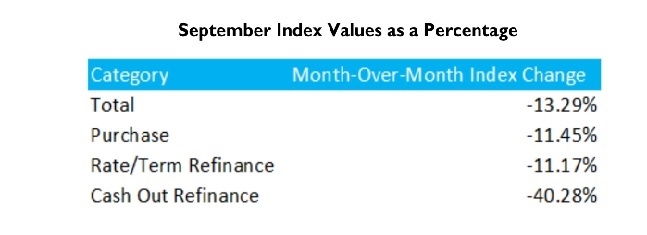

Mortgage Lock Volume Dips 13.29% in September, MCT Reports

High mortgage rates and limited housing supply cited as primary causes; Industry eyes Federal Reserve's upcoming meetings and key economic indicators.

Mortgage Capital Trading Inc. (MCT), a mortgage hedge advisory and secondary marketing software, announced a steep 13.29% decline in mortgage lock volume in September. This follows the 4.76% dip experienced in the month prior.

Increased mortgage rates in the last month are primarily to blame, reaching highs in the sevens and even 8% range. Other contributing factors include limited housing supply and perceived unfavorable housing values.

“We are hopeful that we will get some better sentiment from the Fed in either its November or December meeting which would allow for some relief for rates,” said Andrew Rhodes, senior director, head of trading at MCT, “But without that, high-interest rates will continue to be the prevailing force weighing on the market.”

As winter approaches, analysts and investors alike will closely watch the Consumer Price Index (CPI) and non-farm payroll figures. These metrics are crucial indicators that the Federal Reserve will consider as it outlines its strategy for the remaining winter months and the commencement of Q1.

“As long as those numbers continue to stay strong or in line with the consensus, I believe the rates are going to stay where they are,” Rhodes said.