Rate Of Home Price Growth Returns To Pre-Pandemic Levels

Redfin's Home Price Index saw prices rise 0.6% in February.

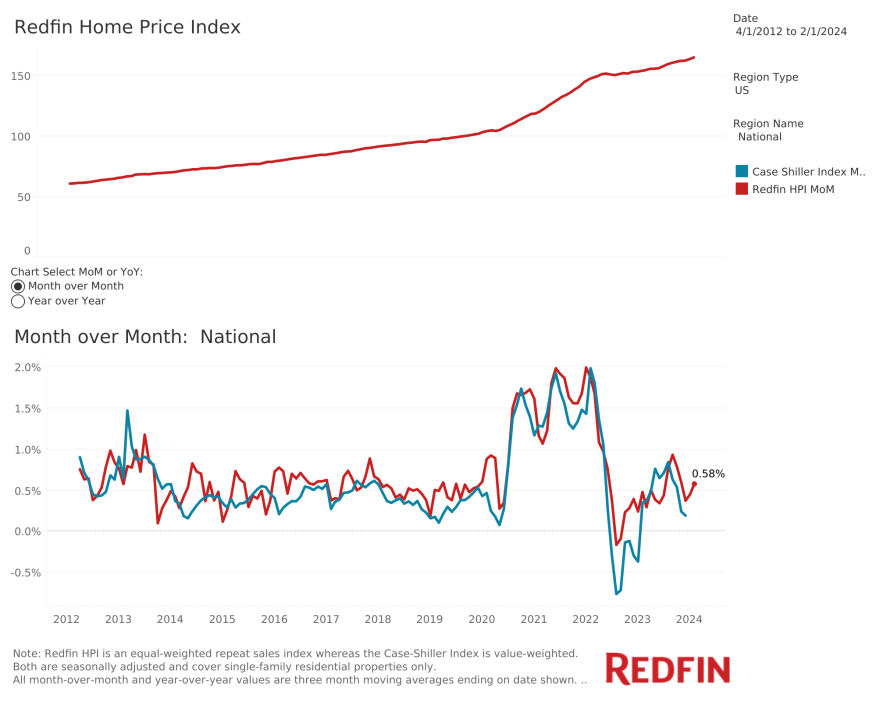

The rate of home price growth returned to pre-pandemic levels, per Redfin’s Home Price Index (RHPI), covering the three months ending February 29, 2024.

The growth follows a three-year rollercoaster ride in which home prices spiked when ultra-low mortgage rates fueled a homebuying rush, and cooled when mortgages rates jumped due to the Federal Reserve’s effort to calm inflation.

In February, U.S. home prices continued their upward trajectory, increasing by 0.6% compared to the previous month, mirroring the average monthly gains observed over the eight years preceding the pandemic. Throughout the pandemic, prices experienced fluctuations, reaching a high of 2% month-over-month growth in January 2022 and dipping by as little as to 0.2% in August 2022.

When examining year-over-year shifts, U.S. home prices surged by 6.7% in February compared to the previous year, reminiscent of the average annual increase of 6.9% pre-pandemic. By comparison, prices rose by as much as 22.9% year over year in March 2022 and by as little as 3.4% in June 2023.

Mortgage rates remain elevated, but they’re not nearly as volatile as they were before, which has helped stabilize home price growth. And while elevated mortgage rates have lessened homebuyer demand, that’s not translating into lower home prices today because there still aren’t enough homes for sale – even as new listings rebound. New listings rose to the highest level in nearly a year and a half last month as the mortgage rate lock-in effect eased, but housing supply was still far below pre-pandemic levels.

Prices Plummet in Six Metros

Home prices fell from a month earlier in six of the 50 most populous U.S. metropolitan areas – including Tampa, FL (-0.5%), San Antonio (-0.4%), and Charlotte, NC (-0.1%). Redfin noted that many of these were pandemic boomtowns that have since seen their housing markets cool.

By comparison, prices fell in 13 metros in January. Prices are likely soft in Texas and Florida in part because those two states have been amping up home building, which means supply has increased. In Florida, condo listings are contributing to the jump in supply amid a surge in HOA and insurance fees.