Mortgage Rates Continue Their Ascent

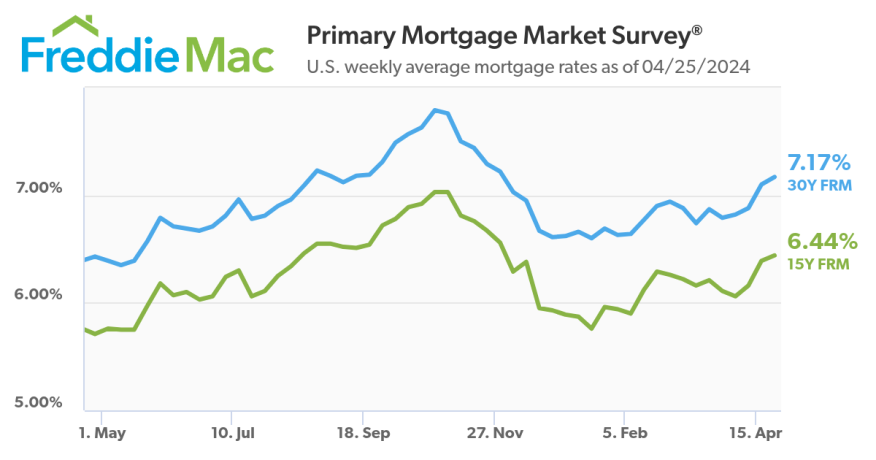

The 30-year FRM averaged 7.17% as of April 25, 2024, up from last week, when it averaged 7.10%.

Freddie Mac's latest Primary Mortgage Market Survey, released weekly, reported the 30-year fixed-rate mortgage (FRM) averaged 7.17% this week.

“Mortgage rates continued rising this week,” said Sam Khater, Freddie Mac’s chief economist. “Despite rates increasing more than half a percent since the first week of the year, purchase demand remains steady. With rates staying higher for longer, many homebuyers are adjusting, as evidenced by this week’s report that sales of newly built homes saw the biggest increase since December 2022.”

The 30-year FRM inched up from last week when it averaged 7.10%. A year ago at this time, the 30-year FRM averaged 6.43%.

The 15-year FRM averaged 6.44%, up from last week when it averaged 6.39%. A year ago at this time, the 15-year FRM averaged 5.71%.