Redfin: Cheaper To Buy Than Rent In Only 4 U.S. Metros

Nationwide, the typical home costs an estimated 25% more per month to own than rent.

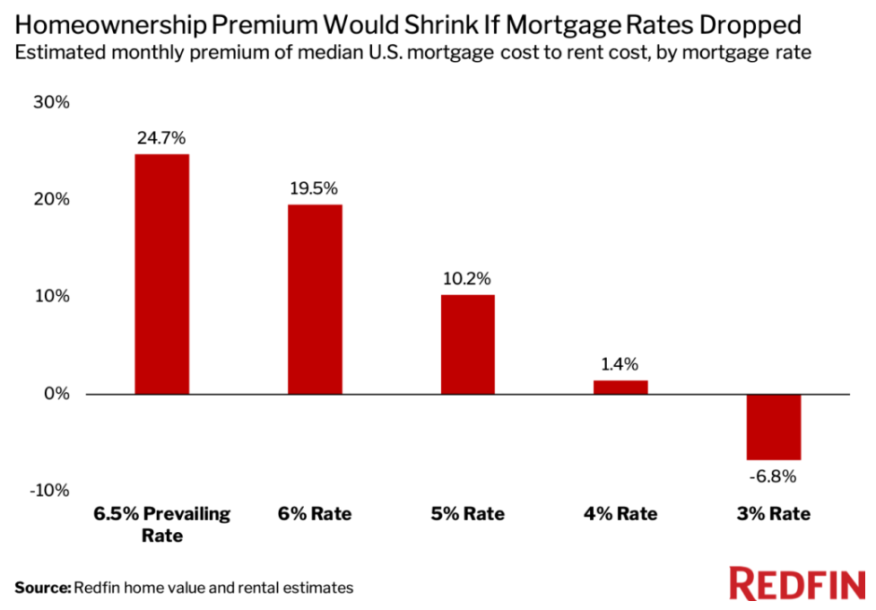

- If the 30-year-fixed mortgage rate dropped to 5%, the median estimated monthly mortgage payment for homebuyers would be 10% higher than the estimated monthly rent.

- The San Francisco bay area is costliest, with 0% of homes cheaper to buy than rent.

The United States has just four major metropolitan areas where it is cheaper to buy than rent the typical home, according to a new report from Redfin.

The report from the technology-powered real estate brokerage listed only the following locations in which a typical home has an estimated monthly mortgage cost lower than its estimated monthly rental cost:

- Detroit, where 80% of properties are cheaper to buy than rent, the highest share in the U.S.;

- Philadelphia, at 59% of properties;

- Cleveland, at 57%; and

- Houston, at 52%.

That compares with a nationwide share of 19%, Redfin said.

According to the report, in Detroit the typical home is 24% less expensive to buy than rent, the largest discount in percentage terms among the 50 most populous metros.

The median estimated monthly mortgage payment for Detroit homebuyers is $1,296, compared to an estimated monthly rent of $1,697. Philadelphia has a 7% ownership discount, followed by Cleveland (4% discount) and Houston (1% discount).

On average, in the 50 most populous U.S. metros, the typical home costs 25% more to buy than rent, with an estimated monthly mortgage payment of $3,385 and an estimated rent of $2,715, Redfin said.

The report estimated monthly housing payments using the Redfin Estimate of the homes’ value in March and a 6.5% mortgage interest rate, which was the average rate in March. It estimated monthly rents on the same homes using the Redfin Rental Estimate.

“Buying a home often makes more financial sense than renting if you can afford a down payment and monthly mortgage because you’re building equity,” said Redfin Deputy Chief Economist Taylor Marr. “When you own your home, your home pays you; when you rent, you and your home pay your landlord.”

Marr conceded that buying isn’t a feasible option for everyone.

“Some people move around a lot, so renting might make more sense because they won’t be in their home long enough to build equity,” he said. “Many others simply don’t have the money for a down payment — a situation that has become increasingly common due to rising mortgage rates and elevated home prices.”

Mortgage Rates A Key Factor

Detroit, Philadelphia, Cleveland, and Houston are outliers, Redfin said. For homebuying to become cheaper than renting in other parts of the country, mortgage rates need to fall substantially.

If the 30-year-fixed mortgage rate dropped to 5%, the median estimated monthly mortgage payment for homebuyers would be $2,993, or 10% higher than the $2,716 estimated monthly rent, the report states. That’s significantly lower than today’s 25% homeownership premium.

If rates dipped to 4%, the estimated premium would shrink to 1%, Redfin said. If they fell back to 3%, it would be 7% cheaper to rent, the report states, noting that the calculations used estimated home values from March, and that prices and rents could change significantly if mortgage rates fall.

Mortgage rates will likely fall below 6% by the end of the year as the Federal Reserve makes progress in its fight against inflation, but rates are unlikely to return to 3% levels anytime soon, Marr said. A national survey by Fannie Mae found that 22% of consumers surveyed in April think mortgage rates will fall, up from 12% the prior month.

"I wouldn't encourage people to squeeze their budgets in order to buy a home when prices are falling and we're teetering on a recession,” Marr said. “In the years leading up to the pandemic, it made sense for some homebuyers to break the rule that says not to spend more than 30% of your income on monthly housing costs, but these times are more risky, so it makes sense to be a little more conservative.”

Bay Area Costliest

In San Jose, Calif., the typical home is 165% more expensive to buy than rent — the largest premium in percentage terms among the 50 most populous metros, the report states. The median estimated monthly mortgage payment for homebuyers is $11,049, compared with an estimated monthly rent of $4,176.

Next are San Francisco (139% ownership premium); Oakland, Calif. (99% premium); Anaheim, Calif. (91% premium); and Seattle (88% premium).

In all five of those metros, 0% of homes are cheaper to buy than rent.

In Sacramento, Calif., Las Vegas, Phoenix, and Austin, Texas — metros that not long ago were fairly affordable but exploded in popularity and price during the pandemic — there are also virtually no homes that are cheaper to buy than rent, the report states.

In Sacramento and Las Vegas, less than 1% of homes are cheaper to buy than rent. In Phoenix, the share is 1%; in Austin, it’s 5%. All four metropolitan areas ranked on Redfin’s list of most popular migration destinations during the pandemic.

“Housing affordability is an issue in Las Vegas. During the pandemic homebuying boom, we had a lot of people moving in from high-priced coastal areas," said local Redfin Premier real estate agent Shay Stein. ”That caused home prices to soar faster than wages, creating a disadvantage for locals looking to buy. The good news is that because the market has slowed, sellers are willing to accept offers from buyers who use FHA loans and down-payment assistance programs, and some are even throwing in money to help with mortgage-rate buydowns. All of that was unheard of during the 2021 home-buying frenzy.”