Median Mortgage Application Payment Rose In March

MBA’s Purchase Applications Payment Index hits record high.

Buying a home became a little more expensive in March as mortgage rates rose and housing inventory remained low, the Mortgage Bankers Association (MBA) said Thursday.

The national median payment applied for by purchase applicants rose to $2,093 in March, up 1.6% from $2,061 in February, according to the MBA’s Purchase Applications Payment Index (PAPI). The median payment is up nearly 21% from a year ago.

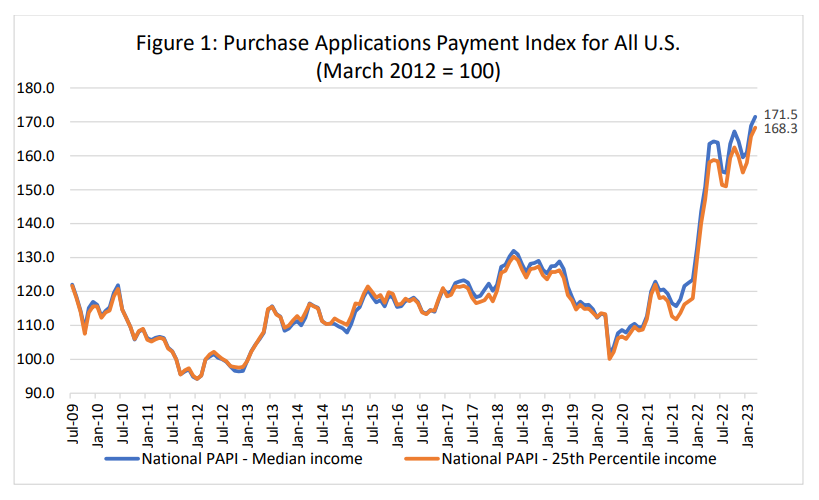

The index measures how new monthly mortgage payments vary across time — relative to income — using data from MBA’s Weekly Applications Survey (WAS).

The national PAPI increased 1.6% to 171.5 in March from 168.9 in February, setting a record high. Compared to March 2022, when the PAPI was 147.1, the index is up 13.7%.

“Homebuyer affordability remained constrained in March as elevated mortgage rates and low inventory kept prices high, leading many prospective homebuyers to delay decisions to enter the market,” said Edward Seiler, MBA's associate vice president, housing economics, and executive director of the Research Institute for Housing America.

He continued, “The affordability index hit a new survey high last month, with both the typical purchase application amount and monthly payment rising on a monthly and annual basis,” Seiler said. “While many prospective buyers currently remain on the sidelines, MBA expects mortgage rates to decline slowly as the year progresses, which will help with affordability and may spur sales activity.”

An increase in MBA’s PAPI — which indicates declining borrower affordability conditions — means that the mortgage-payment-to-income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI — indicative of improving borrower affordability conditions — occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased to $1,411 in March, from $1,391 in February, the MBA said.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey increased to $2,508 in March, up from $2,492 in February.

Key Highlights

Other key findings of MBA's Purchase Applications Payment Index (PAPI) for March 2023:

- The national median mortgage payment was $2,093 in March, up from $2,061 in February and from $1,964 in January. It is up $357 from a year ago, a 20.6% increase.

- The national median mortgage payment for FHA loan applicants was $1,755 in March, up from $1,707 in February and from $1,254 in March 2022.

- The national median mortgage payment for conventional loan applicants was $2,145, up from $2,117 in February and from $1,819 in March 2022.

- The top five states with the highest PAPI were: Idaho (256.5), Nevada (252.2), Arizona (227.7), Utah (219.6), and Florida (215.8).

- The top five states with the lowest PAPI were: West Virginia (118.9), Louisiana (125.3), Alaska (125.9), Connecticut (126.1), and Iowa (129.8).

- Homebuyer affordability decreased for Black households, with the national PAPI increasing from 173.1 in February to 175.8 in March.

- Homebuyer affordability decreased for Hispanic households, with the national PAPI increasing from 157.8 in February to 160.2 in March.

- Homebuyer affordability decreased for White households, with the national PAPI increasing from 169.5 in February to 172.2 in March.