Mortgage Rate Locks Up by 13.96%, Reports MCT

Month-over-month growth in mortgage rate locks coincides with the Federal Reserve's interest rate stance, as market anticipates potential future changes.

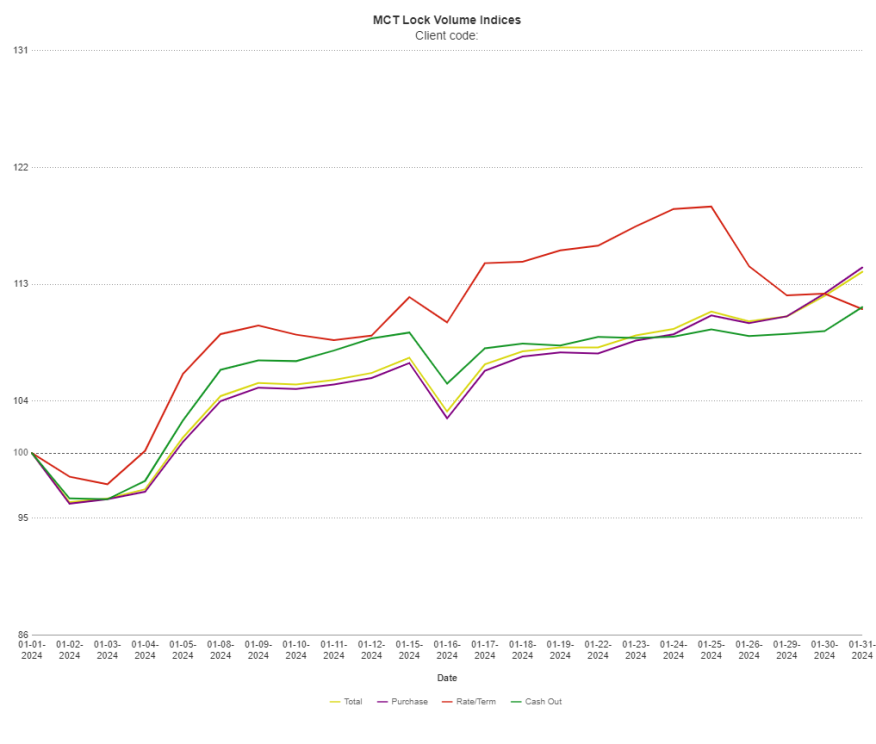

After falling in the last two months of 2023, rate locks are up 13.96%, according to Mortgage Capital Trading (MCT).

For the first time since June 2023, MCT observed month-over-month growth in total volume, purchase volume, rate/term refinances, and cash-out refinances. These figures come as the Federal Reserve has decided to maintain interest rates at their current level.

“The recent decrease in mortgage rates and increase in refinance volume hasn’t yet made a meaningful impact compared to a year ago. However, we anticipate a shift in this scenario as we approach a potential Fed rate cut, unlocking the potential for increased refinance and total volume," MCT Chief Operating Officer Phil Rasori said.