Mortgage Rates Decline As 30-Year Fixed-Rate Mortgage Drops To 6.74%

Freddie Mac's Chief Economist warns of persistent inflation pressure despite recent rate dip, suggesting prolonged elevated rates in the mortgage market.

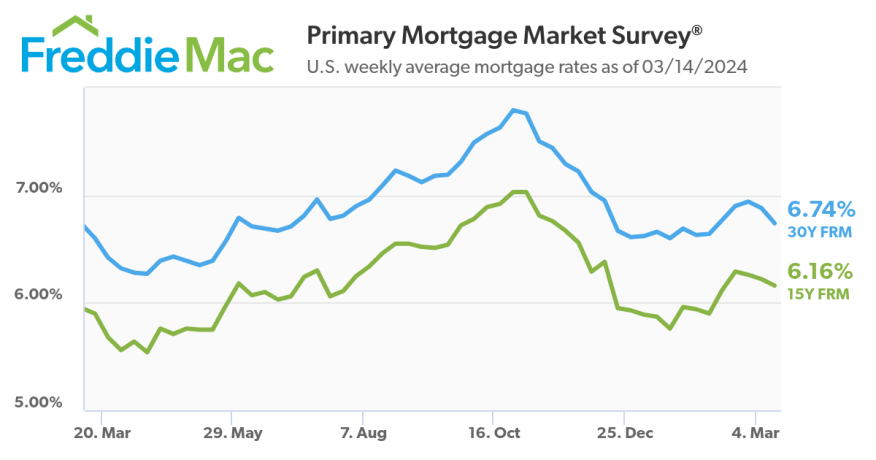

According to Freddie Mac's latest report, mortgage rates saw a decline this week, with the 30-year fixed-rate mortgage (FRM) averaging 6.74%.

This marks a drop from the previous week's average of 6.88%. However, compared to a year ago, rates remain higher, with the 30-year FRM averaging 6.60%.

Similarly, the 15-year FRM also experienced a decrease, averaging 6.16% compared to 6.22% the previous week. A year ago, the 15-year FRM averaged 5.90%.

“The 30-year fixed-rate mortgage decreased again this week, with declines totaling almost a quarter of a percent in two weeks’ time,” said Sam Khater, Freddie Mac’s chief economist. “Despite the recent dip, mortgage rates remain high as the market contends with the pressure of sticky inflation. In this environment, there is a good possibility that rates will stay higher for a longer period of time.”

National Association of Realtors Deputy Chief Economist Jessica Lautz said that for homebuyers looking to purchase a $400,000 home with 20% down this means a $2,073 monthly mortgage payment.

"As mortgage interest rates have declined from a high in October of 7.79%, this translates into a significant savings of $228," Lautz added.