Mortgage Credit Availability Hits Lowest Level Since 2012

The numbers reflect ongoing industry consolidation and reduced loan programs.

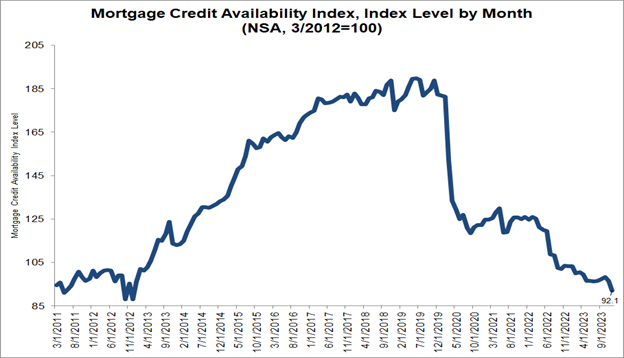

In December, mortgage credit availability saw a decline, indicating that lending standards were tightening, according to the Mortgage Bankers Association's (MBA) Mortgage Credit Availability Index (MCAI). The MCAI dropped by 4.6% to a reading of 92.1.

“Credit availability declined in December to the lowest level since 2012, as ongoing industry consolidation is resulting in more loan programs being removed from the marketplace,” MBA Vice President and Deputy Chief Economist Joel Kan said. “Both conventional and government indices experienced decreases."

Credit availability decreased even as mortgage rates went from 7.79% at the end of October to 6.62% at the end of December, according to Freddie Mac.

Specifically, the Conventional MCAI fell by 3.2%, while the Government MCAI experienced a more substantial decline of 5.9%. Among the component indices within the Conventional MCAI, the Jumbo MCAI decreased by 1.7%, while the Conforming MCAI recorded a significant 5.9% drop.

"The decrease in the government index was driven by lower investor demand for renovation loans and streamline refinance loans," Kan said.

The MCAI serves as a barometer for credit availability in the housing market. When the index decreases, it suggests that lenders are becoming more cautious and restrictive in their lending practices. Conversely, an increase in the index indicates that lenders are offering more lenient terms and conditions to borrowers.

The MCAI, which was benchmarked at 100 in March 2012, highlights the evolving landscape of credit availability in the mortgage industry. A decreasing index underscores the need for potential homebuyers to meet more stringent lending criteria.