Housing Sentiment Again Indicates Signs Of Leveling Off

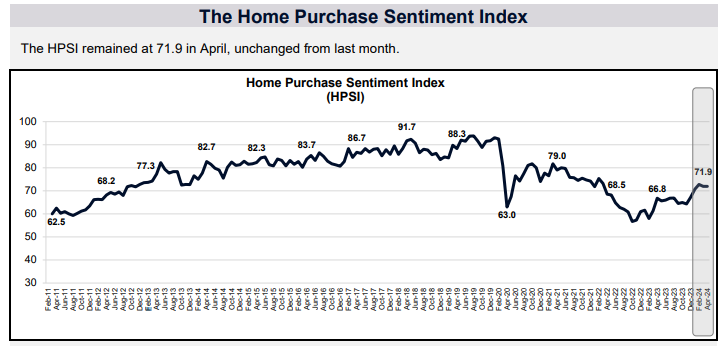

Fannie Mae's latest Home Purchase Sentiment Index (HPSI) was unchanged in April at 71.9.

The Fannie Mae Home Purchase Sentiment Index (HPSI) was unchanged in April at 71.9, revealing signs of once again plateauing as consumers continue to adjust to higher interest rates and home prices.

This month, 67% of consumers indicated that it’s a good time to sell a home, while 20% said it’s a good time to buy a home. These two indicators are up 10 percentage points and three percentage points, respectively, since the end of 2023, despite mortgage rates having moved steadily upward. Additionally, the share of respondents who expect mortgage rates to go down over the next 12 months fell to 26%. The full index is up 5.1 points year over year.

“The HPSI, unchanged this month, may have hit another plateau as consumers maintain their ‘wait and see’ approach to the housing market,” said Fannie Mae Senior Vice President and Chief Economist, Doug Duncan. “Overall, housing sentiment increased from November through February, driven largely by consumer belief that mortgage rates would move lower. However, recent data showing stickier-than-expected inflation, rising mortgage rates, and continued home price appreciation appear to have given consumers pause regarding the market’s direction."

The percentage of respondents who say it is a good time to buy a home decreased from 21% to 20%, while the percentage who say it is a bad time to buy remained unchanged at 79%. As a result, the net share of those who say it is a good time to buy decreased by one percentage point month over month.

The percentage of respondents who say it is a good time to sell a home increased from 66% to 67%, while the percentage who say it’s a bad time to sell decreased from 34% to 32%.

Duncan continued, "While only 20% of consumers think it’s a good time to buy a home, 67% think it’s a good time to sell one, a share that’s moved steadily upward since the start of the year. We think consumers’ generally improved sense of home-selling conditions bodes well for listings and housing activity, particularly for the segment of the population who may need to move for lifestyle reasons and have already begun adjusting their financial expectations to the current mortgage rate and price environment."

Duncan added that for potential homebuyers in less of a rush to transact, ongoing affordability challenges may continue to keep many of them on the sidelines.

The percentage of respondents who say home prices will go up in the next 12 months increased from 40% to 42%, while the percentage who say home prices will go down decreased from 20% to 18%. The share who think home prices will stay the same increased from 38% to 39%.

The percentage of respondents in the survey who say mortgage rates will go down in the next 12 months decreased from 29% to 26%, while the percentage who expect mortgage rates to go up decreased from 34% to 33%. The share who think mortgage rates will stay the same increased from 36% to 40%. As a result, the net share of those who say mortgage rates will go down over the next 12 months decreased one percentage point month-over-month.

The full HPSI report can be read here.