February Delinquency Rates Remain Historically Low

Most homeowners with a mortgage still able to make their payments on time in February, CoreLogic report shows.

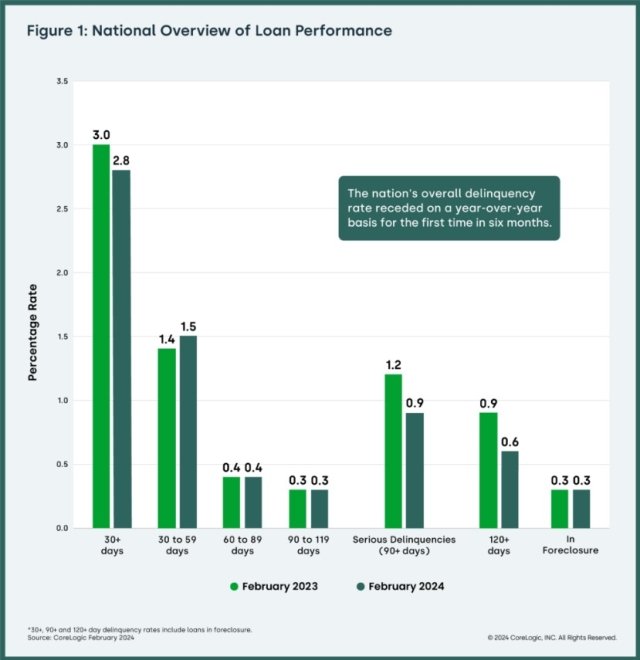

CoreLogic’s latest Loan Performance Insights Report, released Thursday, shows the share of all U.S. mortgages in some stage of delinquency (30 days or more past due, including those in foreclosure) held at 2.8% in February, unchanged from January but a year-over-year decline from February 2023. Early-stage delinquencies rose 0.1% annually.

The data in this report accounts for only first liens against a property and does not include secondary liens. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

“The U.S. delinquency rate fell from a year earlier for the first time in six months in February, indicating that mortgage performance remains strong,” said Molly Boesel, principal economist for CoreLogic. “The decrease in delinquencies was driven by the decline in the share of mortgages that were six months or more past due, a number that has been consistently shrinking and fell to its lowest level in 15 years in February.”

Four states, led by Arizona (+0.2%), posted small overall annual delinquency rate increases in February. Meanwhile, eight states saw no change in their overall delinquency rates, and 39 experienced annual declines ranging from 0.4% to 0.1%.

Fifty-six U.S. metro areas posted increases in overall year-over-year delinquency rates, led by the Kahului-Wailuku-Lahaina, Hawaii metro area (+1.6%) on account of last summer’s wildfires in that region. The Hinesville, Ga. and New Orleans-Metairie, La. metro areas each saw the second-highest increase in overall delinquency rates, both up 0.4%.

Only three metro areas posted annual increases in serious delinquency rates (defined as 90 days or more late on a mortgage payment): Kahului-Wailuku-Lahaina, Hawaii (+1.6%), Carson City, Nev. (+0.2%), and Hinesville, Ga. (+0.1%). Meanwhile, 25 metros recorded no change and declines in other metros ranged from 1.7% to 0.1%.