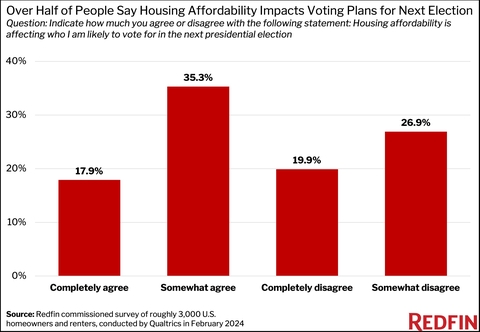

Survey Says Housing Affordability Is A Top Issue

As the November 2024 Election approaches, more than half of homeowners and renters say housing affordability is impacting who they plan to vote for in the upcoming presidential election.

Last week, President Joe Biden pitched a "mortgage relief credit" of $5,000 a year for two years for middle-class, first-time homebuyers, akin to a 1.5% reduction in mortgage interest. Additionally, a one-year credit of up to $10,000 for selling "starter homes."

A recent survey from Redfin seems to agree it's a good election year policy because affordable housing is on everyone's mind.

The report, commissioned by Redfin and conducted by Qualtrics in February 2024, surveyed approximately 3,000 U.S. homeowners and renters, providing a nationally representative sample. According to Redfin Chief Economist Daryl Fairweather, housing affordability has become a paramount issue for voters due to the confluence of factors such as soaring mortgage rates, escalating home prices, and a persistent housing shortage.

“While the economy is strong on paper, a lot of families aren’t feeling the benefits because they’re struggling to afford the house they want or already live in. As a result, many feel stuck, unable to make their desired moves and life upgrades," Fairweather said.

Biden's recent unveiling of initiatives aimed at addressing housing affordability has garnered attention. The proposed measures include tax credits for first-time buyers and sellers of starter homes, coupled with plans to construct over two million new homes.

“What the housing market needs most to address the affordability crisis is more supply,” said Fairweather. “If two million homes are actually built over the next several years like President Biden is proposing, that’s where the rubber will meet the road in addressing housing affordability.”

As the election approaches, housing affordability is poised to remain a central issue, shaping voters' decisions and influencing policy discussions at both local and national levels.