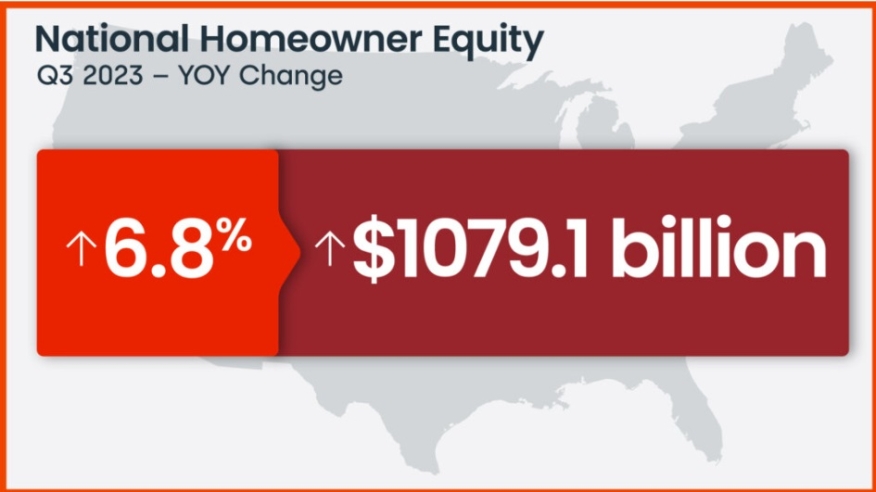

CoreLogic: Home Equity Up 6.8%

Average homeowner gains over $20,000 in wealth.

The latest CoreLogic Homeowner Equity Insights report found that homeowners with mortgages have witnessed a collective increase in equity amounting to a staggering $1.1 billion since the third quarter of 2022. This marks a year-over-year gain of 6.8%.

The positive trend in homeowner equity is a welcomed contrast to the turbulence experienced in the earlier part of the year. The report also found that in the third quarter of 2023, the number of mortgaged residential properties burdened by negative equity declined by 7.7% compared to the previous quarter. This reduction equates to 1 million homes or 1.8% of all mortgaged properties. The improvement is even more pronounced when observed over the course of a year, with negative equity shrinking by 8% to encompass 1.1 million homes, equivalent to 2% of all mortgaged properties, compared to the third quarter of 2022.

After experiencing slight annual losses during the first two quarters of 2023, the housing market rebounded in the third quarter. CoreLogic's monthly Home Price Insights data indicated consistent growth throughout this period, translating into increased equity gains in various regions.

“With price gains continuing to help homeowners build wealth, equity has reached a new high and regained losses that resulted from declines last year," CoreLogic Chief Economist Selma Hepp said. "And while the average U.S. homeowner gained over $20,000 in additional equity compared with the third quarter of 2022, some markets are seeing larger increases as price growth catches up. These include Northeastern states such as Massachusetts, Rhode Island, Connecticut, New Hampshire and Maine, all of which posted about double the national gain.”

Furthermore, sluggish home sales activity has resulted in fewer mortgage originations, influencing overall home equity positively. As of the third quarter, the nation's loan-to-value ratio stood at 42%, reflecting this favorable trend.

It means the average homeowner with a mortgage still enjoys more than $300,000 in equity relative to their purchase date.

The national aggregate value of negative equity decreased to approximately $314.1 billion by the end of the third quarter of 2023. This represents a quarterly decline of roughly $22.3 billion or 6.6%, compared to $336.4 billion in the second quarter of the same year. In comparison to the third quarter of 2022, this figure has decreased by approximately $7.8 billion or 2.4%.

It's still a far cry from 2009 when negative equity reached its zenith at 26% of mortgaged residential properties. The market has certainly come a long way since then, with the average homeowner gaining around $20,000 in equity over the past year.

While national averages provide an overall perspective, there are notable regional differences. States like Hawaii, California, and Massachusetts have experienced substantial average national equity gains, all exceeding $45,000. Conversely, New York, Texas, Utah, and Washington, D.C. have recorded annual equity losses.

Las Vegas and Los Angeles stand out as the least affected, with negative equity shares accounting for just 0.6% of all mortgages in these cities.