Freddie Mac Economist: Mortgage Rates Trend 'Sideways'

Both 30- and 15-year fixed rates decreased this week.

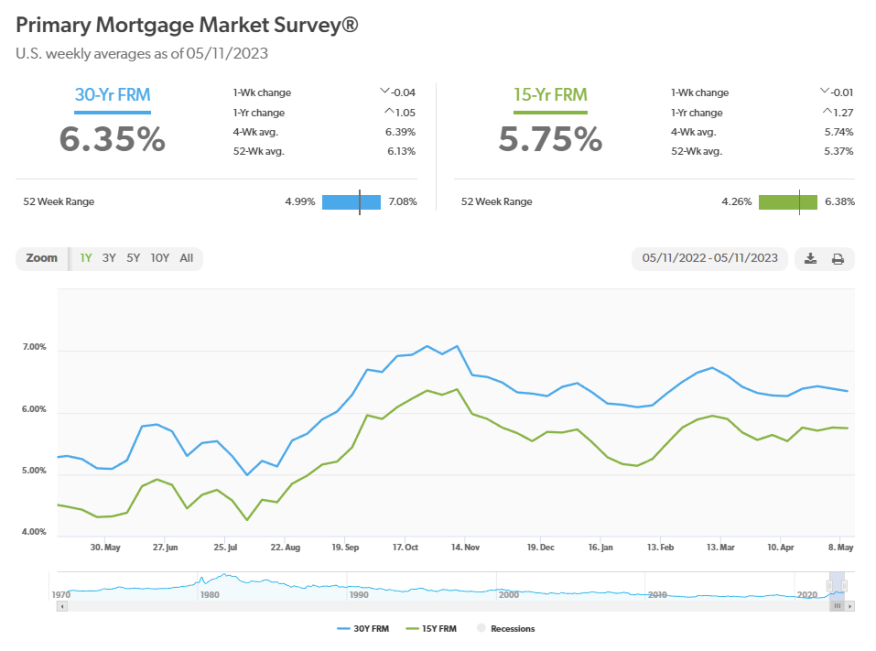

- 30-year fixed-rate mortgage averaged 6.35%.

- 15-year fixed-rate mortgage averaged 5.75%.

Mortgage rates have gone sideways.

That’s the takeaway from the latest Primary Mortgage Market Survey (PMMS) produced by Freddie Mac, which found that both the 30-year and 15-year fixed rates decreased for the week ended May 11.

The 30-year rate slipped to 6.35%, while the 15-year dipped to 5.75%.

The decrease for the 30-year rate was the second straight weekly decline, while the 15-year rate declined after increasing slightly last week.

“This week’s decrease continues a recent sideways trend in mortgage rates, which is a welcome departure from the record increases of last year,” said Sam Khater, Freddie Mac’s chief economist. “While inflation remains elevated, its rate of growth has moderated and is expected to decelerate over the remainder of 2023. This should bode well for the trajectory of mortgage rates over the long-term.”

Mortgage Rates

- The 30-year fixed-rate mortgage averaged 6.35% as of May 11, down a tad from 6.39% last week. A year ago, it averaged 5.3%.

- The 15-year fixed-rate mortgage averaged 5.75%, down slightly from last week when it averaged 5.76% A year ago it averaged%.

Freddie Mac’s PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Jiayi Xu, economist for Realtor.com, said rates moved lower as 10-year Treasury yields trended down.

"In light of a strong jobs report last week, April’s CPI (consumer price index) data reinforced that we are very likely at the end of the tightening cycle,” Xu said. “In April 2023, the headline CPI climbed by 4.9% year-over-year, slowing for the 10th-consecutive month and hitting its lowest level in two years. The core inflation — which includes goods and services excluding volatile food and energy — was at 5.5%. On a monthly basis, both the headline and core indexes increased 0.4%, in line with forecasts from economists.”

As long as the economy continues to see progress on inflation, it is expected that mortgage rates will remain toward the lower end of the 6% to 7% range, Xu said.