Modest Recession Still Likely As Credit Conditions Tighten

Fannie Mae ESR Group updates forecast, includes more positive outlook on housing construction.

- Forecasts mild recession in second half of 2023, says 'soft-landing' still possible.

- Revises forecast for 2023 total home sales slightly upward to 4.86 million units.

- Revises downward its forecast for home sales in 2024 to 5.01 million units.

The economy is still expected to enter a modest recession in the second half of the year, Fannie Mae’s Economic and Strategic Research Group said Friday, while acknowledging that the economy currently has “unusual dynamics” that make it difficult to forecast “the exact timing.”

It added that “there are unusual aspects to the current economic cycle that suggest a soft landing is possible.”

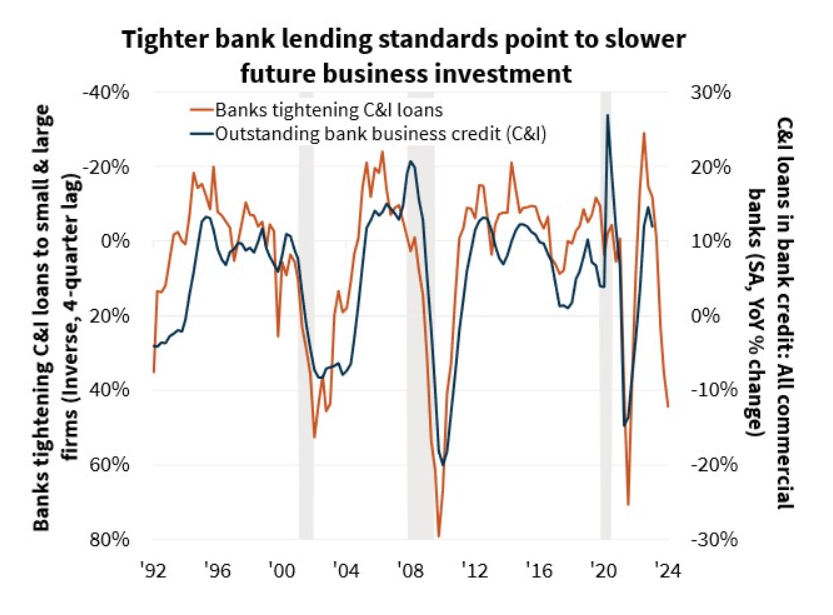

In its latest update to its commentary on the economy, the ESR Group said consumer spending remains unsustainably high compared to incomes, and that recession is the typical conclusion to a monetary policy tightening regimen.

Earlier this month, the Federal Reserve’s Federal Open Market Committee raised its benchmark federal funds rate by 25 basis points, the 10th increase in the past 14 months. The FOMC, however, hinted that it could pause its rate hikes following its next meeting, scheduled for June 13-14.

The usual channels through which monetary policy helps slow the economy, however, may be disrupted, the group said, “as evidenced by recent increases in new auto sales resulting from improving supply conditions and a more upbeat outlook from homebuilders.”

Still, the ESR Group said, it believes “a modest recession is the likeliest outcome — and that its timing remains the principal outstanding question — as the Fed is likely to maintain tighter policy for longer if wage-related inflationary pressures do not subside.”

The group now projects real gross domestic product growth in the fourth quarter to be -0.3% from a year earlier, up 0.1 percentage points from its prior outlook. For all of 2024, the group has downgraded growth by 0.2 percentage points to 1.2%.

Its overall home sales forecast remains fundamentally unchanged, with a slight upward revision of 2023 total sales to 4.86 million units (from its previous forecast of 4.84 million), and a slight downward revision in 2024 to 5.01 million units (from 5.03 million in its previous forecast).

The ESR Group’s commentary said sales of existing homes “have been largely in line” with its recent forecasts for further gradual declines throughout the year due to affordability constraints and an extraordinarily tight inventory.

“This is partially a result of the so-called ‘lock-in effect,’ in which existing homeowners are disincentivized from listing their homes for sale because their existing mortgage rate is well below current market rates,” the group said. “As such, housing demand has shifted further toward the new home market, bolstering builder optimism and the ESR Group’s single-family starts forecast.”

The group added that, on the multifamily side, it continues to expect a significant slowdown in starts later this year resulting from tightening credit conditions, slower rent growth, and higher vacancy rates.

“There are select data available to support several alternative views of the path of the economy, though we maintain our view that a modest recession will begin in the second half of 2023,” said Doug Duncan, senior vice president and chief economist for Fannie Mae. “Housing remains exhibit No. 1 for why we expect the recession to be modest. It continues to outperform our expectations, and we expect that its relative strength will help kickstart the economy into expanding again in 2024.”

He added that inflation “has been resistant to Fed efforts to drive it down, and we view the risks to our baseline forecast as tilted toward more tightening rather than easing — although, for the moment, the Fed has adopted a wait-and-see approach.”