Q1 Home Flippers Earning $70K-Plus per Deal

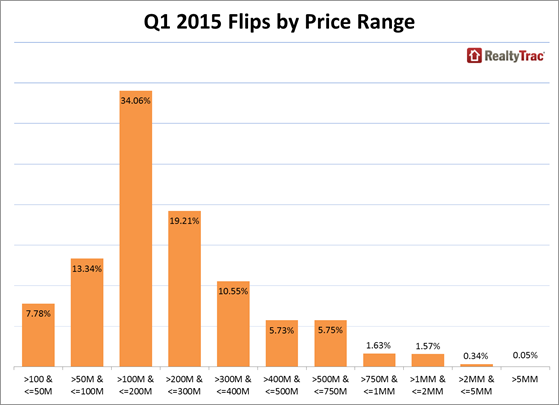

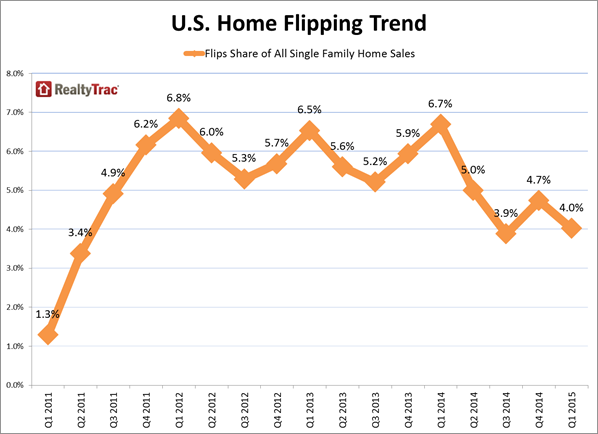

RealtyTrac has released its Q1 2015 U.S. Home Flipping Report, which shows that 17,309 single family homes were flipped—sold as part of an arms-length sale for the second time within a 12-month period—in the first quarter, four percent of all single family home sales during the quarter. The share of homes flipped in the first quarter was the lowest since the second quarter of 2011, when 3.4 percent of all single family home sales were completed flips.

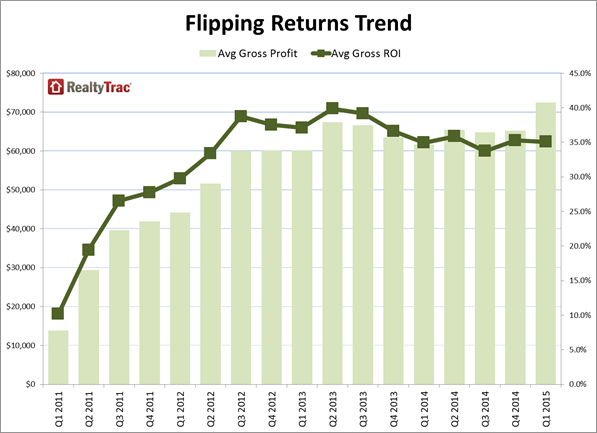

The average gross profit—the difference between the purchase price and the flipped price—for completed flips in the first quarter was $72,450, up from $65,290 in the previous quarter and up from $61,684 in the first quarter of 2014 to the highest level going back to the first quarter of 2011, the earliest where data is available. The average gross return on investment (ROI)—average gross profit as a percentage of the average original purchase price—was 35.1 percent for completed flips in the first quarter, down slightly from 35.3 percent in the fourth quarter but up slightly from 35 percent in the first quarter of 2014.

“The strong returns for home flippers in the first quarter demonstrates that there is still a need in this recovering real estate market for move-in ready homes rehabbed to more modern tastes, particularly given the dearth of new homes being built,” said Daren Blomquist, vice president at RealtyTrac. “The challenge for flippers in 2015 will be finding inventory to flip. Flippers ideally want to buy distressed homes that provide them with an opportunity to add value in markets where there is good affordability and ample demand from buyers for the finished flip product—whether those buyers are millennials becoming first-time homebuyers, baby boomers purchasing their present or future retirement home, or buy-and-hold real estate investors looking for turnkey rental properties that cash flow. Markets with the combination of distressed inventory, affordability and demand that are yielding the best flipping returns include places such as Baltimore, several metros in Central Florida, Detroit, Tucson, Pittsburgh, Memphis and Chicago. Responsible flippers in these markets can do well by doing good—providing a superior product for buyers and renters—although in some cases this may mean betting on neighborhoods that are somewhere between down-and-out and up-and-coming.”

Among markets with at least 50 completed single family home flips in the first quarter, those with the highest average gross ROI were Baltimore (94.1 percent), Deltona-Daytona Beach-Ormond Beach, Florida (74.7 percent), Ocala, Florida (73.9 percent), Lakeland, Florida (62.5 percent), and Detroit (58.3 percent).

Other major markets in the top 20 for highest average gross ROI on homes flipped in the first quarter included Tampa (57.2 percent), Pittsburgh (55.2 percent), Memphis (54.8 percent), Chicago (52.9 percent), Seattle (49.0 percent), New York (47.1 percent), Washington, D.C. (44.2 percent), and Boston (44.0 percent).

“The decline in the number of homes being flipped in the Seattle area is due primarily to two factors: rising prices and low inventory. With the lowest month’s supply of homes in our city’s recorded history, competition is fierce,” said OB Jacobi, president of Windermere Real Estate, covering the Seattle market. “So not only are there very few homes for flippers to choose from, but they’re also competing with a mass of buyers who are willing to pay well above market value, and often in cash. These aren’t exactly ideal conditions for investors looking to flip homes and make a profit but those who do will see a good return.”