NMLS Renewals Pouring In

The 2017 renewal period for the Nationwide Multistate Licensing System (NMLS) is “off to a strong start,” according to the State Regulatory Registry LLC (SRR), the Conference of State Bank Supervisors subsidiary that owns and operates the NMLS.

As of Nov. 30, nearly 63 percent of the 581,000 licenses managed within NMLS were submitted for renewal and more than half (230,000) were approved for 2017. The SRR said this was an increase from the approximately 33,500 license approvals during the same period in 2015. More than 16,000 companies, 24,500 branches, and 189,000 individual licenses received renewals. The number of individuals to request renewal is one percent higher than in 2015.

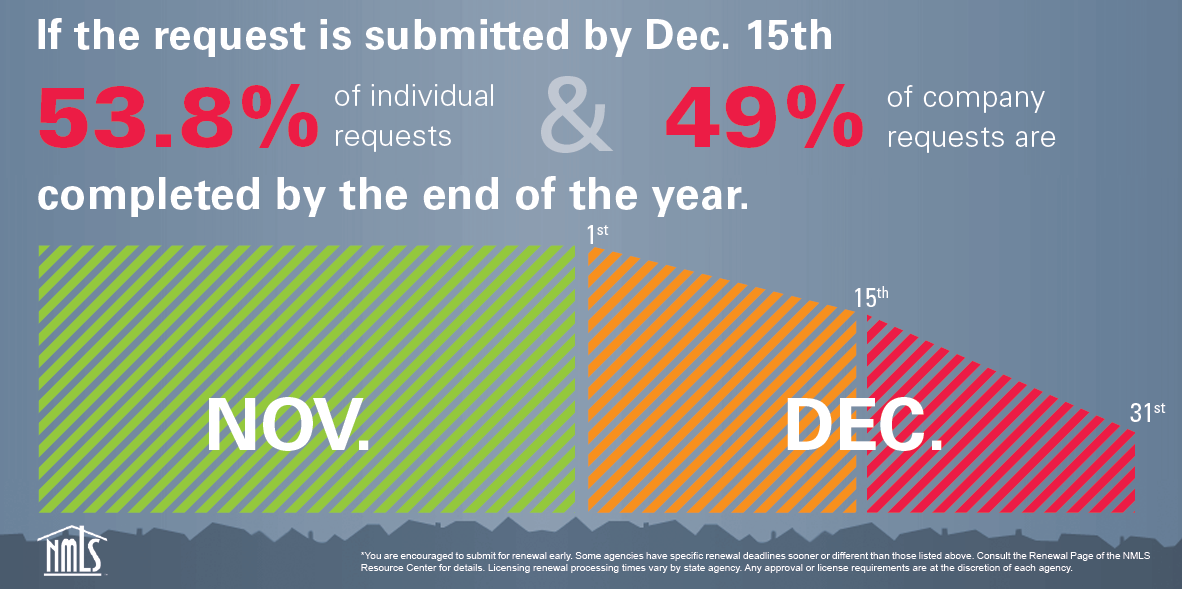

“Throughout November, the renewals process has been very robust, and state regulators continue to encourage non-depository entities to submit annual renewal requests as soon as possible to increase the likelihood of having licenses approved by Dec. 31,” said Sue Clark, chairwoman of the NMLS Policy Committee.