Pending Home Sales Unchanged In April

Lack of inventory, high mortgage rates holding down sales of existing homes, NAR says.

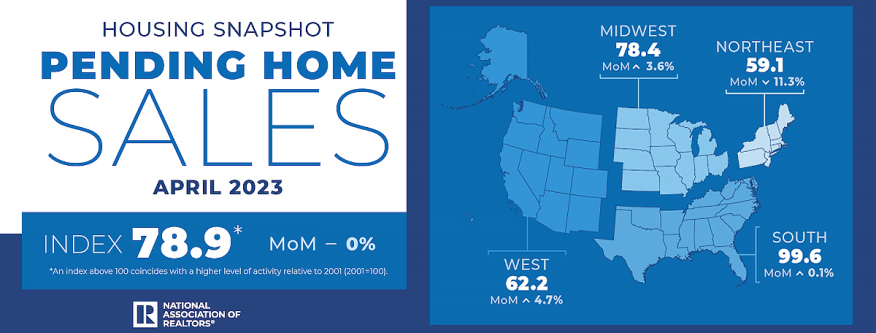

- NAR’s Pending Home Sales Index remained at 78.9 in April, unchanged from March.

- Year over year, pending transactions plunged 20.3%

The lack of inventory and higher mortgage rates continue to be a drag on home sales, with pending home sales recording no change in April, the National Association of Realtors (NAR) said Thursday.

Three U.S. regions posted monthly gains in pending sales, while they declined in the Northeast. All four regions saw year-over-year declines in transactions, the NAR said.

NAR’s Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — remained at 78.9 in April, unchanged from March. Year over year, pending transactions plunged 20.3%. An index of 100 is equal to the level of contract activity in 2001.

The PHSI is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

NAR Chief Economist Lawrence Yun said so far this spring, not all interested buyers are completing purchases because of the significant lack of homes for sale.

"Affordability challenges certainly remain and continue to hold back contract signings, but a sizable increase in housing inventory will be critical to get more Americans moving, Yun said.

The amount of time between pending contracts and completed sales is not identical for all home sales, the NAR said. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues.

Regional Breakdown

The Northeast PHSI dropped 11.3% in April from a month earlier to 59.1. That was also a decrease of 21.8% from April 2022.

The Midwest index improved 3.6% to 78.4 in April, down 21.4% from one year ago. The South PHSI increased 0.1% to 99.6 in April, sinking 16.7% from the prior year. The West index rose 4.7% in April to 62.2, but was down 26% from April 2022.

"Minor monthly variations in regional activity are typical," Yun said "However, cumulative results over many years clearly point towards a much greater number of home sales in the South."

At 99.6, the PHSI in the South is only slightly below 100, which is equal to the average level of contract activity during 2001, the first year NAR analyzed the PHSI.

"The South's pending home sales activity is similar to that of 2001, but the Midwest's activity has decreased by 22% in that same period, and the Northeast and West regions are both about 40% lower than they were in 2001," Yun added.

Tug Of War

Realtor.com Chief Economist Danielle Hale noted that sales of newly constructed homes rose in April, even as pending sales of existing homes were unchanged.

“Pending home sales data highlighted the tug of war between ongoing inventory challenges in the existing home market and homebuyer interest,” Hale said.

“Contract signings remained above the fourth quarter’s low levels, but trailed the year ago pace by 20.3%,” she said. “Because pending home sales or contract signings are the first major step in a home sale transaction, [Thursday’s] index signals that the market faces continued headwinds from low inventory and affordability.”

She continued, “Although buyers, sellers, and builders are all more optimistic about the housing market, asking home price growth is easing, and the typical home sales price is slipping. These point to the nudge that buyers need to act on their improving outlook.”

Hale said the interest in buying homes has held up “reasonably well” despite the expected slowing of the economy, but uncertainties — like the unresolved U.S. debt ceiling negotiations — remain.

“With uncertainties looming, potential buyers have a lot to consider,” she said. “My expectation is that an agreement is reached to end the U.S. debt stalemate, and existing home sales will continue to muddle along, while the new homes market, which is relatively better supplied, will outperform. For homeowners considering a sale, [Thursday’s] data shows that buyers are still shopping, but the varied regional performance suggests that pricing a home well is important.”

The National Association of Realtors is America's largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.