved in the first place,” Dr. Carson said.

However, he added that this should not be interpreted as a pendulum swing back to the pre-2008 environment. The retired neurosurgeon-turned-housing policy chieftain warned that HUD was “not open for business to fraudsters, those without proper controls, or those who do not take their obligations in our market seriously. They will be found out and held accountable.”

About the author