Almost One-Quarter of Mortgage Customers Unhappy Over Lender

Nearly one-quarter of homebuyers regret their choice of lenders, according to the J.D. Power 2016 U.S. Primary Mortgage Origination Satisfaction Study.

The J.D. Power study found 21 percent of customers purchasing a home admitting unhappiness over the lender they worked with, while 27 percent of first-time home buyers later rued their choice. From this group, 72 percent said they were pressured to choose a particular mortgage product.

“This ‘happy buyer’s remorse’ is in part due to customers feeling that circumstances out of their control drove them to a particular choice and that options weren’t totally clear,” said Craig Martin, director of the mortgage practice at J.D. Power. “Like a lot of consumers, they are happy with a good deal, but they can feel that they have to jump through hoops to get the deal. In the end, they may not fully understand exactly what they got, and the longer-term risk for lenders is that customers’ perceptions of the deal may change in the future.”

Still, that is not to say that all borrowers are unhappy the report found more customers reporting that loan representative always called back when promised, compared with last year (85 percent versus 81 percent, respectively), and their loan closed on the desired date (81 percent versus 70 percent).

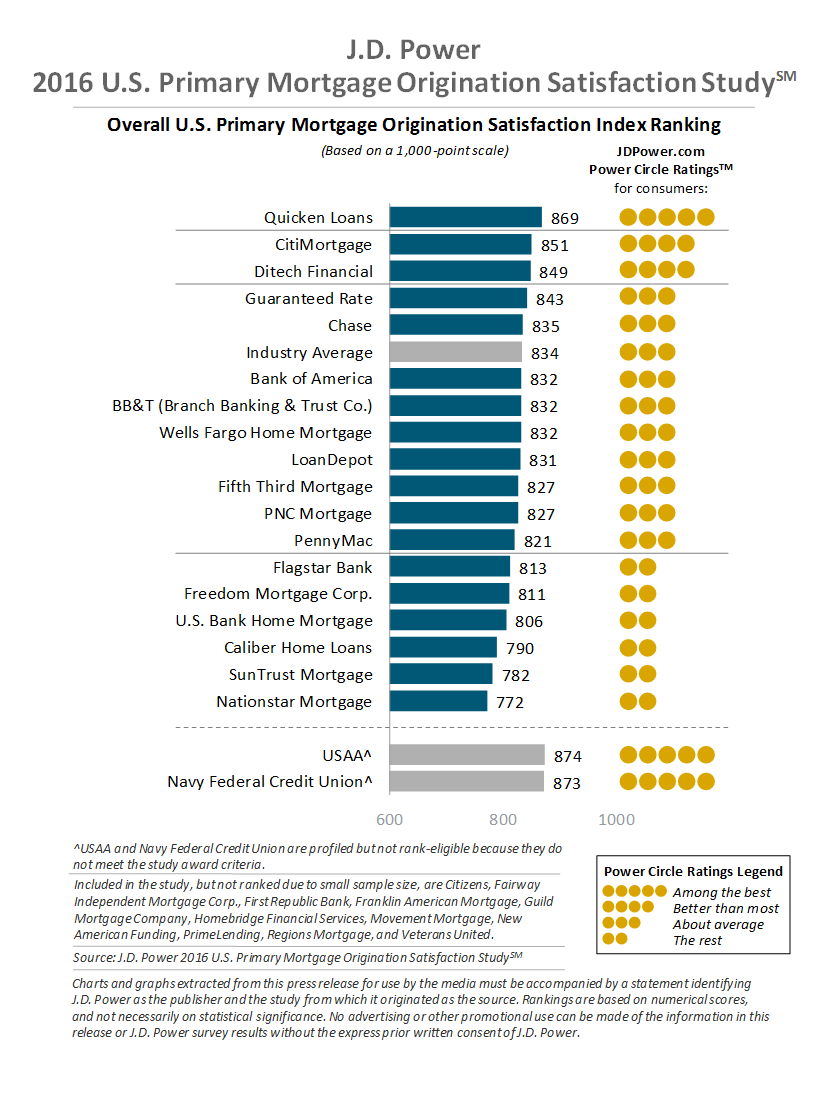

Among the major lenders, Quicken Loans ranked highest in primary mortgage origination satisfaction for a seventh consecutive year, with CitMortgage placing second and Ditech Financial ranking third.