Advertisement

New Study Tracks Credit Score Recovery After Homebuying

New homebuyers can expect an average of four months of falling credit after purchasing their property, according to a new data analysis from LendingTree.

On average, credit scores for homebuyers fall by 15 points and take 160 days to reach their low points. Recovery takes an average of an additional 161 days for scores to return to their prior levels.

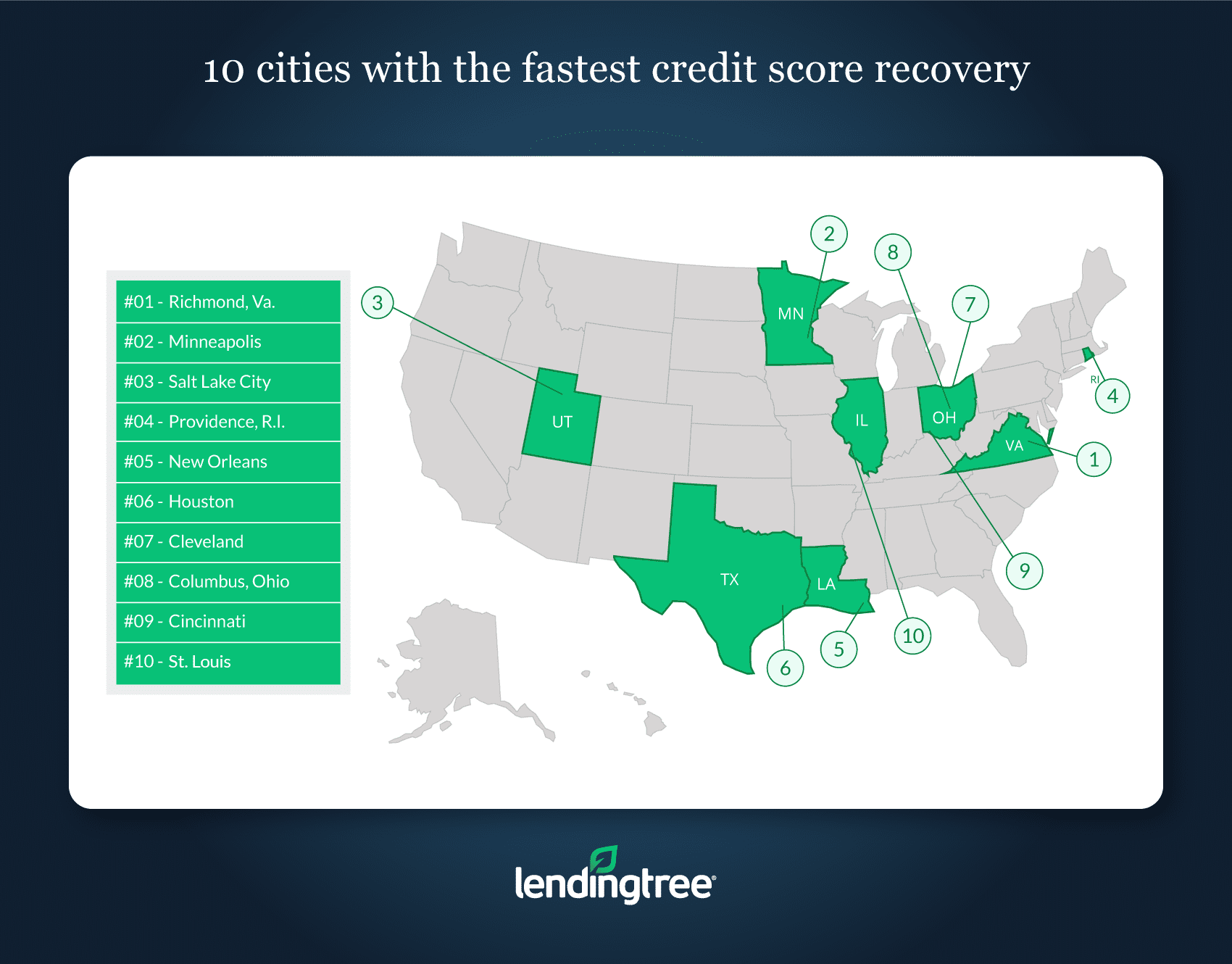

In some markets, credit score recovery times can be faster or slower than the national average.

Among the nation’s 50 largest metros, Richmond, Va., had the nation’s fastest credit score recovery after taking out a mortgage: the average initial credit score of 693 only saw a 13-point decline and a 266-day recovery period. Milwaukee had the slowest recovery time: an average initial credit score of 700 and a 11-point average decline required 384 days for recovery.

"A house is the biggest purchase most people make in their lifetime, with the accompanying mortgage being their largest financial transaction," said Tendayi Kapfidze, Chief Economist at LendingTree. "Most people know they should work toward having the best possible credit score before applying for a mortgage, as an applicant's credit score can significantly affect the amount and cost of borrowing."

About the author