September Sees Slight Boost In Homebuyer Affordability Nationwide

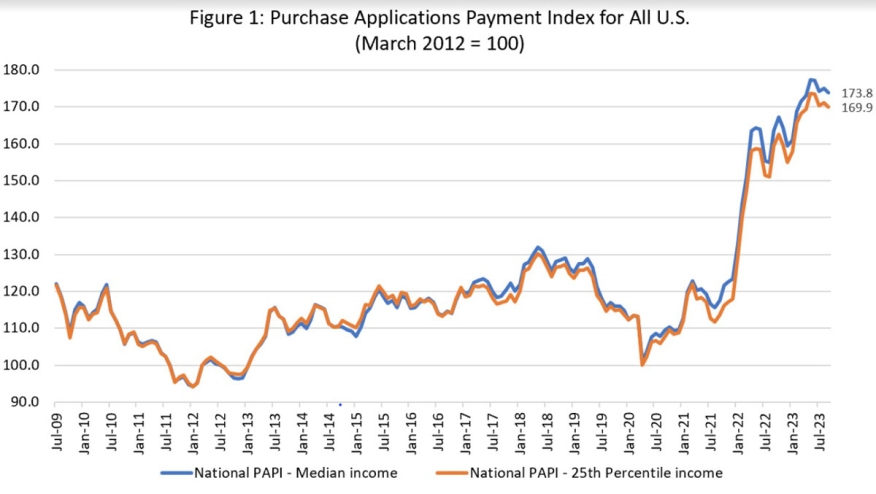

Recent data unveils a dip in median mortgage payments, but annual figures showcase a significant rise.

There's a glimmer of hope for prospective homeowners: national homebuyer affordability witnessed a modest improvement in September. The national median payment noted by purchase applicants edged down to $2,155 from the previous month's $2,170. However, this ray of positivity is tempered by the data from the Builders’ Purchase Application Payment Index (BPAPI), which indicates that the median mortgage payment stemming from MBA's Builder Application Survey rose from $2,609 in August to $2,640 in September.

Diving deeper into the Mortgage Bankers Association's (MBA) Purchase Applications Payment Index (PAPI) for September 2023, several noteworthy trends emerge:

Year-on-year, the national median mortgage payment showcased an 11% spike, leaping by $214 from the previous year to stand at $2,155 this September.

For FHA loan seekers, the median mortgage payment rose slightly to $1,920 in September, marking an increase from both August's $1,909 and September 2022's $1,566.

Meanwhile, conventional loan applicants saw their median mortgage payments dip marginally to $2,180 from August's $2,187, though this figure still reflects a rise from the $2,003 recorded in September the previous year.

Statewise, the top five states boasting the highest PAPI readings were Idaho (280.0), Nevada (267.1), Arizona (241.8), California (227.9), and Florida (225.8). Conversely, the states presenting the most affordability, or the lowest PAPI scores, comprised Alaska (121.4), Connecticut (125.5), New York (126.7), West Virginia (127.5), and Louisiana (130.3).

In terms of racial demographics:

- Black households experienced a bit more financial breathing room as the national PAPI descended from 176.0 in August to 174.8 in September.

- Hispanic households also found themselves in a slightly more favorable position, with their national PAPI slipping from 163.0 in August to 161.9 in September.

- White households mirrored this trend, witnessing their national PAPI reduce from 177.4 in August to 176.2 in September.

While September's figures suggest a minor ease in the burden for potential homebuyers, the overarching theme remains clear: the cost associated with homeownership has grown significantly over the past year.