Pending Home Sales Fell 2.7% In May

NAR says housing market remains resilient, with approximately 3 offers for each listing.

- Pending home sales fell month over month in three regions, while surging in the Northeast.

- All for U.S. regions saw year-over-year declines.

Pending home sales shrank 2.7% in May from the previous month, the National Association of Realtors (NAR) said Thursday.

Three U.S. regions posted month-over-month losses, while sales in the Northeast surged. All four regions saw year-over-year declines in transactions.

“Despite sluggish pending contract signings, the housing market is resilient with approximately three offers for each listing,” said NAR Chief Economist Lawrence Yun. “The lack of housing inventory continues to prevent housing demand from being fully realized.”

A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

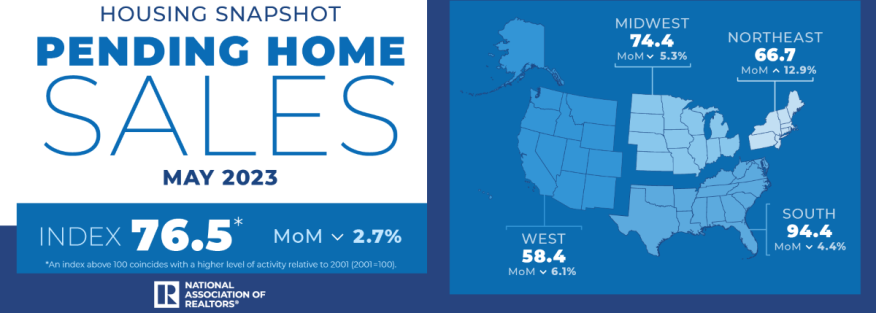

NAR’s Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — dropped 2.7% to 76.5 in May. Year over year, pending transactions fell 22.2%. An index of 100 is equal to the level of contract activity in 2001, the first year to be examined.

“It is encouraging that homebuilders have ramped up production, but the supply from new construction takes time and remains insufficient,” Yun added. “There should be more focus on boosting existing-home inventory with temporary tax incentive measures.”

Regional Breakdown

The Northeast PHSI climbed 12.9% from last month to 66.7, a decrease of 21.9% from a year earlier. The Midwest index dropped 5.3% to 74.4 in May, down 23.5% from a year ago.

The South PHSI decreased 4.4% to 94.4 in May, dropping 19.6% from a year earlier. The West index lessened 6.1% in May to 58.4, falling 26.6% YoY.

First American Financial Corp. Economist Ksenia Potapov said the spring home-buying season has struggled to gain momentum.

“Mortgage rates remain high, reducing house-buying power and keeping existing homeowners rate-locked into their homes,” she said. “As a result, the inventory of homes for sale, which typically increases throughout the spring and summer months, has remained near winter lows.”

Potapov said the divide between the existing-home and new-home markets continues to grow. “While existing-home sales remain muted, multiple leading indicators on the new-home side — including new-home sales, new-home construction, and homebuilder sentiment — have trended higher.”

She added that “there is plenty of demand on the sidelines, the labor market remains strong, and potential home buyers are ready to jump in. While limited inventory is likely to hold back sales activity, the housing market remains resilient.”

The National Association of Realtors is America’s largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.